Carrier Screening Market

Carrier Screening Market is segmented by Product and Service, Type (Expanded Carrier (Predesigned, Customized), Targeted Disease Carrier), Medical Condition (Pulmonary, Hematological), Technology (Sequencing, PCR), End User (Hospitals, Reference Laboratories, Physician Offices & Clinics), and Region (United States, Canada, Mexico, France, Germany, Italy, Spain, United Kingdom, Russia, China, India, Philippines, Malaysia, Australia, Austria, South Korea, Middle East, Japan, Africa and Rest of World)

- Report ID : MD1656 |

- Pages : 200 |

- Tables : 88 |

- Formats :

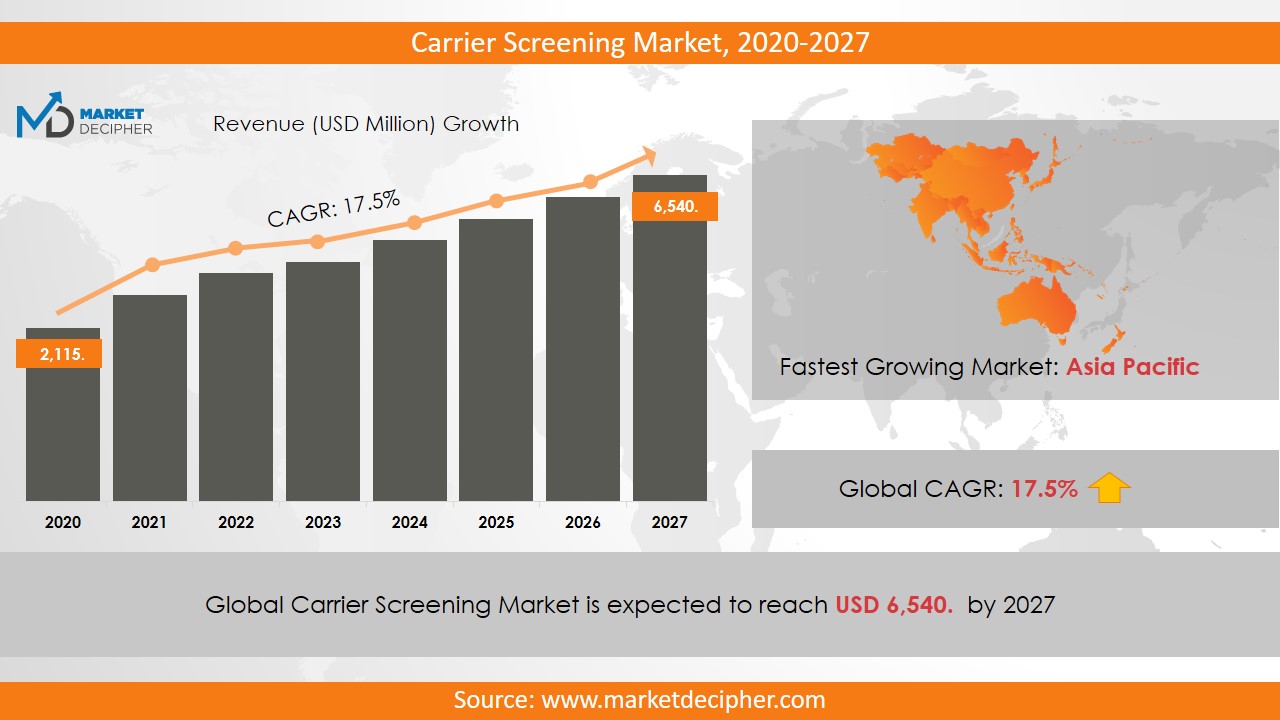

Carrier Screening Market size was estimated at $2,115 Million in 2019 and is expected to reach $6,540 Million by 2027, growing at a CAGR of 17.5% during the forecast period of 2020 to 2027.

There has been a steady growth of the carrier screening market, and such growth is expected to continue because of the increasing realization amongst people about disease detection and prevention, awareness of personal healthcare, and a better standard of living. The faster a disease is diagnosed, the faster it can be treated. Treating the disease early can also make the disease easier to tackle and bear with. Early spotting helps people in planning and hence such a precautionary measure helps create demand. Certain genetic diseases increase the risk of giving birth to a child with a genetic condition. Hence, gynaecologists suggest future parents to undergo carrier screening tests before as well as after conceiving. Hospitals offer flexibility to patients when it comes to scheduling of pickup or drops of samples and shorter processing time to produce results. Thus hospitals owe the highest market share in carrier screening market. Other than hospitals, physicians, clinical centres, medical laboratories hold a significant share. Blood banks, donor banks, and laboratories also create considerable demand because of the susceptibility of their business. And now, the growing realization amongst end-user consumers is expected to effect greater demand to be seen in the upcoming years.

Carrier screening tests may raise the problem of prejudice and the carriers may not go for childbearing or donating. Positive results of carrier screening may lead to the individuals to be considered as uninsurable, unemployable, and unmarriageable. These social issues related to carrier screening restrict the growth of the market. Other issues such as the availability of advanced screening technologies and related skills pose a major threat towards the development of such demand. But healthcare organizations in several countries are financing newborn screening to forecast diseases which may occur later in adulthood. Such funding could tackle the problem of gaining such advance technology and thus uphold the steady rise in demand. Besides, the adoption of carrier tests into day to day healthcare offers an economic advantage to the market.

Carrier Screening Market Growth Factors

Carrier Screening Market Segmentation

Carrier Screening Market Country Analysis

The value of the global carrier screening market was $1.8 billion in 2019 and is expected to reach $4 billion in 2024. North America has been and continues to dominate this market due to the availability of reliable healthcare systems in Canada and the U.S., easy access to sophisticated screening methods like DNA sequencing, the existence of mass genetic testing initiatives, and a rising number of awareness campaigns. In the Europe region, nations such as France, Germany, and the UK are expected to grow their carrier screening market share over the forecasted period due to factors like increasing awareness regarding the value of early disease detection and prevention as well as technological developments in carrier screening. The prominent companies in this market include Quest Diagnostics, Thermo Fisher Scientific, and Eurofins Scientific.

Carrier Screening Market Share and Competition

Key companies operating in this industry are: Invitae (US), Fulgent Genetics (US), Illumina (US), Sema4 (US), Natera Inc. (US), LabCorp (US), CENTOGENE (Germany), Thermo Fisher Scientific (US), Myriad Genetics (US), Eurofins Scientific (US), OPKO Health (US), Fulgent Genetics (US), Quest Diagnostics (US), Luminex Corporation (US), LabCorp (US), BGI Genomics (China), Gene by Gene (US), Progenity (US), Otogenetics Corporation (US), Pathway Genomics (US), MedGenome (US), and True Health (US).

Report Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2020 – 2027)

• Data breakdown for every market segment (2020 – 2027)

• Gross margin and profitability analysis of companies

• Price analysis of each product type

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategy

Industry Segmentation and Revenue Breakdown

Product & Service Analysis (Revenue, USD Million, 2020 - 2027)

• Service

• Product

Type Analysis (Revenue, USD Million, 2020 - 2027)

• Expanded Carrier Screening

o Customized Panel Testing

o Predesigned Panel Testing

• Targeted Disease Carrier Screening

Medical Condition Analysis (Revenue, USD Million, 2020 - 2027)

• Pulmonary Conditions

• Hematological Conditions

• Neurological Conditions

• Other Conditions

Technology Analysis (Revenue, USD Million, 2020 - 2027)

• DNA Sequencing

• Polymerase Chain Reaction

• Microarrays

• Other Technologies

End User Analysis (Revenue, USD Million, 2020 - 2027)

• Hospitals

• Reference Laboratories

• Physician Offices & Clinics

• Other End Users

Region Analysis (Revenue, USD Million, 2020 - 2027)

• United States

• Canada

• Mexico

• France

• Germany

• Italy

• Spain

• United Kingdom

• Russia

• China

• India

• Philippines

• Malaysia

• Australia

• Austria

• South Korea

• Middle East

• Japan

• Africa

• Rest of World

Carrier Screening Market Companies

• Invitae (US)

• Fulgent Genetics (US)

• Illumina (US)

• Sema4 (US)

• Natera Inc. (US)

• LabCorp (US)

• CENTOGENE (Germany)

• Thermo Fisher Scientific (US)

• Myriad Genetics (US)

• Eurofins Scientific (US)

• OPKO Health (US)

• Fulgent Genetics (US)

• Quest Diagnostics (US)

• Luminex Corporation (US)

• LabCorp (US)

• BGI Genomics (China)

• Gene by Gene (US)

• Progenity (US)

• Otogenetics Corporation (US)

• Pathway Genomics (US)

• MedGenome (US)

• True Health (US)

Available Versions:-

United States Carrier Screening Market Industry Research Report

Europe Carrier Screening Market Industry Research Report

Asia Pacific Carrier Screening Market Industry Research Report

Fulgent Genetic Co., a global provider of genetic testing and Next Generation Sequencing (NGS) solutions, has announced the launch of its new platform Picture Genetics, in September 2019. The platform will provide screening tests for various types of consumers. “We are very excited about the launch of Picture Genetics, our consumer-initiated test offering which enables us to deliver our advanced genetic testing capabilities to a much broader audience in an accessible manner.”, says the Chairman and Chief Executive Officer of Fulgent Genetics, Ming Hsieh. VOTI Detection Co., a Canadian company providing latest generation screening tests services, has launched ‘VotilInsights’, an application platform that provides fully integrated analytics and screenings for fleet management purposes, on 20 January 2020. “We are very excited to introduce VotiINSIGHTS to the global x-ray scanning market. This is the first application that we are able to provide to our clients using our new BioSans MATRIX operating system.”, expressed the Rory Olson, President and Chief Executive Officer of VOTI Detection Co.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved