EV Battery Management System Market Size, Statistics, Growth Trend Analysis and Forecast Report, 2022 - 2032

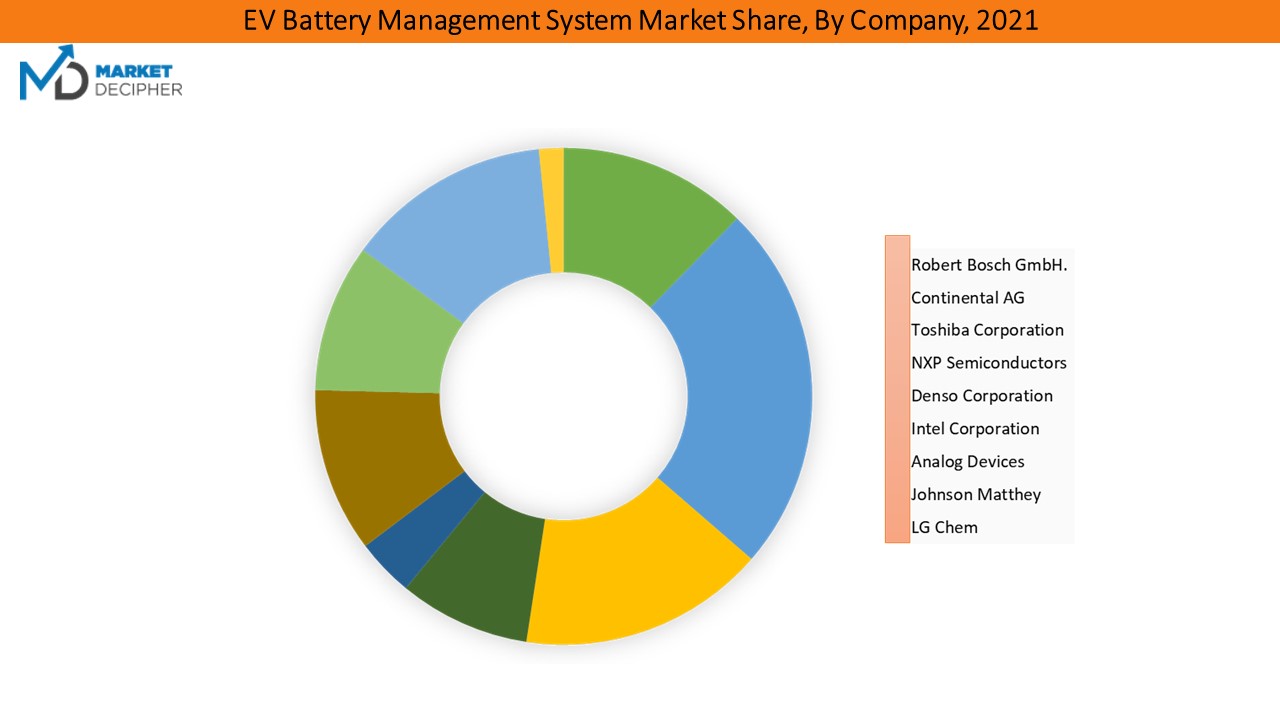

EV Battery Management System Market is segmented by Component (Integrated Circuits, Cutoff FETs and FET Driver, Temperature Sensor, Fuel Gauge/Current Measurement Devices, Microcontroller, and Other Components), by Propulsion Type (Battery Electric Vehicles and Hybrid Vehicles), by Vehicle Type (Passenger Cars and Commercial Vehicles), by Region (United States, Canada, Mexico, France, Germany, Italy, Spain, United Kingdom, Russia, China, India, Philippines, Malaysia, Australia, Austria, South Korea, Middle East, Japan, Africa, Rest of World) and EV Battery Management System Market companies (Robert Bosch GmbH., Continental AG, Toshiba Corporation, NXP Semiconductors, Denso Corporation, Intel Corporation, Analog Devices, Johnson Matthey, LG Chem, and Midtronics)

- Report ID : MD2903 |

- Pages : 220 |

- Tables : 79 |

- Formats :

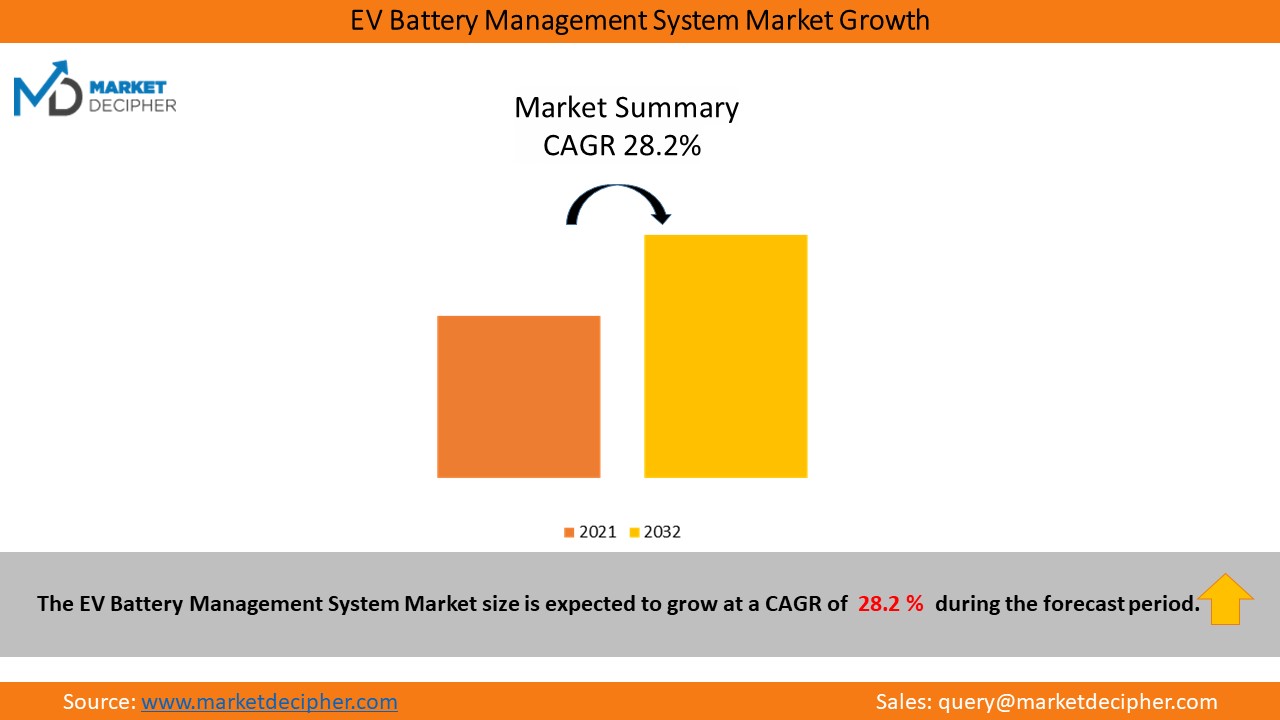

The EV Battery Management System Market was estimated at USD 2,560.1 million in 2021 and is forecast to grow at a CAGR of 28.2 % during the forecast period.

Batteries, in short, are managed by battery management systems. The system controls and monitors the charging and discharging of batteries and provides notifications about the status and condition of battery packs. A battery management system is also responsible for protecting batteries from damage. Lithium-ion batteries have two crucial design issues. First, they can be damaged if overcharged and result in overheating, flames, etc. The lithium-ion battery can also be damaged if it is discharged below a certain threshold, which is around 5% of its total capacity. A battery might be permanently damaged if it is allowed to discharge below this level.

• Several factors including the increasing adoption of electric and hybrid vehicles, increasing partnership and collaboration in the development and implementation of BMS, and the increasing government efforts for electric mobility charging infrastructure will boost the EV battery management system market growth prospects. Moreover, soaring demand for intelligent battery management systems in advanced electric vehicles will boost automotive BMS market sales in the near future.

• A growing number of technological advances in automotive BMS is also projected to drive EV battery management system market sales. Bird Global, Inc. developed an innovative BMS in January 2022 that powers millions of micro-electric vehicle (EV) trips around the world. By minimizing the likelihood of lithium-ion battery failure, Birds BMS is designed to assist riders and communities in a safe manner. Innovative Labs also launched in February 2022 the BaMoS battery management system, which utilizes ultra-thin temperature and pressure sensors to gather comprehensive battery information at the cell level, which enhances battery longevity by up to 40%.

• The integration of BMS into vehicles increases the overall cost of vehicles due to the high price of these components. However, battery management systems are a vital part of electric vehicles. Thus EV battery management system market shares are expected to shooot up crazily during the forecast period. On the other hand, leading market players are constantly focusing on innovation to lower overall costs and simplify the design of these battery control units.

• Electric vehicles use wired BMS to monitor battery statuses, such as charge status and battery health. With traditional wired systems, copper wires are physically attached to each cell of the battery. It is an inefficient and costly design. A wireless BMS eliminates the need to develop specific communication systems or redesign wiring schemes for new vehicles. By using this system, the ultimate battery will be scalable across a range of brands and vehicle segments.

• A wireless BMS can also increase driving range by building lighter vehicles and freeing up space for more batteries since 90% fewer wires are needed than with a wired system. Electric vehicles utilize SmartMesh or Zigbee. Furthermore, wireless connectivity offers manufacturers more flexibility when deciding where to place battery modules, making it easier to match sizes. A wiring harness cannot be used in places where sensors can be mounted in a BMS because of its flexibility.

• Electric Vehicle battery management system market companies are concentrating on developing simpler, lighter, and more affordable wireless variants because of the numerous advantages they provide. A wireless BMS for an electric vehicle was launched by Texas Instruments in January 2021. Additionally, Visteon, an automotive technology company, introduced a truly wireless automotive BMS in December 2020 that continuously monitors battery packs. Wireless BMS are becoming increasingly common in electric vehicles, as this innovation offers designers greater flexibility and reduces complexity and cost.

An increase in overall vehicle prices will hinder the EV BMS market growth

Installation of sin vehicles based on their type and design is adding to the automotive sectors manufacturing costs, as the cooling system required for the components that monitor and control batteries need to be properly designed. A battery management system should also have many ports and connectors since all batteries must be directly connected to the BMS. Consequently, the implementation of such systems may result in an increase in the final cost of a vehicle, which may reduce the demand from cost-sensitive consumers. Despite their potential benefits, this factor somehow discourages vehicle manufacturers from using BMS. Consumers who are price-sensitive avoid paying an additional amount for a vehicle, discouraging manufacturers from investing in innovation and capital investment, and hindering the growth of EV battery management system market revenue.

Cost of BMS to hamper market expansion

A balance between price and functionality is the biggest challenge for automotive BMS. There are multiple innovative battery monitoring and control technologies available, such as wireless sensing and optical sensing of cell voltage, both of which provide more precise data about cell health; state-of-health algorithms and advanced state-of-charge algorithms; and active cell balancing, which recirculates power currently dissipated throughout the system in the existing battery monitoring and control systems. However, most of these technologies are prohibitively expensive to incorporate into mass-produced automobiles. This may have an effect on the total cost of the EV. Due to this, the cost element may stifle market expansion.

Electric Vehicle BMS Market dominance to be enjoyed by battery electric vehicles

Installing battery management system in vehicles incurs additional manufacturing costs, depending on the vehicle type and design. A proper cooling system is also required for the smooth functioning of the battery management system. Globally, electric mobility is rapidly expanding, leading to goods transportation companies converting their existing fleets to electric propulsion-based vehicles. Examples include:

• Mercedes-Benz has announced a new investment plan worth EUR 70 billion or USD 85 billion for the years 2021 through 2025 with the goal of bringing 30 electric vehicles to market, including 20 battery-powered all-electric vehicles.

• VW announced in December 2020 that it would invest EUR 73 billion in digital and electric vehicle technologies over the next five years, as well as EUR 60 billion for completely plug-in vehicles.

• The United States announced in April 2021 that it would invest USD 174 billion in infrastructure to promote electric vehicles and charging stations.

Europe is expected to dominate the market

| Report Attribute | Details |

| Historical Years | 2018-2021 |

| Forecast Years | 2022-2032 |

| Base Year (2021) Market Size | $2560.1 Million |

| Forecast Period CAGR | 28.2% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; List of Mega Projects; Major Contracts Won by Key Players; End User Capacity & Workforce Analysis; Company Profiling |

| Market Size by Segments | By Component, By Propulsion Type, By Vehicle Type |

• With electric cars on the rise in almost every country in Europe, battery management systems are in high demand in the region. The growing sales of hybrid and electric passenger vehicles is driving automobile manufacturers to increase their battery management system production capacity over the forecast period.

• Volkswagen AG, BMW AG, and Daimler AG are preparing for a major battery-car push in Germany, Europes carmaking heartland. As Germanys market becomes more lucrative, several local manufacturers have formed joint ventures with other firms.

• Hella contributes primarily to the field of battery electronics and jointly develops high-class battery management systems.

• A growing number of government policies are also supporting the EV battery management system industry growth, including investment in infrastructure, broader measures to encourage the use of low- and zero-emission vehicles, and long-term purchase incentives to encourage the growth of the EV market in the country. A battery management system for EVs is expected to benefit from this during the forecast period.

Years considered for this report

• Historical Years: 2018-2021

• Base Year: 2021

• Forecast Period: 2022-2032

EV Battery Management System Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

• Data breakdown for application Industries (2022 – 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown

Component Type Analysis (Revenue, USD Million, 2022 - 2032)

• Integrated Circuits

• Cutoff FETs and FET Driver

• Temperature Sensor

• Fuel Gauge/Current Measurement Devices

• Microcontroller

• Other Components

Propulsion Type Analysis (Revenue, USD Million, 2022 - 2032)

• Battery Electric Vehicles

• Hybrid Vehicles

Vehicle Type Analysis (Revenue, USD Million, 2022 - 2032)

• Passenger Cars

• Commercial Vehicles

Country Analysis (Revenue, USD Million, 2022 – 2032)

• North America

• United States

• Canada

• Mexico

• Europe

• France

• Germany

• Italy

• Spain

• United Kingdom

• Rest of the Europe

• APAC

• China

• India

• Philippines

• Malaysia

• Australia

• Austria

• South Korea

• Rest of the APAC

• Rest of the World

• Middle East

• Japan

• Africa

• Rest of the World

EV Battery Management System Market companies:

• Robert Bosch GmbH.

• Continental AG

• Toshiba Corporation

• NXP Semiconductors

• Denso Corporation

• Intel Corporation

• Analog Devices

• Johnson Matthey

• LG Chem

• Midtronics

Available Versions of EV Battery Management System Market Report: -

United States EV Battery Management System Market Research Report

Europe EV Battery Management System Market Research Report

Asia Pacific EV Battery Management System Market Research Report

India EV Battery Management System Market Research Report

• Customization can be done in the existing research scope to cater to your specific

requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email:- david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved