Hardware encryption Market Revenue& Trend Forecast Report, 2019-2026

By Algorithm and Standard (Rivest-Shamir-Adleman (RSA) Algorithm, Advanced Encryption Standard (AES) and Others), architectures (Application-Specific Integrated Circuits (ASIC) and Field-Programmable Gate Arrays (FPGA)),By Product (Solid-State Drives, Internal Hard disk drives, USB Flash drives, External Hard Disk Drives and Inline Network Encryptors),By Application (BFSI, Aerospace and Defence, Consumer Electronics, IT and Telecom, Transportation, Healthcare and Others), By Region(North America, Europe, APAC,MEA and Latin America)

- Report ID : MD1097 |

- Pages : 198 |

- Tables : 87 |

- Formats :

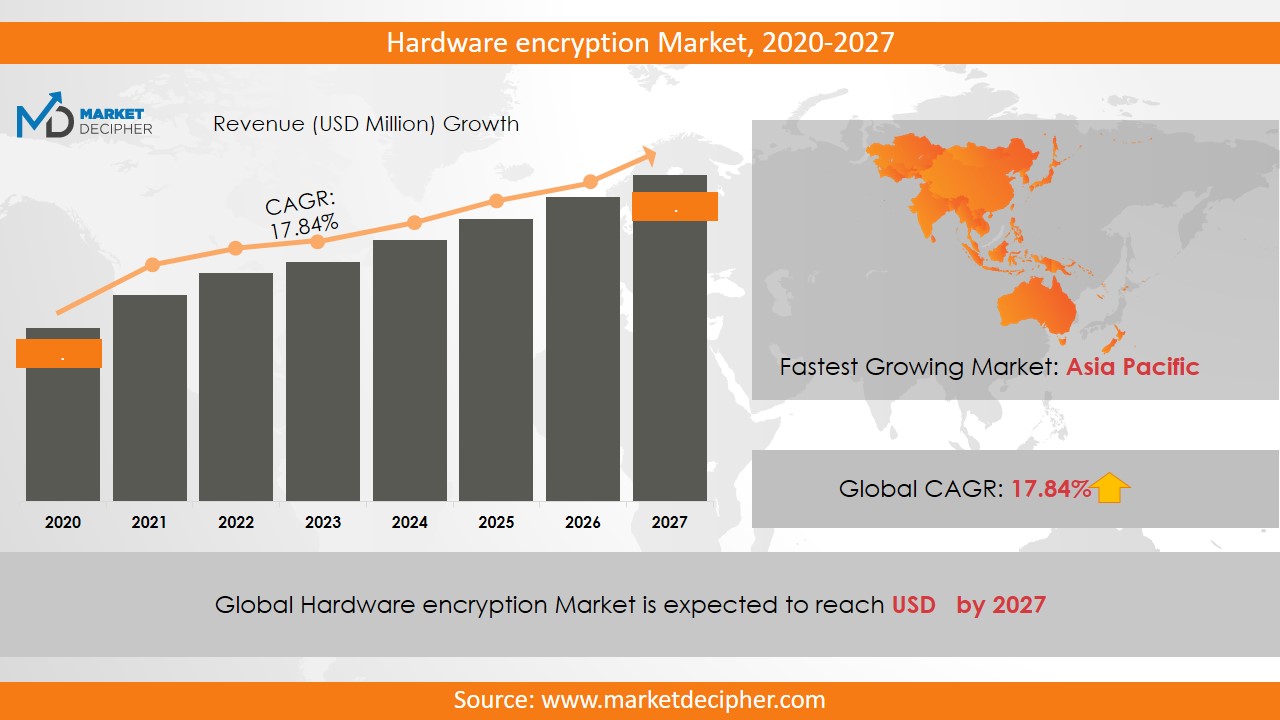

The market revenue of Hardware Encryption shall reach a value of $801.32 Billion in 2026, growing with a CAGR of 52.64% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

The encryption process includes coding of the data so that it can be read only by authorized users. In this way, sensitive information can be protected from hackers and attackers. The information can be decoded using a key which was used as an algorithm to encrypt the data and the process is known as decryption. The hardware encryption ensures high protection from cyber frauds as it provides end to end encryption. Reduction in the cost of this service is further driving the hardware encryption market share.

Increasing awareness about cyber security among people and various organizations has enforced the government to impose stringent rules for the security of hardware. Further, the rising number of cyber attacks and data loss or hacking cases are increasing the hardware encryption market size. Technological advancements and increasing demand for consumer electronics such as tablets, smartphones, etc are poised to accelerate hardware encryption market growth. Apple Inc employs a hybrid encryption model for a wide range of its products including the iPhone, iPad, and iPod.

Hardware Encryption Market Growth and Trends

The hardware encryption market is set to have a high growth rate in the near future. The general market is valued at USD 413.85 Billion by 2022 from USD 58.46 Billion at a CAGR of 29.3% between 2016 and 2022. The main factor contributing to the growth of the hardware encryption market is the information security issue and the development of the protection of data. Hardware encryption can offer several benefits beyond those provided by software encryption. These include faster algorithm processing, tamper-proof or tamper-resistant key storage, and protection against unauthorized code, they can store encryption keys and other sensitive items in highly protected areas of RAM or flash memory, this is one of the key factor in giving them a growth advantage in the industry.

Key growth indicators in the industry are:

• Geographically the APAC region is set to hold the biggest portion of the hardware encryption market, due to its extension and media transmission network in China, Thailand, Malaysia, South Korea, India, and other agricultural nations in APAC.

• Application-specific integrated circuit (ASIC) accounts for the largest stake in the market. ASIC projects massive growth in the markets, this is due to their high speed and small form factor.

• The Hardware-encrypted solid-state drives market to grow at the highest rate, Solid-state drive provides faster encryption gives quicker encryption, unlike the hard disk devices, this gives it a competitive edge in the market place.

• The hardware encryption market for BFSI is dependent on the application and was expected to grow as of 2016- 2022, this is because of the increase of hardware-encrypted devices in various banking operation to prevent data loss or financial fraud across the globe.

The growth of the market is driven by factors such as an increase in household income, high population density, and the growth in the middle-class sector. The market is also able to cater to the industry such as health care, BFSI automotive and transportation, military, and aerospace.

REGIONAL ANALYSIS

The Asia Pacific region is estimated to account for the largest revenue of the market in 2018 owing to the tremendous growth of the IT and telecommunications industries in the developing countries such as India, South Korea, Japan, and China in the region. This region is further anticipated to grow at the highest CAGR during the forecast period. Further, Europe, North America, and Middle East Asia have contributed sufficiently to the growth of the overall revenue of the market.

SEGMENT ANALYSIS

The bifurcation of the hardware encryption market report provides a keen analysis of algorithm and standard, architecture, product, application, and region. In terms of algorithm and standard, the market has been segmented as Rivest-Shamir-Adleman (RSA) Algorithm, Advanced Encryption Standard (AES) and Others. Based on architecture, the market has been segmented as Application-Specific Integrated Circuits (ASIC) and Field-Programmable Gate Arrays (FPGA). By product, the market has been bifurcated as Solid-State Drivers, Internal Hard disk drivers, USB Flash drivers, External Hard Disk Drives and Inline Network Encryptors. The solid-state drivers are propelling the market growth substantially. The solid-state drives provide better encryption and too at a faster rate.

These services find their application in various sectors such as BFSI, Aerospace, and Defence, Consumer Electronics, IT and Telecom, Transportation, Healthcare and Others. The BFSI segment dominated over the market share and is anticipated to continue the same trend over the forecast period due to the increase in the adoption of the hardware encryption service in the sector due to the high need for protection from cyber frauds.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Kingston Technology Corporation, Toshiba Corporation, Sandisk Corporation, Seagate Technology Plc., Kanguru Solutions, Micron technology Incorporated, Samsung electronics corporation Limited, Gemalto NV, WinMagic Incorporated, NetApp and Seagate Technology PLC. Increasing hardware encryption business size explains the winning strategies adopted by these industry players. Other industries in this domain that are growing at a high CAGR include Maritime security Market and Enterprise firewall Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS:

By Algorithm and Standard Outlook ($Revenue, 2018-2026)

· Rivest-Shamir-Adleman (RSA) Algorithm

· Advanced Encryption Standard (AES)

· Others

By Architecture Outlook ($Revenue, 2018-2026)

· Application- Specific Integrated Circuits (ASIC)

· Field-Programmable Gate Arrays (FPGA)

By Product Outlook ($Revenue, 2018-2026)

· Solid-State Drivers

· Internal Hard disk drivers

· USB Flash drivers

· External Hard Disk Drives

· Inline Network Encryptors

By Application Outlook ($Revenue, 2018-2026)

· BFSI

· Aerospace and Defence

· Consumer Electronics

· IT and Telecom

· Transportation

· Healthcare

· Others

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

INDUSTRY PLAYERS ANALYSIS

· Kingston Technology

· Corporation

· Toshiba Corporation

· Sandisk Corporation

· Seagate Technology Plc.

· Kanguru Solutions

· Micron Technology Incorporated

· Samsung electronics corporation Limited

· Gemalto NV

· WinMagic Incorporated

· NetApp

· Seagate Technology PLC.

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. HARDWARE ENCRYPTION MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL HARDWARE ENCRYPTION MARKET DEMAND SIDE ANALYSIS

2.1. HARDWARE ENCRYPTION MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. HARDWARE ENCRYPTION MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL HARDWARE ENCRYPTION MARKET SUPPLY SIDE ANALYSIS

3.1. HARDWARE ENCRYPTION MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL HARDWARE ENCRYPTION MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL HARDWARE ENCRYPTION MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL HARDWARE ENCRYPTION MARKET BY ALGORITHM AND STANDARD

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY ALGORITHM AND STANDARD, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY ALGORITHM AND STANDARD, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY ALGORITHM AND STANDARD, BILLION UNITS, 2018 – 2025

6.4. Rivest-Shamir-Adleman (RSA) Algorithm

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. Advanced Encryption Standard (AES)

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. OTHERS

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL HARDWARE ENCRYPTION MARKET BY ARCHITECTURE

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY ARCHITECTURE, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY ARCHITECTURE, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY ARCHITECTURE, BILLION UNITS, 2018 – 2025

7.4. APPLICATION- SPECIFIC INTEGRATED CIRCUITS (ASIC)

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. FIELD-PROGRAMMABLE GATE ARRAYS (FPGA)

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL HARDWARE ENCRYPTION MARKET BY PRODUCT

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY PRODUCT, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY PRODUCT, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY PRODUCT, BILLION UNITS, 2018 – 2025

8.4. SOLID-STATE DRIVERS

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. INTERNAL HARD DISKDRIVERS

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. USB FLASHDRIVERS

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

8.7. EXTERNAL HARD DISK DRIVES

8.7.1. Market determinants and trend analysis

8.7.2. Market revenue, sales and production volume, 2018 – 2025

8.8. INLINE NETWORK ENCRYPTORS

8.8.1. Market determinants and trend analysis

8.8.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL HARDWARE ENCRYPTION MARKET BY APPLICATION

9.1. SEGMENT OUTLINE

9.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

9.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

9.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

9.4. BFSI

9.4.1. Market determinants and trend analysis

9.4.2. Market revenue, sales and production volume, 2018 – 2025

9.5. AEROSPACE AND DEFENSE

9.5.1. Market determinants and trend analysis

9.5.2. Market revenue, sales and production volume, 2018 – 2025

9.6. CONSUMER ELECTRONICS

9.6.1. Market determinants and trend analysis

9.6.2. Market revenue, sales and production volume, 2018 – 2025

9.7. IT AND TELECOM

9.7.1. Market determinants and trend analysis

9.7.2. Market revenue, sales and production volume, 2018 – 2025

9.8. TRANSPORTATION

9.8.1. Market determinants and trend analysis

9.8.2. Market revenue, sales and production volume, 2018 – 2025

9.9. HEALTHCARE

9.9.1. Market determinants and trend analysis

9.9.2. Market revenue, sales and production volume, 2018 – 2025

9.10. OTHERS

9.10.1. Market determinants and trend analysis

9.10.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 10. GLOBAL HARDWARE ENCRYPTION MARKET BY REGIONS

10.1. REGIONAL OUTLOOK

10.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

10.3. NORTH AMERICA

10.3.1. Current Trends and Future Prospects

10.3.2. North America market revenue, sales and production volume, 2018 – 2025

10.3.3.U.S.

10.3.3.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.3.3.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.3.3.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.3.4. Canada

10.3.4.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.3.4.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.3.4.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.3.5. Mexico

10.3.5.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.3.5.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.3.5.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.4. EUROPE

10.4.1. Current Trends and Future Prospects

10.4.2. Europe market revenue, sales and production volume, 2018 – 2025

10.4.3. U.K

10.4.3.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.4.3.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.4.3.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.4.4. Germany

10.4.4.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.4.4.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.4.4.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.4.5. France

10.4.5.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.4.5.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.4.5.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.4.6. Italy

10.4.6.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.4.6.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.4.6.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.4.7. Rest of Europe

10.4.7.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.4.7.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.4.7.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.5. ASIA PACIFIC

10.5.1. Current Trends and Future Prospects

10.5.2. Europe market revenue, sales and production volume, 2018 – 2025

10.5.3. India

10.5.3.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.5.3.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.5.3.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.5.4. Japan

10.5.4.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.5.4.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.5.4.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.5.5. China

10.5.5.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.5.5.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.5.5.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.5.6. South Korea

10.5.6.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.5.6.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.5.6.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.5.7. Rest of APAC

10.5.7.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.5.7.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.5.7.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.6. REST OF THE WORLD

10.6.1. Current Trends and Future Prospects

10.6.2. Europe market revenue, sales and production volume, 2018 – 2025

10.6.3. Latin America

10.6.3.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.6.3.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.6.3.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.6.4. Middle East

10.6.4.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.6.4.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.6.4.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

10.6.5. Africa

10.6.5.1. Hardware Encryption Market Revenue $BILLION (2018 – 2025)

10.6.5.2. Hardware Encryption Market Consumption BILLION Units (2018 – 2025)

10.6.5.3. Hardware Encryption Market Production BILLION Units (2018 – 2025)

CHAPTER 11. KEY VENDOR PROFILES

11.1. Kingston Technology Corporation

11.1.1. Company overview

11.1.2. Portfolio Analysis

11.1.3. Estimated revenue from hardware encryption business and market share

11.1.4. Regional & business segment Revenue Analysis

11.2. Toshiba Corporation

11.2.1. Company overview

11.2.2. Portfolio Analysis

11.2.3. Estimated revenue from hardware encryption business and market share

11.2.4. Regional & business segment Revenue Analysis

11.3. Sandisk Corporation

11.3.1. Company overview

11.3.2. Portfolio Analysis

11.3.3. Estimated revenue from hardware encryption business and market share

11.3.4. Regional & business segment Revenue Analysis

11.4. Seagate Technology Plc.

11.4.1. Company overview

11.4.2. Portfolio Analysis

11.4.3. Estimated revenue from hardware encryption business and market share

11.4.4. Regional & business segment Revenue Analysis

11.5. Kanguru Solutions

11.5.1. Company overview

11.5.2. Portfolio Analysis

11.5.3. Estimated revenue from hardware encryption business and market share

11.5.4. Regional & business segment Revenue Analysis

11.6. technology Incorporated

11.6.1. Company overview

11.6.2. Portfolio Analysis

11.6.3. Estimated revenue from hardware encryption business and market share

11.6.4. Regional & business segment Revenue Analysis

11.7. Samsung electronics corporation Limited

11.7.1. Company overview

11.7.2. Portfolio Analysis

11.7.3. Estimated revenue from hardware encryption business and market share

11.7.4. Regional & business segment Revenue Analysis

11.8. Gemalto NV

11.8.1. Company overview

11.8.2. Portfolio Analysis

11.8.3. Estimated revenue from hardware encryption business and market share

11.8.4. Regional & business segment Revenue Analysis

11.9. WinMagic Incorporated

11.9.1. Company overview

11.9.2. Portfolio Analysis

11.9.3. Estimated revenue from hardware encryption business and market share

11.9.4. Regional & business segment Revenue Analysis

11.10. NetApp and MicronSeagatetechnology PLC

11.10.1. Company overview

11.10.2. Portfolio Analysis

11.10.3. Estimated revenue from hardware encryption business and market share

11.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved