Optoelectronics Market Revenue, Sales Volume & Trend Forecasts Report, 2019-2026

By Components (Fiber cables, Storage media, Transceiver modules, Display modules, and Connector hardware), By Application (Laser equipment, Consumer Electronics, and Communication paraphernalia), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1018 |

- Pages : 182 |

- Tables : 84 |

- Formats :

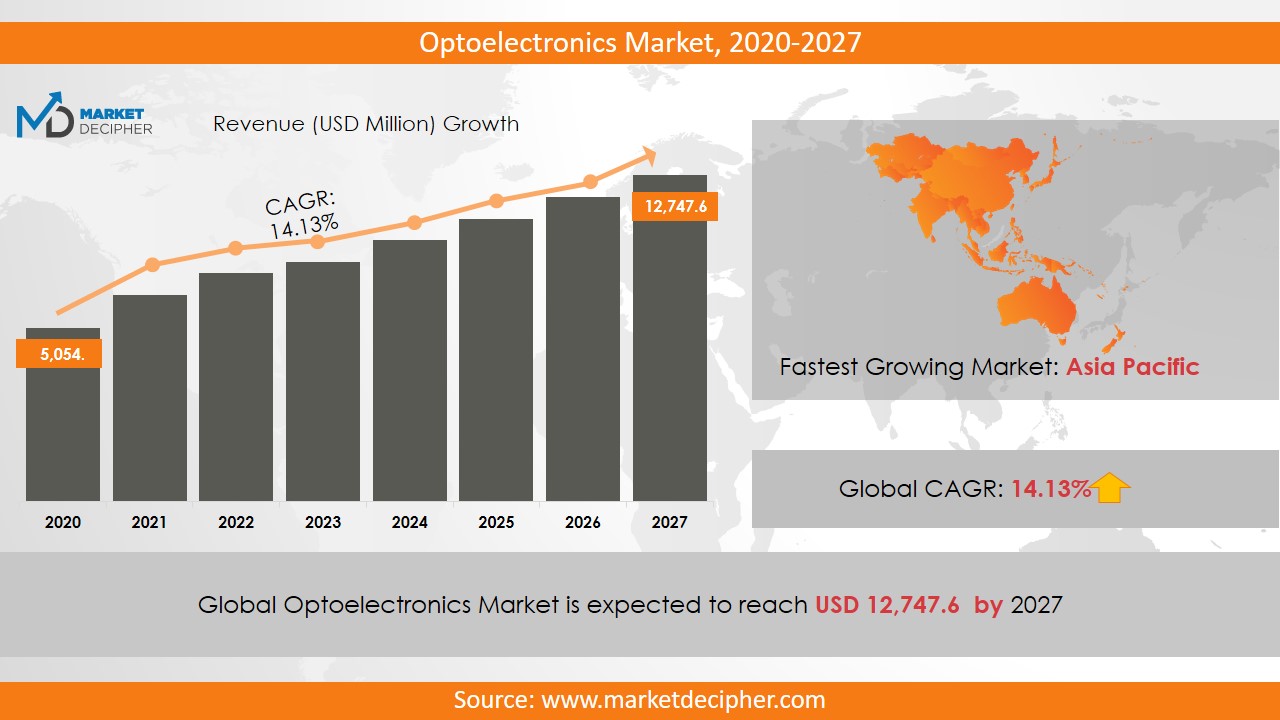

Optoelectronics market revenue shall reach a value of $XX Million in 2026, growing with a CAGR of XX.X% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

Optoelectronics is widely used in luxury cars to automate operations of vehicles such as headlights, brakes, etc. The demand for these devices is increasing rapidly due to their application in different sectors like smartphones, CD-DVDs, Xerox machines, storage technologies. Small size, better performance and efficient functioning of these devices are the major drivers of the optoelectronic market revenue. Optoelectronic devices have outperformed traditional electronic devices because they provide better and consistent performance and that too at a comparatively low cost. However, there are fewer options for optimization and have several complexities in its use, which could affect market growth.

Optoelectronic devices are environment-friendly, which increases the optoelectronics market size, as the government is focusing more on environmental protection. Different options are available as an alternative to optoelectronic components which may restrict the optoelectronics market growth notably. For example, Halogen and Xenon HID bulbs are widely used in the automotive sector and interior lighting because they are cheaper than the OLEDs and LEDs. As compared to phosphorus, the nanoparticles of cadmium selenide and zinc selenide degrade in terms of quality and performance over high temperatures. Further, the high cost of optoelectronic devices and their high maintenance costs work as a major hurdle for market development.

REGIONAL ANALYSIS

The North American region is expected to lead in contributing to the growth of the optoelectronics market shares. The Asia Pacific region is expected to garner significant revenue during the forecast period. Due to an increase in the number of installation of solar panels, India’s Optoelectronics market is also growing at a significant rate. Further, the developed countries like the US and Canada are driving the optoelectronics industry because of the high adoption of these devices in the medical field.

SEGMENT ANALYSIS

In terms of application, the segmentation has been done as the Laser equipment, Consumer Electronics, Computer, Industrial optical sensing equipment, and Communication Paraphernalia. Also, image sensors are widely used in surveillance cameras and automotive cameras, machine vision cameras. These devices are widely used in the Communication sector.

By Component, the market has been segmented as Fiber and cables, Storage media, Transceiver modules, Display modules, Connector and hardware, and Source and detector. A recent optoelectronics market research report says that the LED segment is expected to show its dominance over the revenue of the industry as the LEDs have extensive lighting applications due to their various advantages such as long life, high efficiency, and high-durability.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Fujitsu, JDSU, Oplink communications LLC, Avago Technologies, Toshiba Corporation, Oclaro Incorporated, Sharp Corporation, Sony Corporation, Neophotonics, Philips, Browave and BetaLED. The tremendous competition between the industry players and the increasing demand for more advanced and versatile electronic devices is accelerating the optoelectronics market growth. Other industries in this domain that is growing at a high CAGR include Optical Receivers Market and Active Optical Connectors Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS:

By Component ($Revenue and Unit Sales, 2018-2026)

Fiber and cables

Storage media

Transceiver modules

Display modules

Connector and hardware

Source and detector

By Application ($Revenue and Unit Sales, 2018-2026)

Laser equipment

Consumer electronics

Computer

Industrial optical sensing equipment

Communication Paraphernalia

By Geography ($Revenue and Unit Sales, 2018-2025)

North America

Mexico

U.S

Canada

Europe

France

U.K

Germany

Russia

Italy

Rest of Europe

Asia-Pacific

South Korea

India

Japan

China

Rest of Asia-Pacific

Rest of the World

Middle East

Africa

Latin America

INDUSTRY PLAYER ANALYSIS

• Fujitsu

• JDSU

• Oplink communications LLC

• Avago Technologies

• Toshiba Corporation

• Oclaro Incorporated

• Sharp Corporation

• Sony Corporation

• Neophotonics

• Philips

• Browave

• BetaLED

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. OPTOELECTRONICS MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL OPTOELECTRONICS MARKET DEMAND SIDE ANALYSIS

2.1. OPTOELECTRONICS MARKET CONSUMPTION VOLUME (MILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (MILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.6. OPTOELECTRONICS MARKET REVENUE SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL OPTOELECTRONICS MARKET SUPPLY SIDE ANALYSIS

3.1. OPTOELECTRONICS MARKET PRODUCTION VOLUME (MILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL OPTOELECTRONICS MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL OPTOELECTRONICS MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL OPTOELECTRONICS MARKET BY COMPONENT

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY COMPONENT, $U.S.

8.3.3.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.3.3.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.3.3.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.3.4. Canada

8.3.4.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.3.4.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.3.4.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.3.5. Mexico

8.3.5.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.3.5.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.3.5.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.4. EUROPE

8.4.1. Current Trends and Future Prospects

8.4.2. Europe market revenue, sales and production volume, 2018 – 2025

8.4.3. U.K

8.4.3.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.4.3.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.4.3.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.4.4. Germany

8.4.4.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.4.4.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.4.4.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.4.5. France

8.4.5.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.4.5.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.4.5.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.4.6. Italy

8.4.6.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.4.6.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.4.6.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.4.7. Rest of Europe

8.4.7.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.4.7.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.4.7.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.5. ASIA PACIFIC

8.5.1. Current Trends and Future Prospects

8.5.2. Europe market revenue, sales and production volume, 2018 – 2025

8.5.3. India

8.5.3.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.5.3.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.5.3.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.5.4. Japan

8.5.4.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.5.4.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.5.4.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.5.5. China

8.5.5.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.5.5.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.5.5.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.5.6. South Korea

8.5.6.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.5.6.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.5.6.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.5.7. Rest of APAC

8.5.7.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.5.7.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.5.7.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.6. REST OF THE WORLD

8.6.1. Current Trends and Future Prospects

8.6.2. Europe market revenue, sales and production volume, 2018 – 2025

8.6.3. Latin America

8.6.3.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.6.3.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.6.3.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.6.4. Middle East

8.6.4.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.6.4.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.6.4.3. Optoelectronics Market Production Million Units (2018 – 2025)

8.6.5. Africa

8.6.5.1. Optoelectronics Market Revenue $Million (2018 – 2025)

8.6.5.2. Optoelectronics Market Consumption Million Units (2018 – 2025)

8.6.5.3. Optoelectronics Market Production Million Units (2018 – 2025)MILION, 2018 – 2025

6.2. CONSUMPTION SHARE BY COMPONENT, MILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY COMPONENT, MILLION UNITS, 2018 – 2025

6.4. FIBER AND CABLES

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. STORAGE MEDIA

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. TRANSCEIVER MODULES

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

6.7. DISPLAY MODULES

6.7.1. Market determinants and trend analysis

6.7.2. Market revenue, sales and production volume, 2018 – 2025

6.8. CONNECTOR AND HARDWARE

6.8.1. Market determinants and trend analysis

6.8.2. Market revenue, sales and production volume, 2018 – 2025

6.9. SOURCE AND DETECTOR

6.9.1. Market determinants and trend analysis

6.9.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL OPTOELECTRONICS MARKET BY APPLICATION

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY APPLICATION, $MILION, 2018 – 2025

7.2. CONSUMPTION SHARE BY APPLICATION, MILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY APPLICATION, MILLION UNITS, 2018 – 2025

7.4. LASER EQUIPMENT

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. CONSUMER ELECTRONICS

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. COMPUTER

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

7.7. INDUSTRIAL OPTICAL SENSING EQUIPMENT

7.7.1. Market determinants and trend analysis

7.7.2. Market revenue, sales and production volume, 2018 – 2025

7.8. COMMUNICATION PARAPHERNALIA

7.8.1. Market determinants and trend analysis

7.8.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL OPTOELECTRONICS MARKET BY REGIONS

8.1. REGIONAL OUTLOOK

8.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

8.3. NORTH AMERICA

8.3.1. Current Trends and Future Prospects

8.3.2. North America market revenue, sales and production volume, 2018 – 2025

8.3.3.

CHAPTER 9. KEY VENDOR PROFILES

9.1. Fujitsu

9.1.1. Company overview

9.1.2. Portfolio Analysis

9.1.3. Estimated revenue from optoelectronics business and market share

9.1.4. Regional & business segment Revenue Analysis

9.2. JDSU

9.2.1. Company overview

9.2.2. Portfolio Analysis

9.2.3. Estimated revenue from optoelectronics business and market share

9.2.4. Regional & business segment Revenue Analysis

9.3. Oplink communications LLC

9.3.1. Company overview

9.3.2. Portfolio Analysis

9.3.3. Estimated revenue from optoelectronics business and market share

9.3.4. Regional & business segment Revenue Analysis

9.4. Avago Technologies

9.4.1. Company overview

9.4.2. Portfolio Analysis

9.4.3. Estimated revenue from optoelectronics business and market share

9.4.4. Regional & business segment Revenue Analysis

9.5. Toshiba Corporation

9.5.1. Company overview

9.5.2. Portfolio Analysis

9.5.3. Estimated revenue from optoelectronics business and market share

9.5.4. Regional & business segment Revenue Analysis

9.6. Oclaro Incorporated

9.6.1. Company overview

9.6.2. Portfolio Analysis

9.6.3. Estimated revenue from optoelectronics business and market share

9.6.4. Regional & business segment Revenue Analysis

9.7. Sharp Corporation

9.7.1. Company overview

9.7.2. Portfolio Analysis

9.7.3. Estimated revenue from optoelectronics business and market share

9.7.4. Regional & business segment Revenue Analysis

9.8. Sony Corporation

9.8.1. Company overview

9.8.2. Portfolio Analysis

9.8.3. Estimated revenue from optoelectronics business and market share

9.8.4. Regional & business segment Revenue Analysis

9.9.Neophotonics

9.9.1. Company overview

9.9.2. Portfolio Analysis

9.9.3. Estimated revenue from optoelectronics business and market share

9.9.4. Regional & business segment Revenue Analysis

9.10. Philips

9.10.1. Company overview

9.10.2. Portfolio Analysis

9.10.3. Estimated revenue from optoelectronics business and market share

9.10.4. Regional & business segment Revenue Analysis

9.11. Browave and BetaLED

9.11.1. Company overview

9.11.2. Portfolio Analysis

9.11.3. Estimated revenue from optoelectronics business and market share

9.11.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved