UAE Facility Management Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2022 - 2032

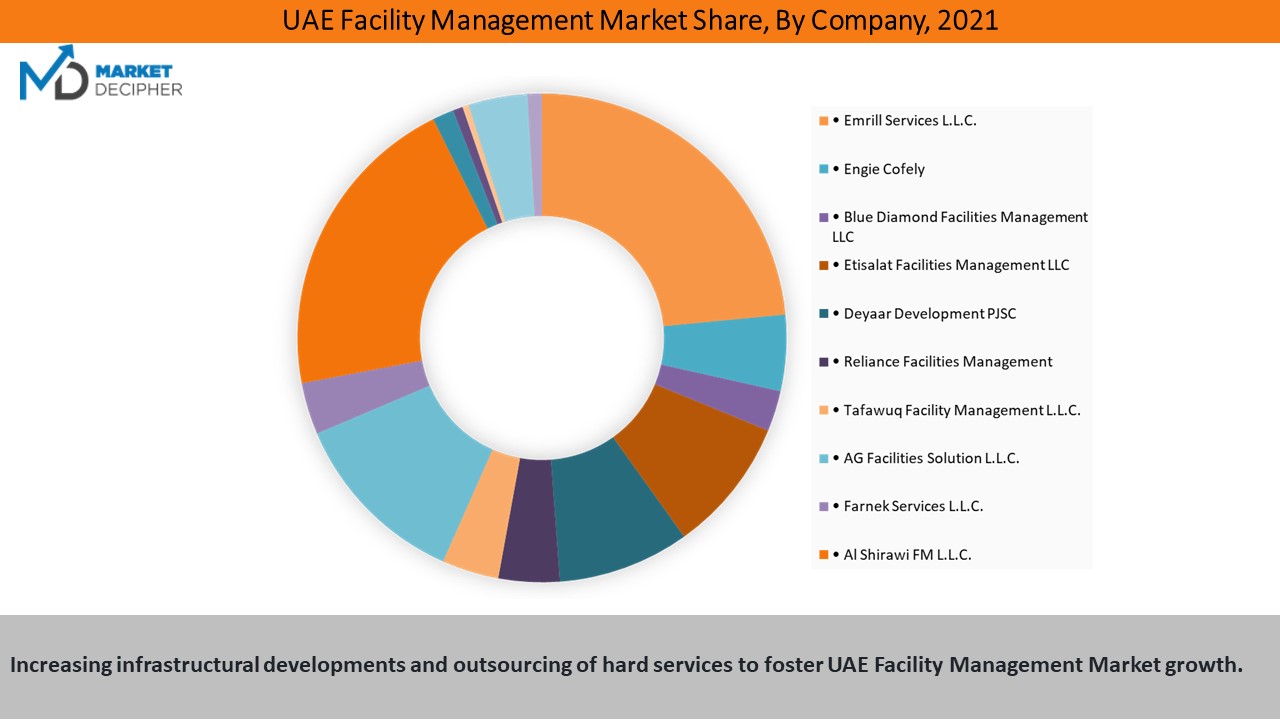

UAE Facility Management Market is segmented by Service (Property (Heating, ventilation, and air conditioning (HVAC) maintenance, Mechanical and electrical maintenance), Cleaning, Security, Catering, Support, Environmental Management), By End-User (Commercial, Industrial, Residential), By Mode of the facility (In-house, Outsourced, Integrated, Bundled, Single), and UAE Facility Management Market companies (Emrill Services L.L.C., Engie Cofely, Blue Diamond Facilities Management LLC, Etisalat Facilities Management LLC, Deyaar Development PJSC, Reliance Facilities Management, Tafawuq Facility Management L.L.C., AG Facilities Solution L.L.C., EFS Facilities Services Group Limited, Farnek Services L.L.C., Al Shirawi FM L.L.C., Imdaad L.L.C., Adeeb Electrical & Electronic Services Co. L.L.C., Transguard Group L.L.C., Ejadah Asset Management Group L.L.C., and ServeU Facilities Management L.L.C.)

- Report ID : MD2896 |

- Pages : 220 |

- Tables : 80 |

- Formats :

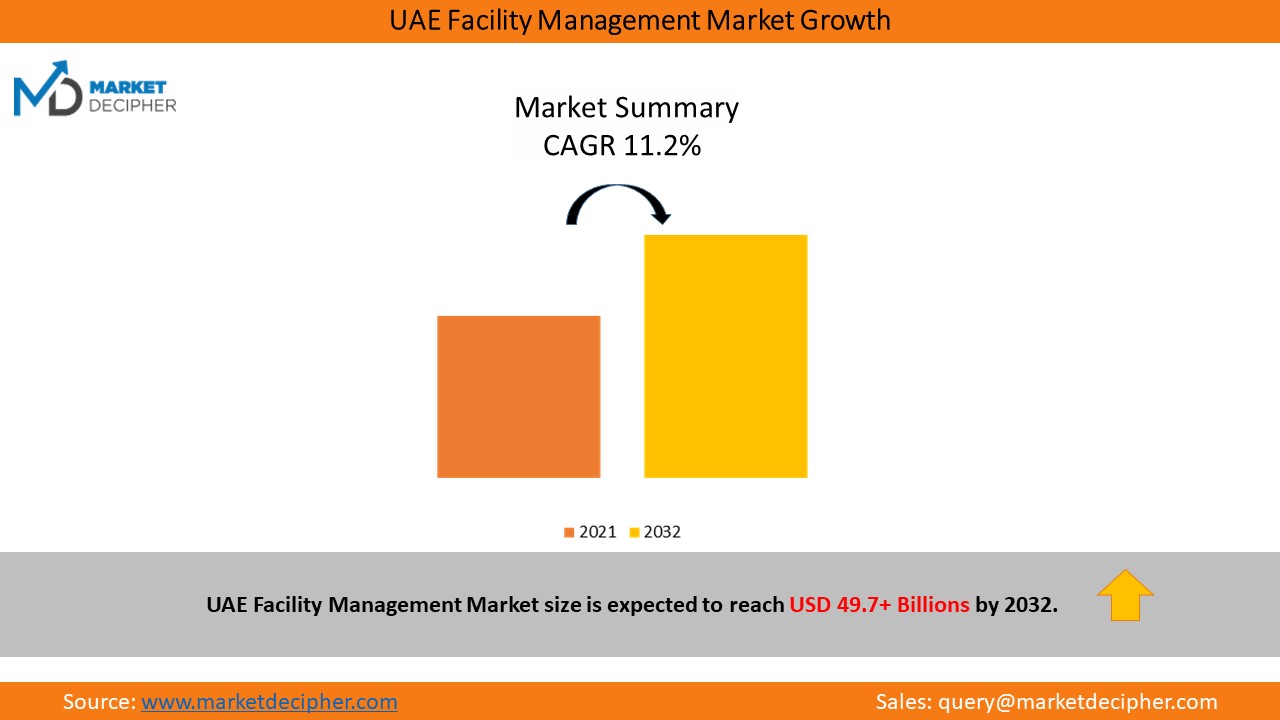

Facility management in the United Arab Emirates was valued at $15,796.2 million in 2021; a CAGR of 11.2% is predicted during the forecast period.

The UAE facility management industry is driven by the increase in investments in the construction sector and tourism growth. In addition, the country is experiencing a growing use of advanced technologies, such as artificial intelligence, robotics, and infrared/thermal scanning, in the facility management sector.

Dubai accounts for a major share of the facility management market growth across GCC Countries.

• Most of the commercial development projects in the U.A.E. are located in Dubai. The country has spent substantial money preparing for and hosting Expo 2020. Consequently, the demand for facility management services in the commercial sector hiked on a large scale in recent years.

• Many information technology and consulting firms have sprouted in Dubai due to its goal of becoming a smart city. With its economic diversification initiative, the country has been able to build numerous new office complexes, increasing the demand for facility management services in this area. ServeU implemented its digital roadmap focusing on business enhancement through operational efficiency in line with Smart Dubai 2021.

• Dubai also offers growth prospects for outsourcing across many industries. The UAE government also encourages green construction. For instance, Dubai is working on achieving 75% clean energy by 2050 as part of its Clean Energy Strategy. EcoMENA organization goals for 50% clean energy by 2050 and almost reached 75% waste management in 2021. These initiatives will lead to a demand for facility management services in the region.

• The construction sector in U.A.E is expected to grow strongly in the coming years, with a variety of projects already there in the tendering phase. The industry trend is going to be positive in 2022 as around 4,000 projects worth $313.2 billion are underway in Dubai. A few of Dubais current mega projects include the Dubai Metro Red Line extension, the Container Terminal 4 expansion project (Jebel Ali Port), and Royal Atlantis Resort and Residences (Palm Jumeirah). The U.A.E. facility management market is expected to benefit greatly from such projects.

As corporate institutions demand more services from the private sector, the sector will dominate.

In the public and private sectors, facility management services have seen a dramatic increase in demand in recent years. The need for facility management services is increasing among private businesses and corporate institutions, such as healthcare facilities and educational institutions. Therefore, the private sector dominates the public sector.

During the forecast period, property services are expected to maintain their market dominance.

The significant growth of property services is supported by growth in the countrys industrial and commercial sectors. Property management consists of building maintenance, ground maintenance, environmental management, damage control, etc. that ensure buildings and other structural frameworks are maintained properly. Property services should be boosted by growth in the countrys industrial and commercial sectors, easy credit conditions, increased purchasing power parity, and a booming housing market.

In-house mode held a larger share of the market in recent years.

For the management of assets and other services, such as cleaning, catering, and security, end users in the country rely primarily on in-house services. Due to the convenience they provide to the end-users, in-house services have been gaining popularity in the country.

Outsourcing has been categorized into integrated, bundled, and single modes. The integrated category accounted for the largest share of the market. A growing number of commercial and manufacturing facilities are outsourcing facility management services to integrated service providers that offer an integrated set of services. The UAE facility management market is expected to grow because of these factors.

Cloud adoption is booming in the U.A.E. facility management market

A major contributor to the growth of the UAE facility management market is the increasing use of cloud-based services. In addition to improving virtual accessibility, SaaS platforms support advanced security and remote management of material components and human resources, thus lowering costs. The growing demand for facility management in the UAE is driven by the capability of SaaS platforms, which also offer disaster recovery, scalability, easy accessibility, and real-time collaboration.

| Report Attribute | Details |

| Historical Years | 2018-2021 |

| Forecast Years | 2022-2032 |

| Base Year (2021) Market Size | $15,796.2 Million |

| Market Size Forecast in 2032 | $49,785.7 Million |

| Forecast Period CAGR | 11.2% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19;Companies’ Strategic Developments; List of Mega Projects; Major Contracts Won by Key Players; End User Capacity & Workforce Analysis; Company Profiling |

| Market Size by Segments | By Service Type, By End User, By Mode |

“Major facility management companies in U.A.E are providing their services for the mega projects such as Yas Bay, the Museum of the Future, Al Qana, Ikea Al Wahda, Dubai Creek Tower, Burj Jumeirah, Hyperloop, Heart of Sharjah, and Mohammed Bin Rashid Library.”

Numerous players operating in the U.A.E. facility management market are Engie Cofely, Transguard Group LLC, Emrill Services LLC, Imdaad LLC, Farnek Services LLC, Reliance Facilities Management, Deyaar Development PJSC, Blue Diamond Facilities Management LLC, Al Shirawi Facilities Management LLC, EFS Facilities Services Group Limited, AG Facilities Solution LLC, Tafawuq Facility Management LLC, Ejadah Asset Management Group LLC, and Adeeb Electrical & Electronic Services Co. LLC. These companies are doing collaboration and acquisitions to gain contracts in order to enhance their market share. For instance:

January 2021: Among the contracts, Farnek won in Dubai was the five-star Fairmont Dubai on Sheikh Zayed Lane, the four-star S Hotel, the deluxe Sonder – JBR Suites on The Walk, the four-star Revier Hotel in Business Bay, Jumeirah Beach Residence.

September 2021: In the United Arab Emirates, Imdaad, a sustainable facilities management services provider, announced a partnership with Disrupt-X, an IoT developer, to implement IoT technology in FM services.

October 2021: Facilities Management (FM) services provider ServeU launched its own dedicated mobile application for its customers.

September 2020: Emrill Services LLC was awarded a five-year contract by Aramex International LLC. The deal included mechanical, electrical, and plumbing (MEP), housekeeping, and specialist services in the companys seven locations in Abu Dhabi and Dubai.

Years considered for this report

• Historical Years: Available on Request

• Base Year: 2021

• Forecast Period: 2022-2032

UAE Facility Management Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue (2022 – 2032)

• Data breakdown for every market segment (2022 – 2032)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Service Type Analysis (Revenue, USD Million, 2022 - 2032)

• Property

• Heating, ventilation, and air conditioning (HVAC) maintenance

• Mechanical and electrical maintenance

• Cleaning

• Security

• Catering

• Support

• Environmental Management

End-User Analysis (Revenue, USD Million, 2022 - 2032)

• Commercial

• Industrial

• Residential

Mode Analysis (Revenue, USD Million, 2022 - 2032)

• In-house

• Outsourced

• Integrated

• Bundled

• Single

UAE Facility Management Market companies:

• Emrill Services L.L.C.

• Engie Cofely

• Blue Diamond Facilities Management LLC

• Etisalat Facilities Management LLC

• Deyaar Development PJSC

• Reliance Facilities Management

• Tafawuq Facility Management L.L.C.

• AG Facilities Solution L.L.C.

• Farnek Services L.L.C.

• Al Shirawi FM L.L.C.

• Imdaad L.L.C.

• Adeeb Electrical & Electronic Services Co. L.L.C.

• Transguard Group L.L.C.

• Ejadah Asset Management Group L.L.C.

• ServeU Facilities Management L.L.C.

Available Versions: -

Qatar Facility Management Market Research Report

South Arabia Facility Management Market Research Report

Kuwait Facility Management Market Research Report

GCC Facility Management Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research

scope and proposal.

Reach out directly to David Correa at his email: - david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved