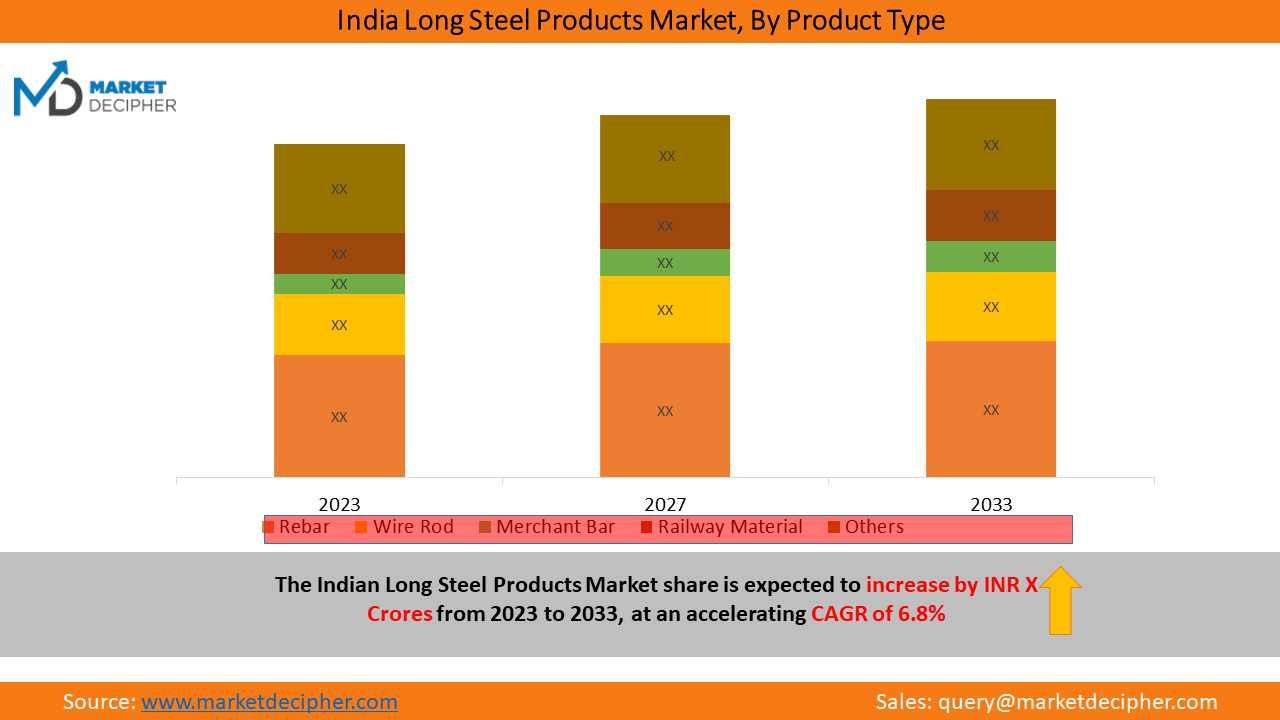

India Long Steel Products Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2023 – 2033

The India Long Steel Products Market is segmented By Product (Rebar, Wire Rod, Merchant Bar, Railway Material, Others), By Process (Basic Oxygen Furnace, Electric Arc Furnace), By Application (Automotive, Industrial Construction, Residential Construction, Commercial Construction, Food Processing and Catering Facilities, Kitchenware and Appliances, Industrial Machinery, Oil and Gas Industry, Energy and Power Generation, Chemical and Petrochemical Industry, Others), and By Geography (North, Northeast, East, Central, West, South).

- Report ID : MD2972 |

- Pages : 220 |

- Tables : 45 |

- Formats :

The India Long Steel Products Market shall reach a value of INR X Crores in 2033, growing with a CAGR of 6.8% during the forecast period of 2023 to 2033

India’s long steel product industry primarily caters to the infrastructure and construction sectors. They are considered over the flat steel products when it comes to construction. The rise in Government Initiatives in the construction sector has increased the demand for long steels all over the country. Long products are categorized into bars & rods, rebars, merchant bars, wire rods, and railway material. These products are usually produced by hot rolling/forging of bloom/billets into useful shapes and sizes. The long products are less expensive as compared to flat products as they do not require finishing because they are mainly used for construction purposes.

Factors driving the demand

The growth of the steel long products market is dependent on some of the driving factors like global economic conditions, infrastructure development (both commercial and residential), automotive production, and construction activities. As the economy is strong and industries are thriving, the demand for steel long products is expected to increase at a rapid rate. India, being a developing economy is experiencing a rising demand for long steel products. The production of this product depends on its demand, and thus only a little above the demand is produced in the market. Commercial Infrastructure development with the transportation networks like Metro expansion projects in northern and southern parts of India, and major energy projects are also contributing to the demand for steel long products. The production of long steel products in India is second to the flat steel production, ranging from around 42.9% - 43.2% of the total steel output, in FY2019. Urbanization and establishment of many industrial cities, together with manufacturing units and the service sector are key contributory factors to the growing demand for long steel products.

Use of advanced production processes, resulting in more efficiency

Advanced manufacturing techniques, such as electric arc furnaces and continuous casting, have made steel production more efficient and cost-effective. The Electrical Arc Furnace (EAC) is employed more commonly in the process of steel production as compared to Basic Oxygen Furnace (BOF). The former was developed mainly to recycle scrap and reduce CO2 emissions. The EAF process utilizes electric arcs to meet and refine scrap steel, this process is highly flexible and versatile as it can use a variety of scrap as input to produce different types of grades, whereas the BOF process is more suitable for large-scale production. It is usually used to produce carbon, low-alloy steels, and stainless steels. Almost all large players use the BOF route as these players maintain end-to-end operations. The small players on the other hand depend on the EAF route which uses melting scrap and non-coking coal for steel production.

Long Steel dominates the consumption market in India

The total finished steel production in India stood at 78.09 MT in April -November 2022. Since most of the long steel produced in India is based on the estimation of the requirement of the product, almost everything that is produced is consumed in the home country. These are extensively used in the construction of buildings, bridges, roads, dams, and other infrastructure projects. TMT bars, rebars, structural steel sections (beams, columns, angles, etc.), and wire rods are commonly employed to provide strength, stability, and reinforcement to concrete structures. With increasing expenditure by Government programs and the aim to complete 100 Smart Cities in India under the Smart City Mission, the construction industry forefront is on the boom. Moreover, the construction Industry in India is expected to reach $1.4 Tn by 2025. The residential projects are also on the rise, by 2030, more than 40% of the population is expected to live in urban India (33% today), creating a demand for 25 Mn additional mid-end and affordable units, directly impacting the demand for raw materials.

Regional Analysis

The market of Long Steel Products is spread across various states of India. The demand for the products depends on the key infrastructural projects, industrial development, residential, and construction projects. With major projects like Delhi-Mumbai Corridor in Northern India, to the Chenab River Railway Bridge connecting Kashmir Valley with the rest of India; the consumption of long steel products is not settling soon. With initiatives like ‘Ude Desh ka Aam Nagrik’ intended to provide economical flights, several new airports are anticipated to transform India in the coming years. New airports like Navi Mumbai International Airport in Maharashtra, Bhiwadi Greenfield International Airport in Alwar, and Mandi Greenfield International Airport in Himachal Pradesh among others; the long steel products demand is expected to grow in such regions. Upcoming Metro projects in Bengaluru, Agra, Ahmedabad, Bhopal, Gurgaon, Hyderabad, Kochi, Kolkata, Lucknow, Meerut, Mumbai, Patna, Pune, and Surat, will drive the contributory demand for steel-based raw materials in the specific regions.

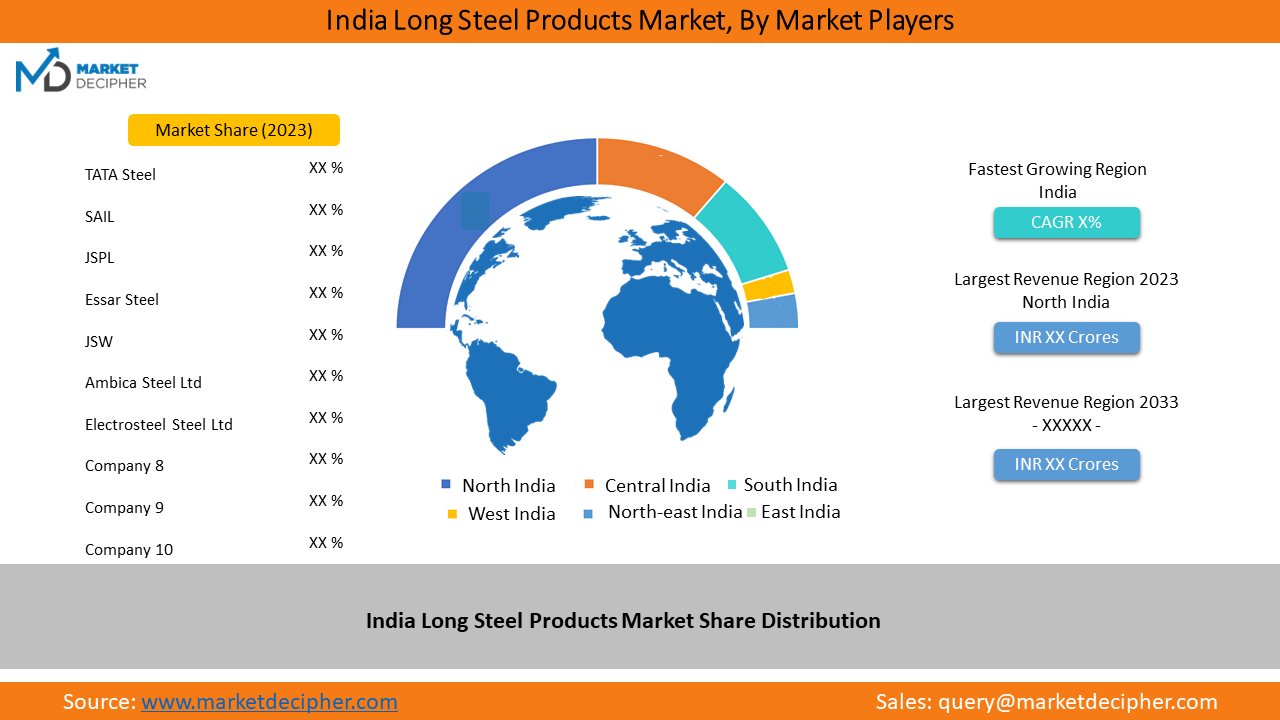

Competitive Landscape

The Long Steel Products Market in India is highly competitive and concentrated with both large-scale and small-scale players. TATA Steel, JSW Steel, Steel Authority of India Ltd (SAIL), Jindal Steel and Power Ltd, Essar Steel, Electrosteel Ltd, and Rashtriya Ispat Nigam Ltd (RINL) are primary producers of long steel products in India. SAIL, which is a state-owned steel producer, operated multiple integrated steel plants in various locations including Bhilai, Bokaro, Durgapur, and Rourkela. TATA Steel produces operations of long steel products under TATA Steel Long Products LTD, with captive iron ore mines at Vijay-II in Jharkhand. Primary products are Steel Rods, Sponge Iron, and Wire Rods. JSPL also operates in producing a vast range of long products from angles & channels, rebars, and wire rods, to parallel flange beams & Columns. The top 5 companies in the list occupy over 50% of the market share in production and the rest is distributed among other medium-scale and small-scale producers. India is home to the fifth-highest reserves of iron ore in the world. The easy availability of low-cost manpower and the presence of abundant iron ore reserves make India competitive in the global setup.

Recent Strategic Developments

- Under the Union Budget 2023-24, the government allocated Rs. 70.15 crore (US$ 8.6 million) to the Ministry of Steel.

- In August 2022, Tata Steel signed an MoU with Punjab Government to set up a steel scrap-based electric arc furnace steel plant.

- In October 2021, JSW Steel invested Rs. 150 billion (US$ 19.9 million) to build a steel plant in Jammu and Kashmir and boost manufacturing in the region.

- In the next three years from June 2021, JSW Steel is planning to invest Rs. 47,457 crore (US$ 6.36 billion) to increase Vijayanagars steel plant capacity by 5 MTPA and establish a mining infrastructure in Odisha.

- Steel giants ArcelorMittal, and Sajjan Jindal’s JSW Steel are in the race to acquire the steel plant of mining major National Mineral

- Development Corporation (NMDC) in Chhattisgarh. The steel manufacturing facility located in Nagarnar; Chhattisgarh has been planned for privatization in the current financial year (FY23).

- Policy allowing 100% FDI (via the automatic route) in the steel industry has boosted investments.

Years considered for this report

- Historical Years: 2021 - 2022

- Base Year: 2022

- Forecast Period: 2023-2033

India Long Steel Products Market Research Report Analysis Highlights

- Historical data available (as per request)

- Estimation/ projections/ forecast for revenue and unit sales (2022 - 2032)

- Data breakdown for application Industries (2022 - 2032)

- Integration and collaboration analysis of companies

- Capacity analysis with application sector breakdown

- Gross Margin and Profitability Analysis of Companies

- Business trend and expansion analysis

- Import and Export Analysis

- Competition analysis/market share

- Supply chain analysis

- Client list and case studies

- Market entry strategies adopted by emerging companies

India Long Steel Products Market Segments

By Product Type (Revenue, INR Crores, 2022 - 2032)

- Rebar

- Wire Rod

- Merchant Bar

- Rail

- Others

By Process

- Basic Oxygen Furnace

- Electric Arc Furnace

By Application (Revenue, INR Crores, 2022 - 2032)

- Automotive

- Industrial Construction

- Residential Construction

- Commercial Construction

- Kitchenware and Appliances

- Industrial Machinery

- Oil and Gas Industry

- Energy and Power Generation

- Chemical and Petrochemical Industry

- Others

By Geography (Revenue, INR Crores, 2022 - 2032)

- North

- Northeast

- East

- Central

- West

- South

India Long Steel Products Market Players

- TATA Steel

- SAIL

- Ambica Steel Ltd

- Essar Steel

- Company 5

- Company 6

- Company 7

- Company 8

- Company 9

- Company 10

Available Versions of Long Steel Products Market Report:

Global Long Steel Products Market Research Report

US Long Steel Products Market Research Report

GCC Long Steel Products Market Research Report

APAC Long Steel Products Market Research Report

Europe Long Steel Products Market Research Report

Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply).

- Send us a query to get the Table of Contents and Research Scope along with the research proposal.

Related Reports Available:

India Hot Rolled Coil Market Research Report

India Cold Rolled Coil Market Research Report

India Flat Steel Products Market Research Report

India Structural Steel Market Research Report

India Stainless Steel Flat Products Market Research Report

India Stainless Steel Bright Bars Market Research Report

India Stainless Steel Fasteners Market Research Report

India Steel Bars and Rods Market Research Report

India Semi-finished Steel Market Research Report

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved