Automotive Hub Motor Market Size, Statistics, Growth Trend Analysis and Forecast Report 2022-2032

Hub Motor Market is segmented By Vehicle Type (Pedelecs, Throttle on Demand, Scooter or Motorcycle, Passenger Cars, and Commercial Vehicles), By Installation Type (Front Hub Motor, Rear Hub Motor), By Motor Type (Gearless Hub Motor, Geared Hub Motor), By Output Type (Below 1000W, 1000-3000W, Above 3000W, 100 KW), By Electric Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Hybrid Electric Vehicle), By Distribution Channel (Aftermarket, OE Market), and By Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa)

- Report ID : MD2911 |

- Pages : 220 |

- Tables : 60 |

- Formats :

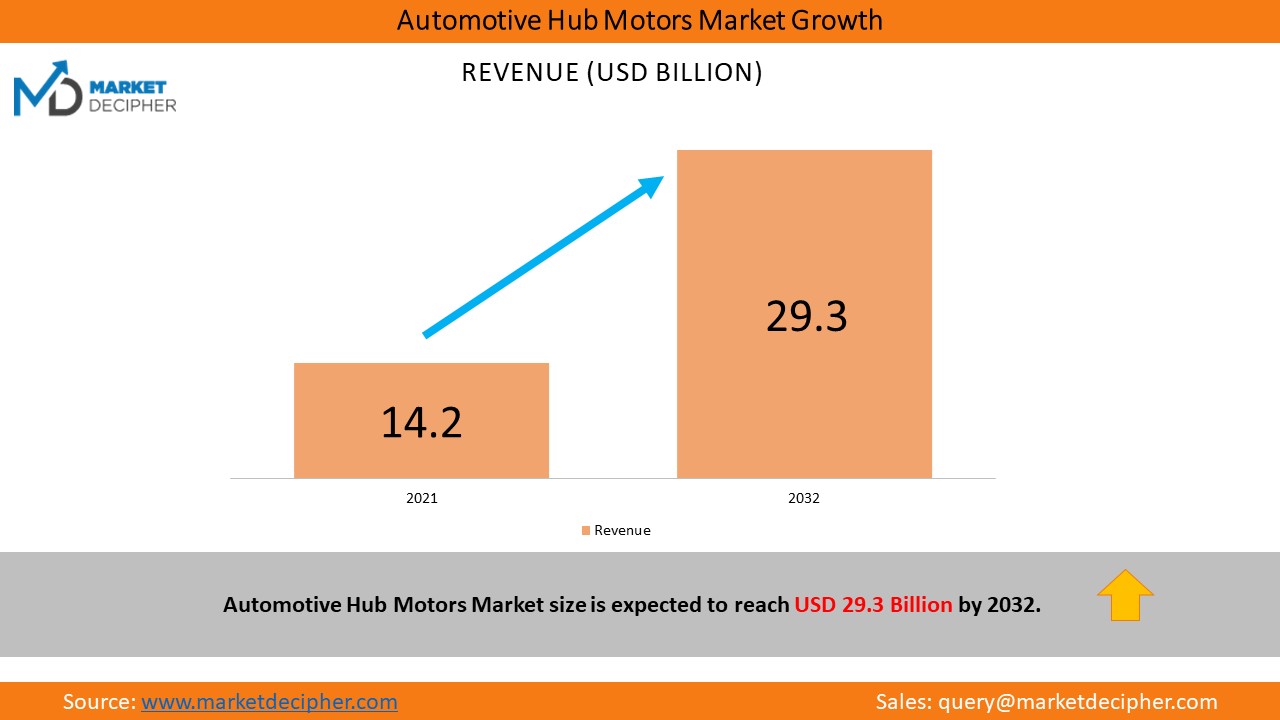

The Automotive Hub Motor Market was estimated at USD 14.18 Billion in 2021 and is expected to reach USD 22.31 Billion by the end of 2032 with a CAGR of 14.12% during the forecast period.

“Hub motors are also termed wheel hub drive, wheel motor, and in-wheel motors. Hub Motors eliminates the need for axels, drivelines, and transmissions which helps in lowering the mechanical losses between engine components and the wheel, thus offering higher efficiency”. Hub Motors are a type of power generator installed on the wheels to reduce the engines load and enhance the vehicles effectiveness and performance. Other factors like easy installation, cost competitiveness, flexibility, and compact & lightweight design tend to propel growth.

Covid-19 Impact

The Covid-19 pandemic posed a mild threat to the Automotive Hub Motor Industry but consistent developments in the form of technology and innovation and the projected exponential growth in electric vehicle usage, have supported the economic revival of the market, which is forecasted to grow manifolds henceforth.

Eco-Friendly Electric Vehicles Revolution: The Demand Generator for Hub Motors

The increasing awareness about the harmful effects of automobiles, powered by gasoline that increases air pollution and emits toxic gases, causing harmful diseases, and exhaustion of natural resources coupled with the adoption of favourable government policies to safeguard the environment has broadly promoted the purchase of EVs around the globe and thereby highly contributed to the rising demand for Electric Vehicles. Hub motors are gaining popularity throughout the world, driving up demand and drawing in potential customers, which is helping to expand the motor market.

Efficient Features Will Propel Growth

The hub motor reduces the fuel consumption and maintenance costs of the motorcycle, which in turn extends vehicle life. The compact size, flexibility, energy efficiency and lightweight features of the hub motor tend to add to its benefits. The increased production capacity due to huge investments by major market participants in the hub motor market with focus on improving the efficiency and performance of their hub Motors, is also contributing towards the growth of hub motor market over the forecast period. The growing demand for hub motors from the hybrid vehicles segment is expected to boost the market.

Rear Hub Motor Lead the Market due to Higher Application

Rear Hub Motor has been estimated to be the largest contributor to this market by Installation type. This type of installation generally provides more traction, flexibility, and high acceleration. They are best for higher power applications in vehicles.

Gear Type Hub Motors Increasing at a Fast Rate

This segment is growing swiftly as it adjusts the speed of the vehicle. It provides high torque at low speed which helps drivers to enjoy long uphill rides and is also lightweight and smaller in size. The increasing sales of e-vehicles in the Asia Pacific region will boost the demand for geared hub motors in this region.

E-Bikes and Scooters Dominate the Volume in Market Demand

In terms of volume, Electric Bikes have been the major application area for hub motors due to their huge market and demand in developed as well as developing economies. Recent trends show a clear inclination of 2-wheelers customers shifting towards EV bikes due to growing awareness, government subsidy, and lower maintenance and fuel/charging costs. The passenger cars segment is expected to witness a slower adoption of EV technology in growing economies due to high prices and incompatible road infrastructure. However, the premium car segment will hugely get replaced by EVs due to better luxury and aesthetics along with technologically advanced functionalities.

Upsprung Mass and Mid-Drive Motors Driving the Market Down

As the motor is structured in the wheels, the electrical connection between the body and the wheels makes the harness connection more complex and poses a risk of fire hazard. Automotive hub motors increase the upsprung mass, or the weight of components not supported by the vehicle’s suspension system leads to poor ride handling and steering, resulting in transmission of more shock, making the ride bumpier. Hub Motor operated vehicles are not suitable for off-road and construction site applications due to their inefficiency to function on dirt and off-road sites. Two major hindrances in the growth of hub motor markets is the presence of alternatives such as mid-drive motors and the lack of skill, as integration of hub motor in the aftermarket requires expertise. The easy availability of mid-drive motors can hamper the hub motors overall potential growth.

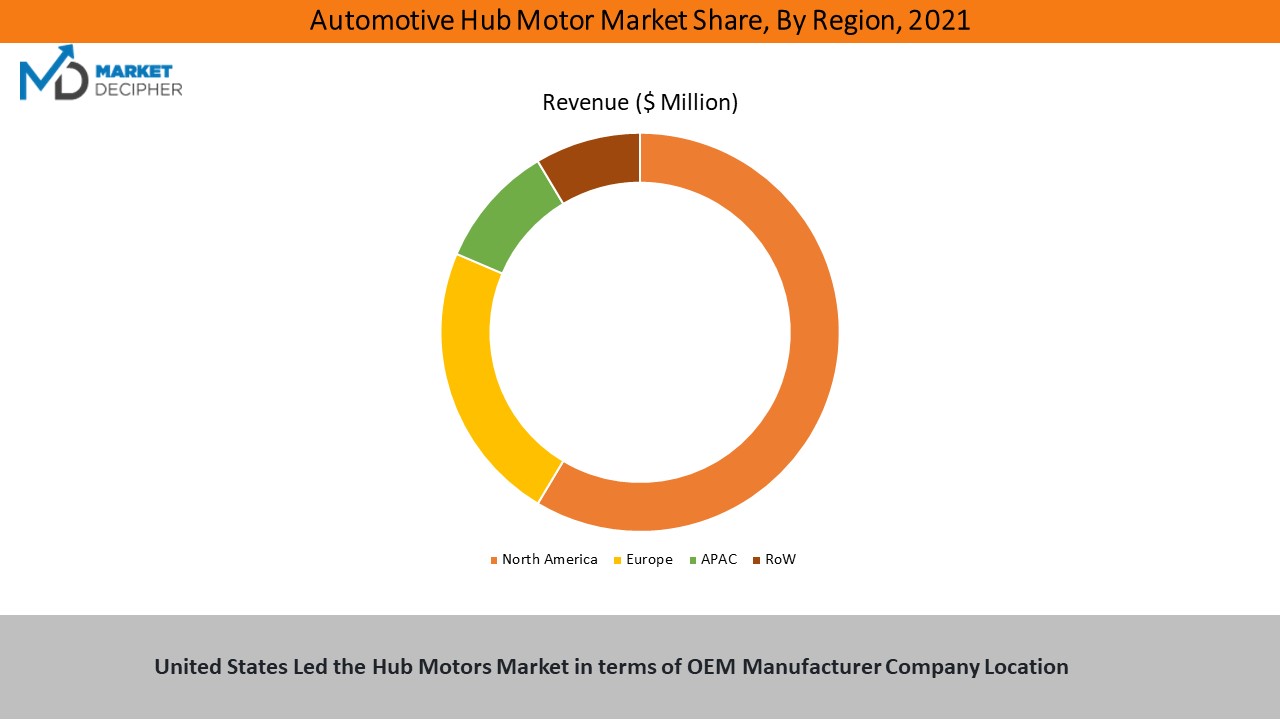

Asia Pacific and Europe predicted to be lucrative markets

Asia-Pacific leads the hub motor market with the introduction of innovative and enhanced features in hub motors like high torque density and high power. Europe is also expected to expand owing to the launch of new generation hub motors with advanced features. Asia Pacific and Europe are projected to be chief flourishing markets during the forecast period, primarily due to the presence of the prominent automotive industry in China, Japan, and India. The huge potential of the electric vehicles segment coupled with its rising penetration in the developing countries such as China, United Kingdom, Japan, France is attracting several significant automotive manufacturers and paving the way for capitalization of the hub motor industry.

Top Companies and Recent Strategic Developments:

Some major market players in the leading hub motors industry are Schaeffler Technologies AG & Co. KG, Hyundai Mobis, Printed Motor Works Limited, Protean Electric Limited, Aisin, QS Motor Ltd, Hero, ABB, Elaphe Propulsion Technologies Ltd, Alstom, General Electric, Robert Bosh GmbH, Accell Group N.V, Toshiba, Trek and many more.

• July 2022: Trek releases two new more affordable electric bikes with hub motors and hidden batteries

• July 2022: Heavy Industries Ministry signs contracts with Reliance New Energy Limited, Ola Electric Mobility Private Limited, and Rajesh Exports Limited for battery manufacturing incentives

• July 2022: FREY Runner electric bike with hub motor launched as the eMTB brand’s first touring e-bike

• June 2022: Toshiba developing a lightweight, compact, high-power superconducting hub motor for mobility applications

• May 2022: Toyota to Make India Its EV Parts Production Hub

• Jan 2022: Hitachi believes it has the formula to deliver in-wheel power

• March 2022: Sona Comstar launches Motor T family of hub motors & controllers

Years considered for this report

• Historical Years: 2019-2021

• Base Year: 2021

• Forecast Period: 2022-2032

Automotive Hub Motor Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/ projections/ forecast for revenue and unit sales (2022 - 2032)

• Data breakdown for application Industries (2022 - 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Automotive Hub Motor Industry Segmentation and Revenue Breakdown

Product Type Analysis (Revenue, USD Million, 2022 - 2032)

• Pedelecs

• Throttle on Demand

• Scooter or Motorcycle

• Passenger Cars

• Commercial Vehicles

Installation Type Analysis (Revenue, USD Million, 2022 - 2032)

• Front Hub Motor

• Rear Hub Motor

Motor Type Analysis (Revenue, USD Million, 2022 - 2032)

• Gearless Hub Motor

• Geared Hub Motor

Electric Vehicle Type (Revenue, USD Million, 2022 - 2032)

• Battery Electric Vehicle

• Plug-in Hybrid Electric Vehicle

• Hybrid Electric Vehicle

Output Type Analysis (Revenue, USD Million, 2022 - 2032)

• Below 1000W

• 1000-3000W

• 3000W – 100KW

• 100 KW – 200 KW

• Above 200 KW

Distribution Channel Analysis (Revenue, USD Million, 2022 - 2032)

• Aftermarket

• OEM

Region Type Analysis (Revenue, USD Million, 2022 - 2032)

• North America (United States, Mexico, and Canada)

• Latin America (Brazil & Mexico)

• Europe (Germany, United Kingdom, France, Italy, Spain, Russia, Netherlands, and others)

• Middle East & Africa

• Asia Pacific (China, India, South Korea, Indonesia, Australia, Vietnam, and others)

Key Companies

These brands have competed to maintain their position as the leading seller of Hub Motors to the customers.

• Schaeffler technologies AG & Co. KG

• Aisin

• QS Motor Ltd

• ABB

• Elaphe Propulsion Technologies Ltd

• Alstom

• General Electric

• Robert Bosh GmbH

• Accell Group N.V

• Toshiba

Available Versions of Hub Motor Market Report:

United States Hub Motor Market Research Report

Europe Hub Motor Market Research Report

Asia Pacific Hub Motor Market Research Report

India Hub Motor Market Research Report

• Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply).

• Send us a query to get the Table of Contents and Research Scope along with the research proposal.

Fill out the sample request form OR reach out directly to David Correa at his email: -

david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved