Potassium Tetrafluoroborate Market Size, Statistics, Trend Analysis and Forecast Report, 2020 - 2027

By Purity (98% Purity, 99% Purity), By Application (Metal Processing, Fluxing Agent, Abrasives, Soldering Agent), Industry Analysis Report, Regional Outlook (U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Netherlands, Sweden, Poland, China, India, Japan, South Korea, Australia, New Zealand, Taiwan, Malaysia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, South Africa)

- Report ID : MD1451 |

- Pages : 240 |

- Tables : 85 |

- Formats :

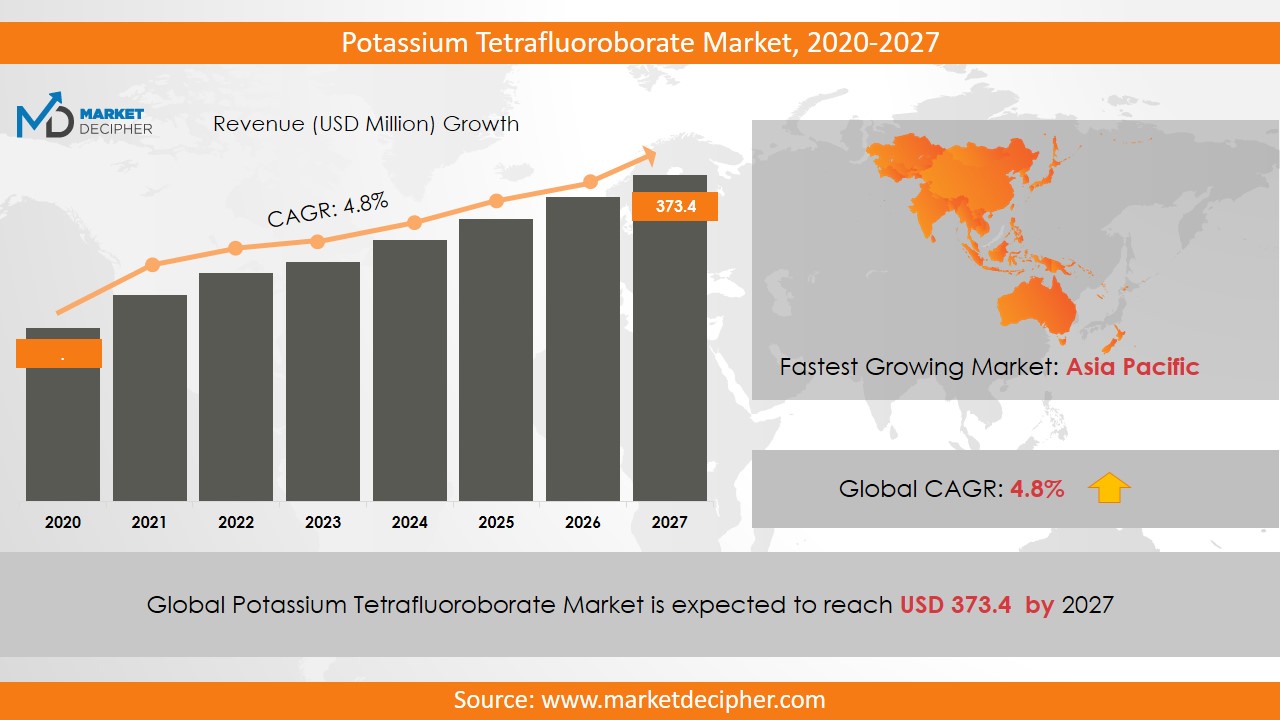

Potassium Tetrafluoroborate Market size was estimated at $260 Million in 2019 and is expected to reach $319.7 Million by 2027, growing at a CAGR of 3% during the forecast period of 2020 to 2027.

Potassium Tetrafluoroborate is affiliated with the machining industry, especially in the production of the aluminum boron alloy. It is a vital source of Potassium and finds application in oxygen-sensitive work environments such as those where metals are refined.

Analysis by Purity

According to purity, the two main segments are 98% purity and 99% purity.

98% purity Potassium Tetrafluoroborate is likely to see a modest growth rate over this period. Its main use is in the machining of alloys. These include Titanium, Boron, and Aluminium. There is another emerging technical expertise that this product possesses. This is its introduction as a feedstock for the production of fluorine salts. This diversification will lead to stable growth.

On the other hand, 99% purity grade will transform into a multi-million dollar segment. It finds applications such as soldering in HVAC systems and those in electronics. Further, it improves joint strength and this will fuel its demand further.

Analysis by Application

According to the application areas, the major segments are Metal Processing, Fluxing Agent, Abrasives, and Soldering Agent.

Both, metal processing as well as abrasives will see a significant growth in market capitalization. Most of the abrasive activities occur in metal fabrication, electronic equipment production, and the automotive industries. All these three areas are on the rise and thus, will also result in a favorable trade situation for manufacturers.

The abrasives market is a multi-billion dollar industry and a stable source of income for the world’s largest service providers and manufacturers. One of the lifelines of the machining industry is the grinding wheel. This universally used machinery is made up of specialized abrasives which need replacement after a period of use. Hence, the leading companies earn a stable revenue with this repetitive market demand.

Analysis by Region

The North American market is quickly turning into an active trading zone for Potassium Tetrafluoroborate owing to the excellent establishment of new industrial businesses setting up in the vicinity. This product is the preferred choice of engineers and design teams as a filler in the manufacture of abrasives. Moreover, the use of Potassium Tetrafluoroborate improves the temperature resistance of the abrasives and thus helps in better machining of the tools that are subjected to the grinding wheel.

The European Union is finding a different niche wherein Potassium Tetrafluoroborate is a clear champion. This is in machining of aluminum parts which are being extensively used in their Automotive sector. The leading demand centers are Italy, Germany, and France. Besides, aluminum parts are getting approval in use in railways and aircraft. This diversification will further boost the ease of doing business for most manufacturers in this region.

The Asia-Pacific region is also poised to be valued considerably higher than what it is today. Most of this region is rapidly developing with a large consumer base. Thus, the manufacturers in this space will also keep a close eye to meet all new incoming demand.

Analysis by Leading manufacturers

This is a vertically specialized industry and thus most of the power is found with the following companies: American Elements, Solvay, Morita Chemical Industries, Coronet industries, and AMG Aluminium.

Most leading companies in the fray are focussing on increasing the production of the desired grade of Potassium Tetrafluoroborate according to specific industry needs. The second most pondered overstep is to enhance production rates by way of expanding manufacturing capabilities in various geographies.

COVERAGE HIGHLIGHTS

● Market Revenue Estimation and Forecast (2019 – 2026)

● Market Production Estimation and Forecast (2019 – 2026)

● Market Sales/Consumption Volume Estimation and Forecast (2019 – 2026)

● Breakdown of Revenue by Segments (2019 – 2026)

● Breakdown of Production by Segments (2019 – 2026)

● Breakdown of Sales Volume by Segments (2019 – 2026)

● Gross Margin and Profitability Analysis of Companies

● Business Trend and Expansion Analysis

● Import and Export Analysis

● Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Purity Outlook ($Revenue and Unit Sales, 2019-2026)

• 98%

• 99%

By Application Outlook ($Revenue and Unit Sales, 2019-2026)

• Metal Processing

• Fluxing Agent

• Abrasives

• Soldering Agent

• Others

By Regional Outlook ($Revenue and Unit Sales, 2019-2026)

• U.S.

• Canada

• Mexico

• Germany

• UK

• France

• Italy

• Spain

• Russia

• Netherlands

• Sweden

• Poland

• China

• India

• Japan

• South Korea

• Australia

• New Zealand

• Taiwan

• Malaysia

• Vietnam

• Brazil

• Argentina

• Saudi Arabia

• UAE

• South Africa

Leading Manufacturers

• American Elements

• Solvay

• Morita Chemical Industries

• Alfa Aesar

• Honeywell Fine Chemicals

• Hunan Merits New Material Co. Ltd.

• Coronet Industries, Inc.

• Foshan Nanhai Double Fluoride Chemical Co. Ltd.

• Reewood International Limited

• AMG Aluminum

• DDF (Derivados del Flúor)

• Harshil Industries

• STELLA CHEMIFA CORPORATION

• Madras Fluorine Private Ltd. (MFPL)

• S.B. Chemicals

CHAPTER 1: INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. GLOBAL MARKET OUTLOOK

2.2. CORE INSIGHTS –DELIVERY MODEL

2.3. CORE INSIGHTS – POTASSIUM TETRAFLUOROBORATE

2.4. CORE INSIGHTS – SERVICE PROVIDER

2.5. CORE INSIGHTS – GEOGRAPHY

CHAPTER 3: MARKET OVERVIEW

3.1. MARKET DEFINITION AND SCOPE

3.2. KEY FORCES SHAPING THE INDUSTRY

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. MARKET DYNAMICS

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. INDUSTRY - ANALYSIS

3.4.1. Political Market

3.4.2. Environmental Market

3.4.3. Social Market

3.4.4. Technology Market

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2019-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: POTASSIUM TETRAFLUOROBORATE MARKET, BY PURITY OUTLOOK

5.1. Overview

5.1.1. Market Revenue (US$ Million) and Forecast, 2019-2026

5.2. 98%

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Revenue (US$ Million) and Forecast, By Region

5.3. 99%

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: POTASSIUM TETRAFLUOROBORATE MARKET BY APPLICATION OUTLOOK

6.1. Overview

6.1.1. Market Revenue (US$ Million) and Forecast, 2019-2026

6.2. Metal Processing

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Revenue (US$ Million) and Forecast, By Region

6.3. Fluxing Agent

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Revenue (US$ Million) and Forecast, By Region

6.4. Abrasives

6.4.1. Key Market Trends, Growth Factors and Opportunities

6.4.2. Market Revenue (US$ Million) and Forecast, By Region

6.5. Soldering Agent

6.5.1. Key Market Trends, Growth Factors and Opportunities

6.5.2. Market Revenue (US$ Million) and Forecast, By Region

6.6. Others

6.6.1. Key Market Trends, Growth Factors and Opportunities

6.6.2. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: POTASSIUM TETRAFLUOROBORATE MARKET, BY GEOGRAPHY

7.1. Overview

7.2. North America

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Revenue and Forecast, By Delivery Model

7.2.3. Market Revenue and Forecast, By Agriculture Type

7.2.4. Market Revenue and Forecast, By Service Provider

7.2.5. Market Revenue and Forecast, By Country

7.2.6. U.S.

7.2.6.1. Market Revenue and Forecast

7.2.7. Canada

7.2.7.1. Market Revenue and Forecast

7.2.8. Mexico

7.2.8.1. Market Revenue and Forecast

7.3. Europe

7.3.1. Market Revenue and Forecast, By Delivery Model

7.3.2. Market Revenue and Forecast, By Agriculture Type

7.3.3. Market Revenue and Forecast, By Service Provider

7.3.4. Market Revenue and Forecast, By Country

7.3.5. Germany

7.3.5.1. Market Revenue and Forecast

7.3.6. UK

7.3.6.1. Market Revenue and Forecast

7.3.7. France

7.3.7.1. Market Revenue and Forecast

7.3.8. Italy

7.3.8.1. Market Revenue and Forecast

7.3.9. Spain

7.3.9.1. Market Revenue and Forecast

7.3.10. Poland

7.3.10.1. Market Revenue and Forecast

7.3.11. Austrai

7.3.11.1. Market Revenue and Forecast

7.3.12. Luxembourg

7.3.12.1. Market Revenue and Forecast

7.3.13. Rest of Europe

7.3.13.1. Market Revenue and Forecast

7.4. Asia-Pacific

7.4.1. Market Revenue and Forecast, By Delivery Model

7.4.2. Market Revenue and Forecast, By Agriculture Type

7.4.3. Market Revenue and Forecast, By Service Provider

7.4.4. Market Revenue and Forecast, By Country

7.4.5. China

7.4.5.1. Market Revenue and Forecast

7.4.6. India

7.4.6.1. Market Revenue and Forecast

7.4.7. Japan

7.4.7.1. Market Revenue and Forecast

7.4.8. South Korea

7.4.8.1. Market Revenue and Forecast

7.4.9. Rest of APAC

7.4.9.1. Market Revenue and Forecast

7.5. REST OF THE WORLD

7.5.1. Market Revenue and Forecast, By Delivery Model

7.5.2. Market Revenue and Forecast, By Agriculture Type

7.5.3. Market Revenue and Forecast, By Service Provider

7.5.4. Market Revenue and Forecast, By Country

7.5.5. Latin America

7.5.5.1. Market Revenue and Forecast

7.5.6. Middle East

7.5.6.1. Market Revenue and Forecast

7.5.7. Africa

7.5.7.1. Market Revenue and Forecast

CHAPTER 8: COMPANY PROFILES

8.1. Airbus S.A.S

8.1.1. Company Overview

8.1.2. Financial Performance

8.1.3. SWOT Analysis

8.2. Aviation Industry Corporation of China Ltd. (AVIC)

8.2.1. Company Overview

8.2.2. Financial Performance

8.2.3. SWOT Analysis

8.3. Astronics Corporation

8.3.1. Company Overview

8.3.2. Financial Performance

8.3.3. SWOT Analysis

8.4. Boeing

8.4.1. Company Overview

8.4.2. Financial Performance

8.4.3. SWOT Analysis

8.5. Ball Corporation

8.5.1. Company Overview

8.5.2. Financial Performance

8.5.3. SWOT Analysis

8.6. BAE Systems

8.6.1. Company Overview

8.6.2. Financial Performance

8.6.3. SWOT Analysis

8.7. Cobham plc

8.7.1. Company Overview

8.7.2. Financial Performance

8.7.3. SWOT Analysis

8.8. Curtiss Wright

8.8.1. Company Overview

8.8.2. Financial Performance

8.8.3. SWOT Analysis

8.9. Elbit System

8.9.1. Company Overview

8.9.2. Financial Performance

8.9.3. SWOT Analysis

8.10. Gramin Ltd

8.10.1. Company Overview

8.10.2. Financial Performance

8.10.3. SWOT Analysis

8.11. GE Aviation

8.11.1. Company Overview

8.11.2. Financial Performance

8.11.3. SWOT Analysis

8.12. Harris Corporation

8.12.1. Company Overview

8.12.2. Financial Performance

8.12.3. SWOT Analysis

8.13. Honeywell International Inc.

8.13.1. Company Overview

8.13.2. Financial Performance

8.13.3. SWOT Analysis

8.14. Lockheed Martin Corporation

8.14.1. Company Overview

8.14.2. Financial Performance

8.14.3. SWOT Analysis

8.15. L3 Harris Corporation

8.15.1. Company Overview

8.15.2. Financial Performance

8.15.3. SWOT Analysis

8.16. Meggitt PLC

8.16.1. Company Overview

8.16.2. Financial Performance

8.16.3. SWOT Analysis

8.17. Northrop Grumman Corporation

8.17.1. Company Overview

8.17.2. Financial Performance

8.17.3. SWOT Analysis

8.18. Nucon Aerospace

8.18.1. Company Overview

8.18.2. Financial Performance

8.18.3. SWOT Analysis

8.19. Panasonic Corporation

8.19.1. Company Overview

8.19.2. Financial Performance

8.19.3. SWOT Analysis

8.20. Rolls Royce

8.20.1. Company Overview

8.20.2. Financial Performance

8.20.3. SWOT Analysis

8.21. Raytheon Company

8.21.1. Company Overview

8.21.2. Financial Performance

8.21.3. SWOT Analysis

8.22. Saab AB

8.22.1. Company Overview

8.22.2. Financial Performance

8.22.3. SWOT Analysis

8.23. Safran

8.23.1. Company Overview

8.23.2. Financial Performance

8.23.3. SWOT Analysis

8.24. Thales Group

8.24.1. Company Overview

8.24.2. Financial Performance

8.24.3. SWOT Analysis

8.25. Teledyne Technologies Inc.

8.25.1. Company Overview

8.25.2. Financial Performance

8.25.3. SWOT Analysis

8.26. Transdigm Group Inc.

8.26.1. Company Overview

8.26.2. Financial Performance

8.26.3. SWOT Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved