Saudi Arabia Facility Management Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2022 - 2032

Saudi Arabia Facility Management Market is segmented by Service (Property (Heating, ventilation, and air conditioning (HVAC) maintenance, Mechanical and electrical maintenance), Cleaning, Security, Catering, Support, Environmental Management), by End-User (Commercial, Industrial, Residential), by Mode of facility (In-house, Outsourced, Integrated, Bundled, Single), and Saudi Arabia Facility Management Market companies (MEEM Facility Management Co., MUHEEL SERVICES, INITIAL, SAUDI GROUP, Al Mahmal Facilities Services Company, Afras, TOFM (AlKifah Holding), G4S Limited, Munjz, TAMAM, Fanni, AJEER, and Albaap)

- Report ID : MD2905 |

- Pages : 220 |

- Tables : 80 |

- Formats :

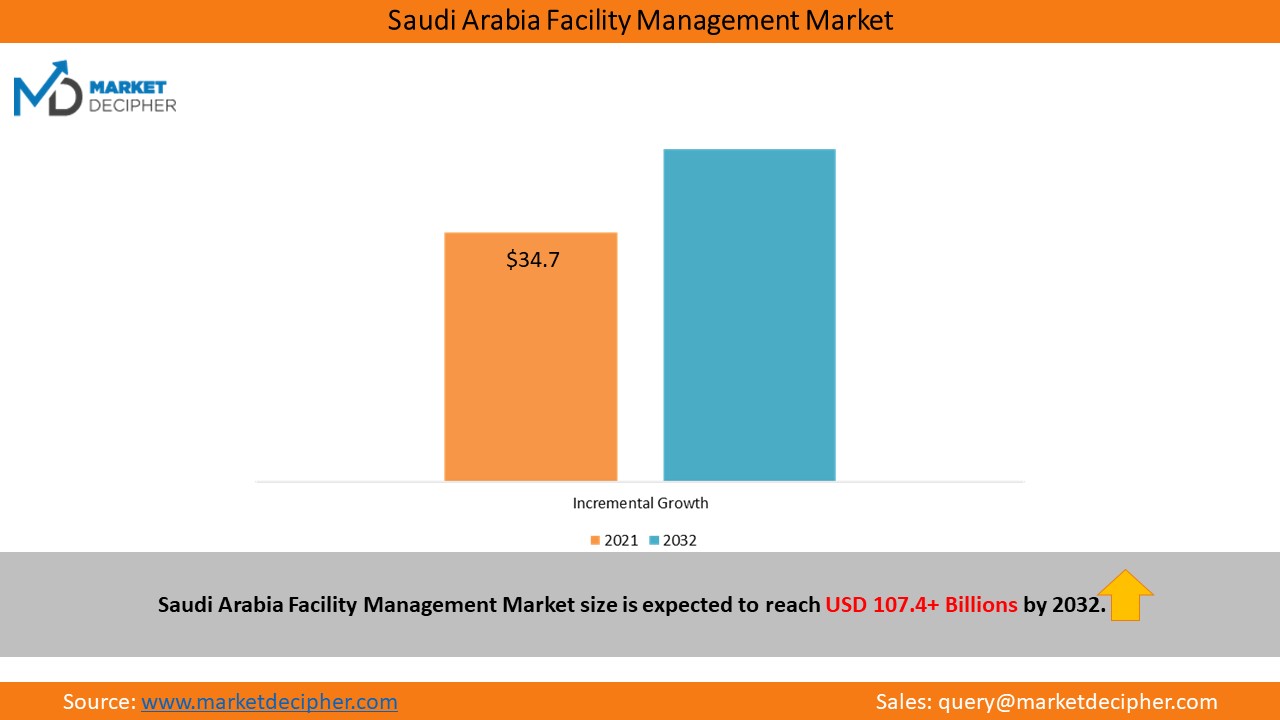

Saudi Arabia facility management market generated revenue of $34,703.2 million in 2021, and it is expected to grow at a rate of 11.2% between 2021 and 2032.

A rising governmental push for industry localization has become an important effort to transform the economic situation of GCC countries, while reducing the region’s reliance on oil revenues. GCC region has been facing economic disruptions since late 1990’s with rapid depletion and technical obsolescence of hydrocarbon reserves, along with oil price fluctuations. Considering to which, the GCC countries have initiated several plans to spur the economies for developing private sectors that will generate job opportunities for the Saudi Arabia facility management labor force thus creating industry localization, and generating economic growth.

• In the current market scenario, the Saudi 2030 Vision is playing the major role in surging the economic development in GCC region. This in return is expected to create ample of market opportunities for the building & construction, automotive, and heavy engineering sectors, henceforth projected to surge the demand for facility management services across these sectors while gaining advantages from the socio-economic factors in the coming years.

• Moreover, privatization will lead to huge investments that will ultimately strengthen the infrastructural growth of the country. Therefore, the Saudi Arabia facility management market revenue will grow rapidly over the forecast period. Additionally, Saudi Arabia facility management market companies are working continuously on adding energy management services in their portfolios. On the other hand, consumers are adopting such type of facility services, owing to rising energy costs and building’s energy consumption.

• Currently, the government of Saudi Arabia is continuously working on its economic diversifications by investing in its tourism industry. In recent years, the government has invested heavily in diversifying its non-oil economy. Moreover, under the program named Vision 2030, the government has initiated to unlock its tourism sector by executing numerous substantial changes.

• In 2019, the government has started issuing tourist visas for the first time, which is the among the most significant changes recently. The government is promoting the relaxation of immigration rules and the development of tourism infrastructure. Also, over the next ten years, with the investment for tourism of more than USD 54 billion (SAR 200 billion), the Saudi Arabian government is promoting the private sector companies to invest in the kingdom.

• Moreover, in April 2021 the Council of Economic and Development Affairs announced that the council is taking several recommendations on its 5th anniversary that are necessary to process the next phase of Saudi Vision 2030 to continue the development of construction and other new sectors. This process is expected to include development updates on Vision 2030 programs to ensure increase in the efficiency of spending, consistency with the targets, and response to the economic development.

By Industry Vertical, Healthcare Industry to Dominate Market in terms of Growth Rate

Among which the soft services segment is expected to grow significantly at the highest CAGR. This growth is attributed due to the increasing investments in waste management, energy management, waste water management and other green energy management sectors. The hard services segment holds the lion’s share in the market, including various types of services, such as cleaning, plumbing & drainage, and building fabric maintenance. Other services sub-segment is anticipated to depict stable growth that includes services, such as catering, environmental management, utility management, etc.

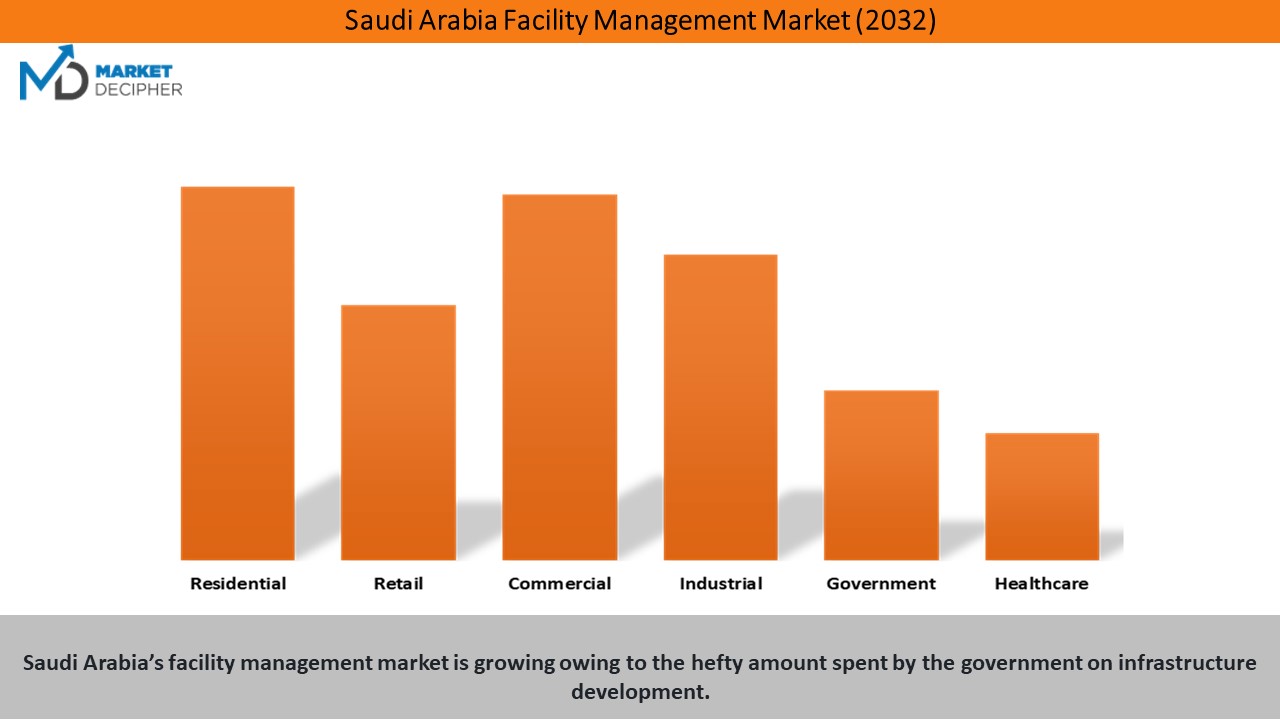

By industry vertical, the Saudi Arabia facility management market segmentation is split into healthcare, government, education, military & defense, real estate, and others. Healthcare industry is expected to grow significantly at highest CAGR during the forecast period, owing to the increase in the adoption of healthcare facilities management services as a precautionary measure in various countries. In the educational sector, services such as technical maintenance, space management, and integrated services management, need attention and are among the most important services the institution require.

The real estate segment is expected to dominate the market share for 2020 in the Saudi Arabia facilities management market in the coming years, owing to the government’s focus on investing in its infrastructural sector. Government sector is expected to witness stable market growth, owing to the government’s focus on investing in its infrastructural sector. The military & defense, and others segment are anticipated to grow steadily in the near future.

Due to Volatile Oil Prices, Government Focusing on Economic Diversification

The increasing focus of the government on economic diversification is a key trend being observed in the Saudi Arabia facility management market shares. In order to reduce the dependence on the oil & gas sector, which was severely affected by the slump in the oil prices in 2015 and 2016, the government is putting a strong focus on developing a long-term economic roadmap to decrease the country’s dependence on hydrocarbons. In this regard, the government has introduced an economic reformation plan, known as the Saudi Vision 2030, in order to develop other sectors, including health, education, infrastructure, recreation, and tourism. Such factors are expected to propel the construction of several types of facilities, thus boosting the Saudi Arabia facility management market growth.

Competitive Landscape

Major players are acquiring regional players and small & medium enterprises (SMEs) and are partnering with universities across the globe in order to create lucrative business opportunities in the unattainable markets. Major global and regional players emphasize on re-modelling their service activities by partnering with governmental bodies to create profitable, sustainable and manageable business structure for engineering and infrastructure sectors. These players emphasize on well-built culture of excellence in operations, internal control and business services to sustain in this market. Several players are re-modelling their key account approach (i.e. discontinuation of high-end non-key account customer contracts) to establish integrated facility services contracts for their legitimate customers.

MEEM Facility Management Co., MUHEEL SERVICES, INITIAL, SAUDI GROUP, Al Mahmal Facilities Services Company, Afras, TOFM (AlKifah Holding), G4S Limited, Munjz, TAMAM, Fanni, AJEER, and Albaap are the top leading market players. Many of these companies have signed many small contracts for providing services at mega projects, such as Amaala, King Salman Park, and Qiddiya. Additionally, players in the industry have aimed at bagging large-scale projects in order to stay ahead of their competitors. For instance:

In August 2020, APSG announced the successful start of a new large-scale project with its strategic client Alrajhi Bank. The project includes the provision of cleaning, maintenance, and hospitality services at more than 150 branches and 612 ATMs of Alrajhi Bank in the southern region of Saudi Arabia.

In February 2020, Enova Facility Management and Kinan International Real Estate Development Co. signed a three-year contract for facility management services at 10 malls across Saudi Arabia, which cover a 265,000-square-meter area. Enova stated that it will provide subcontractor work, stock management, mechanical, electrical, and plumbing (MEP) services, and technical services.

Years considered for this report

• Historical Years: Available on Request

• Base Year: 2021

• Forecast Period: 2022-2032

Saudi Arabia Facility Management Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue (2022 – 2032)

• Data breakdown for every market segment (2022 – 2032)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Service Type Analysis (Revenue, USD Million, 2022 - 2032)

• Property

• Heating, ventilation, and air conditioning (HVAC) maintenance

• Mechanical and electrical maintenance

• Cleaning

• Security

• Catering

• Support

• Environmental Management

End-User Analysis (Revenue, USD Million, 2022 - 2032)

• Commercial

• Industrial

• Residential

Mode Analysis (Revenue, USD Million, 2022 - 2032)

• In-house

• Outsourced

• Integrated

• Bundled

• Single

Saudi Arabia Facility Management Market companies:

• MEEM Facility Management Co.

• MUHEEL SERVICES

• INITIAL SAUDI GROUP

• Al Mahmal Facilities Services Company

• Afras

• TOFM (AlKifah Holding)

• G4S Limited

• Munjz

• TAMAM

• Fanni

• AJEER

• Albaap

Available Versions: -

Qatar Facility Management Market Research Report

Kuwait Facility Management Market Research Report

U.A.E Facility Management Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research

scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email: - david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved