Qatar Facility Management Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2022 - 2032

Qatar Facility Management Market is segmented by Service (Property (Heating, ventilation, and air conditioning (HVAC) maintenance, Mechanical and electrical maintenance), Cleaning, Security, Catering, Support, Environmental Management), by End-User (Commercial, Industrial, Residential), by Mode of facility (In-house, Outsourced, Integrated, Bundled, Single), and Qatar Facility Management Market companies (Mosanada Facilities Management Services, Engie Cofely, Al-Asmakh Facilities Management W.L.L., COMO Facilities Management Services, OCS Qatar LLC, CBM Qatar LLC, Elegancia Group, Al Tamyoz Business Group, Conservo Facility Management W.L.L., Sodexo Group, AMWAJ Catering Services Company, Facilities Management & Maintenance Company LLC, and Waseef)

- Report ID : MD2893 |

- Pages : 220 |

- Tables : 80 |

- Formats :

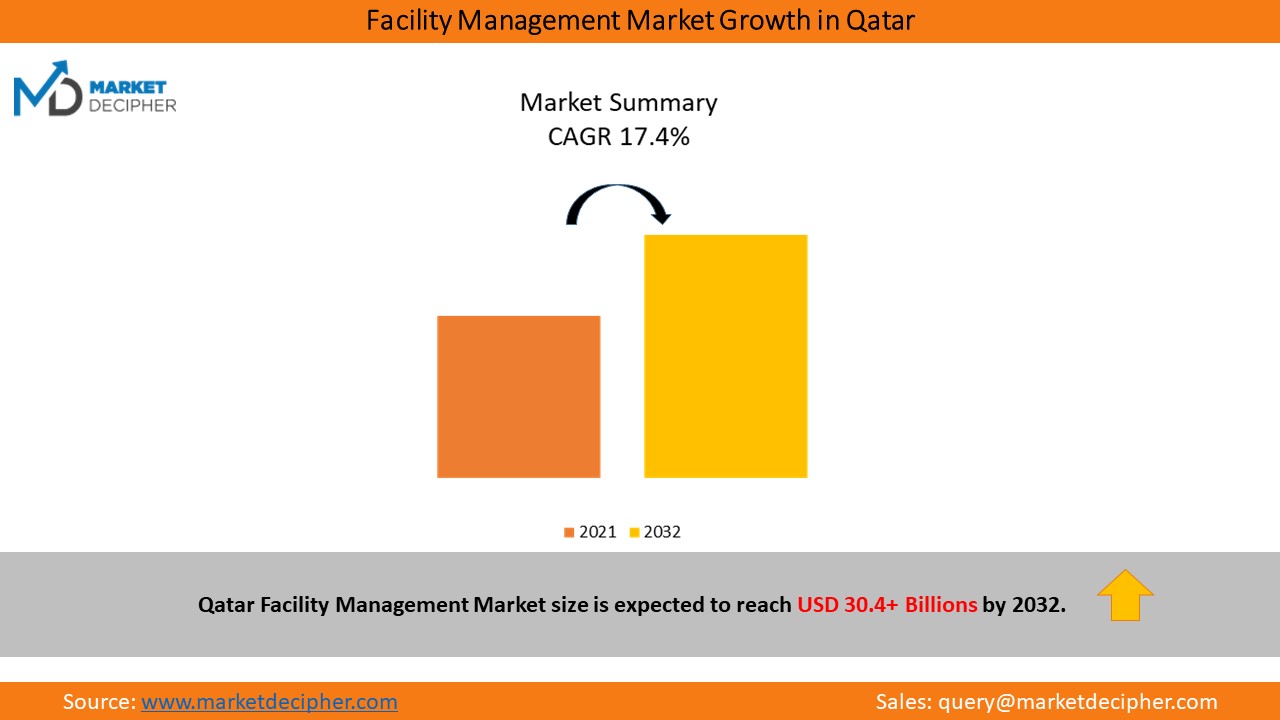

Qatar facility management market generated revenue of $5,287.4 million in 2021, and it is expected to grow at a rate of 17.4% between 2021 and 2032.

Infrastructure development, tourism expansion, and robust private sector are driving the Qatar facility management industry growth. Qatar National Vision 2030 and the FIFA World Cup 2022 are also expected to drive the demand for facility management services in the country.

Infrastructural Development on the rise is boosting the facility management market in Qatar.

In order to boost Qatars economy, the government has been focusing on the development of infrastructure. The Municipality and Environment Sector of Qatar allocated $7 billion (QR 25 billion) in its 2021 budget to continue developing major infrastructure projects, as well as the maintenance, development, and expansion of roads. This budget included roads, water, electricity, sewage networks, and other public facilities. In addition, the government allocated 7.9% of the total expenditure in 2019 to upgrading the capabilities of airports and offering the best aviation and cargo services. The expenditures cover the rail project, the Doha Metro, and the Hamad International Airport (expansion). Qatar Foundation (QF) has been actively promoting Qatars sustainability vision. The Qatari government spent $58 billion (QR 210.5 billion) on infrastructure projects in 2020. Qatars infrastructure development is also driven by industrialization. As an example, Manateq - Economic Zones Company announced an investment of $2.7 billion (QR 10 billion) in the development of basic infrastructure in industrial zones in 2020.

Key Highlights of the Qatar Facility Management Market

• As part of Qatar National Vision 2030, the government plans to expand tourism, education, and real estate rapidly. As the 2022 World Cup approaches, the region is experiencing a rise in construction activities and is upgrading its infrastructure.

• FM teams have changed their roles as a result of the shift towards reducing the buildings energy use. Qatar is already ahead of most countries in the region in green building practices, but the scope for FM operators is likely to expand as more developers and organizations adopt green building practices.

• Moreover, in Qatar the residential, commercial, industrial, and public infrastructure sectors are most well served. The upcoming sectors are oil and gas companies, banks, large waterfront properties, and sports and healthcare facilities. Furthermore, it appears that facility management operators in Qatar are matching pricing accordingly in response to increased awareness among buyers in the market.

• In the coming years, FM operators will focus on integrating technology-based solutions into their daily operations. As FM operators embrace digital disruption, they will be able to collaborate with asset owners, developers, and service providers. For instance, the maintenance solutions that were previously being used for janitorial and sanitizing operations have also been extended to flat surfaces, touch panel displays, and door handles to help combat the outbreak of COVID-19 in the region.

• Qatar facility management market growth is restrained by micro and macroeconomic factors. Despite volatile oil prices that are expected to impact the spending levels of end-users, Facility Management companies are unable to achieve their business goals due to a shortage of skilled labour and increased labour costs.

• As World Cup 2022 is supported by a V-shaped recovery, the facility management market growth in Qatar is forecast slowed down in 2020 despite increased government constant spending to ease the impact of COVID-19 and to rise to 3% in the medium term. To offset the falling spending on FIFA, Qatar National Vision 2030 plans to invest nearly USD 16.4 billion in infrastructure and real estate next year.

The increasing importance of green building practices is another major factor driving the Qatar Facility Management Market

• Qatars growing market share in Facility Management services is due to its high number of green buildings. Only UAE has more certified green buildings in the Middle East. The number of LEED-certified buildings in Qatar is the fifth highest outside the United States.

• Local regulatory bodies have actively promoted sustainable practices, such as the Qatar Green Building Council (QGBC). By organizing the Qatar Sustainability Week (QSW), the regulatory body raises awareness among a broader community (public and private sectors).

• Qatar developed the Global Sustainability Assessment System (GSAS), billed as the worlds most comprehensive green building assessment system. A rigorous analysis of 40 green building codes worldwide led to its development. Codes developed have a strong focus on environmental stress reduction and sustainable development.

• The Sustainable Energy Management Services remain one of the key offerings of the vendors. Vendors advisory services include reductions in water consumption, carbon emissions, and compliance with legislation and energy consumption metrics.

• With water-sensitive landscaping plans and a district cooling system designed to save 65 million tons of CO2 every year, Lusail epitomizes the governments Vision 2030 sustainable development plan.

| Report Attribute | Details |

| Historical Years | 2018-2021 |

| Forecast Years | 2022-2032 |

| Base Year (2021) Market Size | $5287.4 Million |

| Market Size Forecast in 2032 | $30,482.9 Million |

| Forecast Period CAGR | 17.4% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19;Companies’ Strategic Developments; List of Mega Projects; Major Contracts Won by Key Players; End User Capacity & Workforce Analysis; Company Profiling |

| Market Size by Segments | By Service Type, By End User, By Mode |

Market Players are involved in securing contracts for Qatar Facility Management Market to gain competitive edge

There are several key players in the facility management industry in Qatar, which makes it competitive. To achieve a significant position in the market, market players have been actively involved in the acquisition of facility management contracts. For example: Mosanada Facilities Management Services, Engie Cofely, Al-Asmakh Facilities Management W.L.L., COMO Facilities Management Services, OCS Qatar LLC, CBM Qatar LLC, Elegancia Group, Al Tamyoz Business Group, Conservo Facility Management W.L.L., Sodexo Group, AMWAJ Catering Services Company, Facilities Management & Maintenance Company LLC, and Waseef.

• A facility management contract has been secured by CBM Qatar LLC from Al Kaabi Tower at Al Aaliya Street in Doha and the Embassy of the Republic of Singapore in Doha in June 2020. The contracts stipulate that the company would provide cleaning, security, and MEP services for two years to Al Kaabi Tower and the Embassy of the Republic of Singapore.

• AKTOR Qatar W.L.L. renewed its facility management contract with Hamad International Airport (HIA), Doha, in October 2019. For another six years, the company would provide soft and hard services to major airport facilities, including hangars for aircraft maintenance, duty-free warehouses, car rental facilities, and access control for airport staff. A specialized aircraft maintenance support service would also be provided by the company.

• EFS Facilities Services Group marked accomplishments of flagship projects from large government entities in the UAE and Saudi Arabia. Further expansion into Bangladesh for providing FM services to multinational banking projects has resulted in over AED 170 million of contracts awarded to the company.

• CBFM participated in the Joint Commission International (JCI) accreditation process with Al Qassimi Womens and Childrens Hospital in February 2019. As part of the accreditation process, CBFM and the hospital developed a comprehensive maintenance plan as well as a safety-first approach to ensure that the highest standards are maintained throughout the facility. The JCI accreditation is an important healthcare accreditation that helps improve outcomes, enhance efficiency, and reduce costs.

Years considered for this report

• Historical Years: Available on Request

• Base Year: 2021

• Forecast Period: 2022-2032

Qatar Facility Management Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue (2022 – 2032)

• Data breakdown for every market segment (2022 – 2032)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Service Type Analysis (Revenue, USD Million, 2022 - 2032)

• Property

• Heating, ventilation, and air conditioning (HVAC) maintenance

• Mechanical and electrical maintenance

• Cleaning

• Security

• Catering

• Support

• Environmental Management

End-User Analysis (Revenue, USD Million, 2022 - 2032)

• Commercial

• Industrial

• Residential

Mode Analysis (Revenue, USD Million, 2022 - 2032)

• In-house

• Outsourced

• Integrated

• Bundled

• Single

Qatar Facility Management Market companies:

• Mosanada Facilities Management Services

• Engie Cofely

• Al-Asmakh Facilities Management W.L.L.

• COMO Facilities Management Services

• OCS Qatar LLC

• CBM Qatar LLC

• Elegancia Group

• Al Tamyoz Business Group

• Conservo Facility Management W.L.L.

• Sodexo Group

• AMWAJ Catering Services Company

• Facilities Management & Maintenance Company LLC

• Waseef

Available Versions: -

Kuwait Facility Management Market Research Report

Kingdom of Saudi Arabia (KSA) Facility Management Market Research Report

United Arab Emirates (U.A.E) Facility Management Market Research Report

The Gulf Cooperation Council (GCC) Facility Management Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email: - david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved