Embedded Systems in Automobiles Market

By Functions (Hardware and Software), By Application (Ignition, security and Entertainment, Airbag, GPS, Fuel injection system and Anti-locking breakage system), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1053 |

- Pages : 98 |

- Tables : 72 |

- Formats :

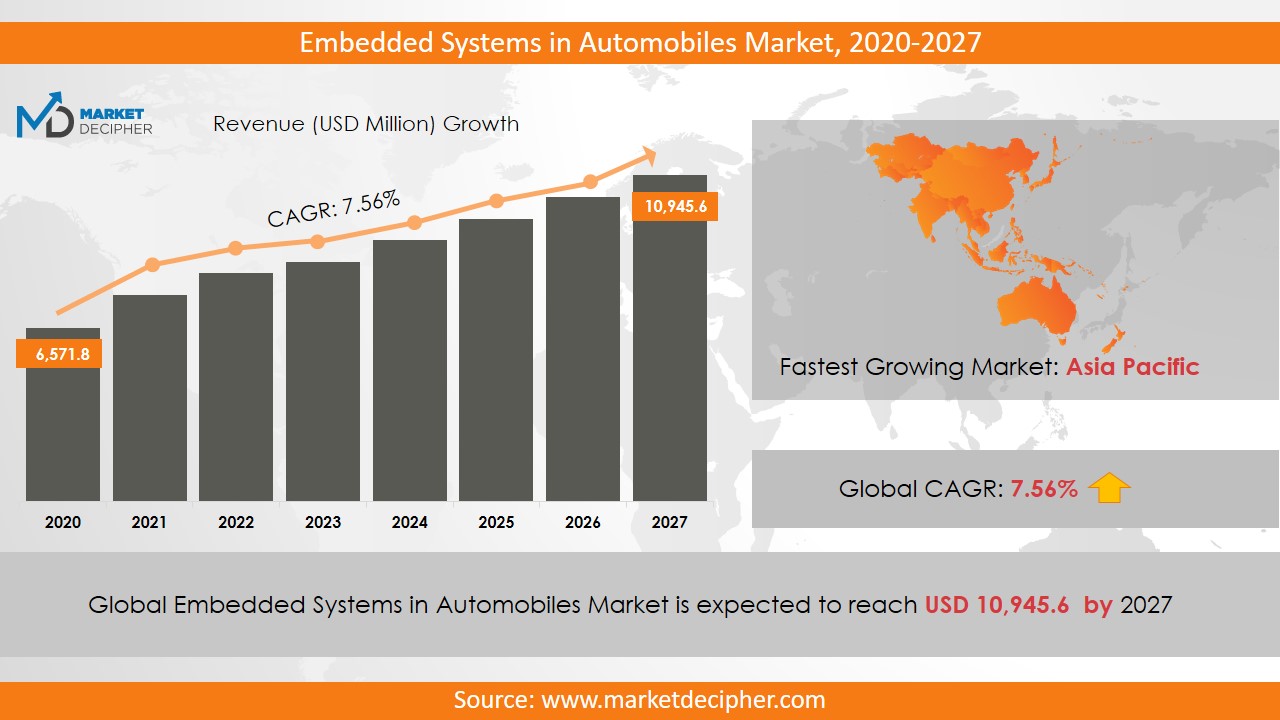

Embedded Systems in Automobiles market revenue shall reach a value of $119.12 Billion in 2026, growing with a CAGR of 4.2% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

An embedded system includes computer hardware and software that are ready to work together to reduce pollution and increase vehicle performance. This system enhances the functioning of a device due to features like reliability, adaptability, power, efficiency, speed, and accuracy. The various enhanced attributes provided by these embedded systems in automobiles include automatic four-wheel drive, anti-lock braking system, and electronic control. These systems are used widely in aeronautics for the assistance and safety of the pilots and the passengers. Apart from this, they are also greatly used in mobile communication, electronic payment solutions, and rails. The rising demand for smart and power efficient automobiles in today’s world is anticipated to fuel up the embedded systems in automobiles market growth significantly. The GPS parking sensors provided in this system are one of the key features which drive the embedded systems in automobiles market revenue significantly.

The rising penetration of technologies such as the Internet of Things is adding to the embedded systems in automobiles industry size. This system helps the vehicle work more efficiently and makes it more competitive and the adoption of these systems affects the life of the vehicle positively. Moreover, the auto companies are working hard for enhancing the automated features in their automobiles and the ongoing innovations are going to fuel up the embedded systems in automobiles market shares satisfactorily over time. Further, the government rules and regulations to ensure the safety of the consumers are anticipated to increase embedded systems in automobiles market size.

REGIONAL ANALYSIS

The Asia Pacific region has contributed substantially in 2018 owing to the increasing investment in the market by developing economies such as South Korea, India, Japan, and China. Moreover, this region has registered the majority of the overall revenue due to the increasing production of automobiles in the region. Likewise, the North American region also contributed substantially to the overall revenue of the market. Further, the Asia Pacific embedded systems in automobiles business are anticipated to witness a significant increase in its revenue during the forecast period.

SEGMENT ANALYSIS

In terms of function, the splitting has been done as hardware and software. Both are expected to register a commendable growth in the coming years. Based on application, the market has been segmented as ignition, security, and entertainment. This can be further segmented as airbag, GPS, fuel injection system and anti-locking breakage system. Out of which, the airbag segment dominated the overall market revenue.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Renesas Electronics Corporation, Infineon Technologies, Atmel Corporation, and Infosys, Texas Instruments, Free scale Semiconductors, Microsoft Corporation, NXP Semiconductors, HCL Technologies Limited, and Intel Corporation. Moreover, the increasing investments by various industry players in this market are leading to heavy competition among them and thereby the demand for these systems is increasing worldwide. Nowadays, most of the premium auto vehicles contain around 100 electronic integrated system units. One of the key embedded systems in automobiles market trends expected to provide lucrative opportunities to the market during the forecast period is the increasing investment by many companies in research & development. Other industries in this domain that are growing at a high CAGR include Automotive Embedded Telematics Market and Mild hybrid Vehicle Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS

By Function Outlook ($Revenue, 2018-2026)

• Software

• Hardware

By Application Outlook ($Revenue, 2018-2026)

• Security

• Ignition

• Entertainment

By Regional Outlook ($Revenue, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the World

• Middle East

• Africa

• Latin America

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. EMBEDDED SYSTEMS IN AUTOMOBILES MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET DEMAND SIDE ANALYSIS

2.1. EMBEDDED SYSTEMS IN AUTOMOBILES MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. EMBEDDED SYSTEMS IN AUTOMOBILES MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET SUPPLY SIDE ANALYSIS

3.1. EMBEDDED SYSTEMS IN AUTOMOBILES MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET BY FUNCTION

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY FUNCTION, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY FUNCTION, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY FUNCTION, BILLION UNITS, 2018 – 2025

6.4. SOFTWARE

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. HARDWARE

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET BY APPLICATION

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

7.4. SECURITY

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. IGNITION

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. ENTERTAINMENT

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL EMBEDDED SYSTEMS IN AUTOMOBILES MARKET BY REGIONS

8.1. REGIONAL OUTLOOK

8.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

8.3. NORTH AMERICA

8.3.1. Current Trends and Future Prospects

8.3.2. North America market revenue, sales and production volume, 2018 – 2025

8.3.3. U.S.

8.3.3.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.3.3.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.3.3.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.3.4. Canada

8.3.4.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.3.4.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.3.4.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.3.5. Mexico

8.3.5.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.3.5.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.3.5.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.4. EUROPE

8.4.1. Current Trends and Future Prospects

8.4.2. Europe market revenue, sales and production volume, 2018 – 2025

8.4.3. U.K

8.4.3.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.4.3.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.4.3.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.4.4. Germany

8.4.4.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.4.4.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.4.4.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.4.5. France

8.4.5.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.4.5.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.4.5.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.4.6. Italy

8.4.6.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.4.6.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.4.6.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.4.7. Rest of Europe

8.4.7.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.4.7.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.4.7.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.5. ASIA PACIFIC

8.5.1. Current Trends and Future Prospects

8.5.2. Europe market revenue, sales and production volume, 2018 – 2025

8.5.3. India

8.5.3.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.5.3.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.5.3.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.5.4. Japan

8.5.4.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.5.4.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.5.4.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.5.5. China

8.5.5.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.5.5.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.5.5.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.5.6. South Korea

8.5.6.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.5.6.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.5.6.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.5.7. Rest of APAC

8.5.7.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.5.7.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.5.7.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.6. REST OF THE WORLD

8.6.1. Current Trends and Future Prospects

8.6.2. Europe market revenue, sales and production volume, 2018 – 2025

8.6.3. Latin America

8.6.3.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.6.3.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.6.3.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.6.4. Middle East

8.6.4.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.6.4.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.6.4.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

8.6.5. Africa

8.6.5.1. Embedded Systems in Automobiles Market Revenue $BILLION (2018 – 2025)

8.6.5.2. Embedded Systems in Automobiles Market Consumption BILLION Units (2018 – 2025)

8.6.5.3. Embedded Systems in Automobiles Market Production BILLION Units (2018 – 2025)

CHAPTER 9. KEY VENDOR PROFILES

9.1. Renesas Electronics Corporation

9.1.1. Company overview

9.1.2. Portfolio Analysis

9.1.3. Estimated revenue from embedded systems in automobiles business and market share

9.1.4. Regional & business segment Revenue Analysis

9.2. Infineon Technologies

9.2.1. Company overview

9.2.2. Portfolio Analysis

9.2.3. Estimated revenue from embedded systems in automobiles business and market share

9.2.4. Regional & business segment Revenue Analysis

9.3. Atmel Corporation

9.3.1. Company overview

9.3.2. Portfolio Analysis

9.3.3. Estimated revenue from embedded systems in automobiles business and market share

9.3.4. Regional & business segment Revenue Analysis

9.4. Infosys

9.4.1. Company overview

9.4.2. Portfolio Analysis

9.4.3. Estimated revenue from embedded systems in automobiles business and market share

9.4.4. Regional & business segment Revenue Analysis

9.5. Texas Instruments

9.5.1. Company overview

9.5.2. Portfolio Analysis

9.5.3. Estimated revenue from embedded systems in automobiles business and market share

9.5.4. Regional & business segment Revenue Analysis

9.6. Free scale Semiconductors

9.6.1. Company overview

9.6.2. Portfolio Analysis

9.6.3. Estimated revenue from embedded systems in automobiles business and market share

9.6.4. Regional & business segment Revenue Analysis

9.7. Microsoft Corporation

9.7.1. Company overview

9.7.2. Portfolio Analysis

9.7.3. Estimated revenue from embedded systems in automobiles business and market share

9.7.4. Regional & business segment Revenue Analysis

9.8. , NXP Semiconductors

9.8.1. Company overview

9.8.2. Portfolio Analysis

9.8.3. Estimated revenue from embedded systems in automobiles business and market share

9.8.4. Regional & business segment Revenue Analysis

9.9. HCL Technologies Limited

9.9.1. Company overview

9.9.2. Portfolio Analysis

9.9.3. Estimated revenue from embedded systems in automobiles business and market share

9.9.4. Regional & business segment Revenue Analysis

9.10. Intel Corporation

9.10.1. Company overview

9.10.2. Portfolio Analysis

9.10.3. Estimated revenue from embedded systems in automobiles business and market share

9.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved