- Report ID : MD1248 |

- Pages : 191 |

- Tables : 91 |

- Formats :

By Packaging Technology (2D IC, 2.5D IC and 3D IC), By Bumping Technology (tin-lead eutectic solder, copper pillar, gold bumping solder bumping and lead free solder), By Industry Vertical (industrial, electronics and automotive and transport), By Region (North America, Europe, APAC and Rest of the World)

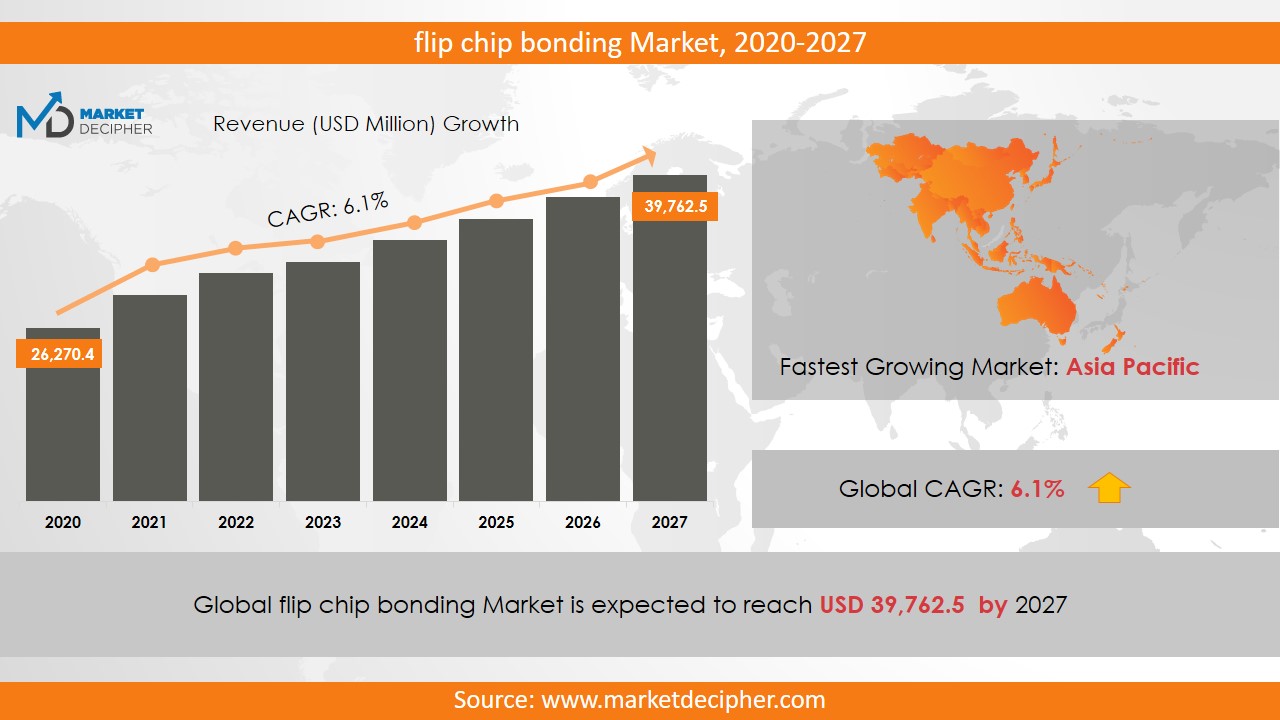

Flip Chip Bonding market revenue is estimated to be $XX Billion in 2018 and shall grow with a CAGR of XX.X% during the forecast period of 2018 to 2026.

This market is anticipated to witness tremendous growth in its market revenue in the coming few years owing to the high demand for this type of bonding in manufacturing industries. The flip chip bonding is used for connecting the microsensors, integrated chips and microscopic devices to the outer circuit. Further, this kind of bonding provides a better replacement to the traditional wire bonds due to its various advanced features such as good electrical performance, high thermal efficiency, and greater flexibility. Flip Chip bonding has greater O capability which in turn is helping in the affecting flip chip bonding market positively. Further, the increasing trend of the Internet of Things especially in the Asia Pacific region is anticipated to propel the flip chip bonding market sales over the forecast period.

Increasing adoption electronic devices such as laptops, smartphones, and tablets are also anticipated to propel the market shares significantly over time. Smartphones & tablets are expected to generate the highest flip chip bonding market revenue as compared to all the consumer electronic devices. Moreover, the rising number of development and research activities is anticipated to boost up the market revenue significantly over the forecast period. The automotive market is expected to grow at a second-highest CAGR rate, catapulting the flip chip technology market further.

North America generated about the largest market revenue in 2018 and is anticipated to continue to grow with the same rate during the forecast period:

The North American region is the dominant region in contributing to market growth in 2018. The rising investment by the market players of the region is driving the shares of the market in the region. Further, this region is anticipated to fuel up the market shares significantly over the forecast period owing to the increasing contribution of the U.S region in augmenting the shares of the market. Moreover, the Asia Pacific region is also anticipated to grow significantly over the forecast period owing to the heavy competition among the market players in these regions.

2.5D IC has dominated the flip chip bonding market in terms of revenue:

Based on packaging technology, the segmentation has been done as a 2D IC, 2.5D IC, and 3D IC. Out of which, the 2.5 D IC has dominated the market shares in 2018 owing to its enhanced features and affordable cost. Further, this segment is expected to grow fastly over the forecast period. By bumping technology, the bifurcation has been done as a tin-lead eutectic solder, copper pillar, gold bumping solder bumping and lead-free solder. By industry vertical, the market has been bifurcated as industrial, electronics and automotive and transport.

Flip Chip Bonding Industry Players:

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Advanced Micro Devices, Inc., Cisco, EV Group, Amkor Technology, ASE Group, IBM Corporation, Jiangsu Changjiang Electronics Technology Co. Ltd., On Semiconductor, Intel, Intel Corporation, Qualcomm Technologies, Inc., Rudolph Technology, Sony Corporation, STMicroelectronics, SAMSUNG Electronics Co. Ltd. and Siliconware Precision Industries Co., Ltd.

Key Points covered in the Report:

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

MARKET SEGMENTATION

By Packaging Technology Outlook ($Revenue, 2018-2026)

• 2D IC

• 2.5D IC

• 3D IC

By Bumping Technology Outlook ($Revenue, 2018-2026)

• Tin-lead eutectic solder

• Copper pillar

• Gold Bumping

• Solder Bumping

• Lead-free solder

By Industry Vertical Outlook ($Revenue, 2018-2026)

• Industrial

• Electronics

• Automotive and transport

By Regional Outlook ($Revenue, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the World

• Middle East and Africa

• Latin America

Flip Chip Bonding Industry Players:

• Advanced Micro Devices, Inc.

• Cisco

• EV Group

• Amkor Technology

• ASE Group

• IBM Corporation

• Jiangsu Changjiang Electronics Technology Co. Ltd.

• On Semiconductor

• Intel

• Intel Corporation

• Qualcomm Technologies, Inc.

• Rudolph Technology

• Sony Corp

• STMicroelectronics

• SAMSUNG Electronics Co. Ltd.

• Siliconware Precision Industries Co., Ltd.

CHAPTER 1: INTRODUCTION

1.1. Research Methodology

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Global Market Outlook

2.2. Core Insights - Packaging Technology

2.3. Core Insights – Bumping Technology

2.4. Core Insights – Packaging Technology

2.5. Core Insights – Geography

CHAPTER 3: MARKET OVERVIEW

3.1. Market Definition and Scope

3.2. Key Forces Shaping the Industry

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Industry Landscape - PESTEL Analysis

3.4.1. Political Landscape

3.4.2. Environmental Landscape

3.4.3. Social Landscape

3.4.4. Technology Landscape

3.4.5. Economic Landscape

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2018-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: GLOBAL FLIP CHIP BONDING MARKET, BY PACKAGING TECHNOLOGY

5.1. Overview

5.1.1. Market Volume and Forecast, 2018-2026

5.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

5.2. 2D IC

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Volume and Forecast, By Region

5.2.3. Market Revenue (US$ Million) and Forecast, By Region

5.3. 2.5D IC

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Volume and Forecast, By Region

5.3.3. Market Revenue (US$ Million) and Forecast, By Region

5.4. 3D IC

5.4.1. Key Market Trends, Growth Factors and Opportunities

5.4.2. Market Volume and Forecast, By Region

5.4.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: GLOBAL FLIP CHIP BONDING MARKET, BY BUMPING TECHNOLOGY

6.1. Overview

6.1.1. Market Volume and Forecast, 2018-2026

6.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

6.2. Tin-lead eutectic solder

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Volume and Forecast, By Region

6.2.3. Market Revenue (US$ Million) and Forecast, By Region

6.3. Copper pillar

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Volume and Forecast, By Region

6.3.3. Market Revenue (US$ Million) and Forecast, By Region

6.4. Gold Bumping

6.4.1. Key Market Trends, Growth Factors and Opportunities

6.4.2. Market Volume and Forecast, By Region

6.4.3. Market Revenue (US$ Million) and Forecast, By Region

6.5. Solder Bumping

6.5.1. Key Market Trends, Growth Factors and Opportunities

6.5.2. Market Volume and Forecast, By Region

6.5.3. Market Revenue (US$ Million) and Forecast, By Region

6.6. Lead-free solder

6.6.1. Key Market Trends, Growth Factors and Opportunities

6.6.2. Market Volume and Forecast, By Region

6.6.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: GLOBAL FLIP CHIP BONDING MARKET, BY PACKAGING TECHNOLOGY

7.1. Overview

7.1.1. Market Volume and Forecast, 2018-2026

7.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

7.2. Industrial

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Volume and Forecast, By Region

7.2.3. Market Revenue (US$ Million) and Forecast, By Region

7.3. Electronics

7.3.1. Key Market Trends, Growth Factors and Opportunities

7.3.2. Market Volume and Forecast, By Region

7.3.3. Market Revenue (US$ Million) and Forecast, By Region

7.4. Automotive and transport

7.4.1. Key Market Trends, Growth Factors and Opportunities

7.4.2. Market Volume and Forecast, By Region

7.4.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 8: GLOBAL FLIP CHIP BONDING MARKET, BY GEOGRAPHY

8.1. Overview

8.2. North America

8.2.1. Key Market Trends, Growth Factors and Opportunities

8.2.2. Market Volume and Forecast, By Packaging Technology

8.2.3. Market Volume and Forecast, By Bumping Technology

8.2.4. Market Volume and Forecast, By Packaging Technology

8.2.5. Market Revenue and Forecast, By Packaging Technology

8.2.6. Market Revenue and Forecast, By Bumping Technology

8.2.7. Market Revenue and Forecast, By Packaging Technology

8.2.8. Market Revenue and Forecast, By Country

8.2.9. U.S.

8.2.9.1. Market Volume and Forecast

8.2.9.2. Market Revenue and Forecast

8.2.10. Canada

8.2.10.1. Market Volume and Forecast

8.2.10.2. Market Revenue and Forecast

8.2.11. Mexico

8.2.11.1. Market Volume and Forecast

8.2.11.2. Market Revenue and Forecast

8.3. Europe

8.3.1. Market Volume and Forecast, By Packaging Technology

8.3.2. Market Volume and Forecast, By Bumping Technology

8.3.3. Market Volume and Forecast, By Packaging Technology

8.3.4. Market Revenue and Forecast, By Packaging Technology

8.3.5. Market Revenue and Forecast, By Bumping Technology

8.3.6. Market Revenue and Forecast, By Packaging Technology

8.3.7. Market Revenue and Forecast, By Country

8.3.8. Germany

8.3.8.1. Market Volume and Forecast, By Packaging Technology

8.3.8.2. Market Revenue and Forecast, By Bumping Technology

8.3.9. UK

8.3.9.1. Market Volume and Forecast, By Packaging Technology

8.3.9.2. Market Revenue and Forecast, By Bumping Technology

8.3.10. France

8.3.10.1. Market Volume and Forecast, By Packaging Technology

8.3.10.2. Market Revenue and Forecast, By Bumping Technology

8.3.11. Italy

8.3.11.1. Market Volume and Forecast, By Packaging Technology

8.3.11.2. Market Revenue and Forecast, By Bumping Technology

8.3.12. Rest of Europe

8.3.12.1. Market Volume and Forecast, By Packaging Technology

8.3.12.2. Market Revenue and Forecast, By Bumping Technology

8.4. Asia-Pacific

8.4.1. Market Volume and Forecast, By Packaging Technology

8.4.2. Market Volume and Forecast, By Bumping Technology

8.4.3. Market Volume and Forecast, By Packaging Technology

8.4.4. Market Revenue and Forecast, By Packaging Technology

8.4.5. Market Revenue and Forecast, By Bumping Technology

8.4.6. Market Revenue and Forecast, By Packaging Technology

8.4.7. Market Revenue and Forecast, By Country

8.4.8. China

8.4.8.1. Market Volume and Forecast, By Packaging Technology

8.4.8.2. Market Revenue and Forecast, By Bumping Technology

8.4.9. India

8.4.9.1. Market Volume and Forecast, By Packaging Technology

8.4.9.2. Market Revenue and Forecast, By Bumping Technology

8.4.10. Japan

8.4.10.1. Market Volume and Forecast, By Packaging Technology

8.4.10.2. Market Revenue and Forecast, By Bumping Technology

8.4.11. South Korea

8.4.11.1. Market Volume and Forecast, By Packaging Technology

8.4.11.2. Market Revenue and Forecast, By Bumping Technology

8.4.12. Rest of Asia-Pacific

8.4.12.1. Market Volume and Forecast, By Packaging Technology

8.4.12.2. Market Revenue and Forecast, By Bumping Technology

8.5. REST OF THE WORLD

8.5.1. Market Volume and Forecast, By Packaging Technology

8.5.2. Market Volume and Forecast, By Bumping Technology

8.5.3. Market Volume and Forecast, By Packaging Technology

8.5.4. Market Revenue and Forecast, By Packaging Technology

8.5.5. Market Revenue and Forecast, By Bumping Technology

8.5.6. Market Revenue and Forecast, By Packaging Technology

8.5.7. Market Revenue and Forecast, By Country

8.5.8. Latin America

8.5.8.1. Market Volume and Forecast, By Packaging Technology

8.5.8.2. Market Revenue and Forecast, By Bumping Technology

8.5.9. Middle East

8.5.9.1. Market Volume and Forecast, By Packaging Technology

8.5.9.2. Market Revenue and Forecast, By Bumping Technology

8.5.10. Africa

8.5.10.1. Market Volume and Forecast, By Packaging Technology

8.5.10.2. Market Revenue and Forecast, By Bumping Technology

CHAPTER 9: COMPETITIVE LANDSCAPE

9.1. Flip Chip Bonding Market Share Analysis, 2018

CHAPTER 10: COMPANY PROFILES

10.1. Advanced Micro Devices, Inc.

10.1.1. Company Overview

10.1.2. Financial Performance

10.1.3. SWOT Analysis

10.2. Cisco

10.2.1. Company Overview

10.2.2. Financial Performance

10.2.3. SWOT Analysis

10.3. EV Group

10.3.1. Company Overview

10.3.2. Financial Performance

10.3.3. SWOT Analysis

10.4. Amkor Technology

10.4.1. Company Overview

10.4.2. Financial Performance

10.4.3. SWOT Analysis

10.5. ASE Group

10.5.1. Company Overview

10.5.2. Financial Performance

10.5.3. SWOT Analysis

10.6. IBM Corporation

10.6.1. Company Overview

10.6.2. Financial Performance

10.6.3. SWOT Analysis

10.7. Jiangsu Changjiang Electronics Technology Co. Ltd.

10.7.1. Company Overview

10.7.2. Financial Performance

10.7.3. SWOT Analysis

10.8. On Semiconductor

10.8.1. Company Overview

10.8.2. Financial Performance

10.8.3. SWOT Analysis

10.9. Intel

10.9.1. Company Overview

10.9.2. Financial Performance

10.9.3. SWOT Analysis

10.10. Intel Corporation

10.10.1. Company Overview

10.10.2. Financial Performance

10.10.3. SWOT Analysis

10.11. Qualcomm Technologies, Inc.

10.11.1. Company Overview

10.11.2. Financial Performance

10.11.3. SWOT Analysis

10.12. Rudolph Technology

10.12.1. Company Overview

10.12.2. Financial Performance

10.12.3. SWOT Analysis

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved