Automotive Embedded Telematics Market Revenue, Sales Volume & Trend Forecasts Report, 2019-2026

By Service (Security and safety, Information and navigation, Entertainment and Remote Diagnostics), By Vehicle type (Heavy commercial vehicle, Passenger car, and Light commercial vehicle), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1035 |

- Pages : 96 |

- Tables : 88 |

- Formats :

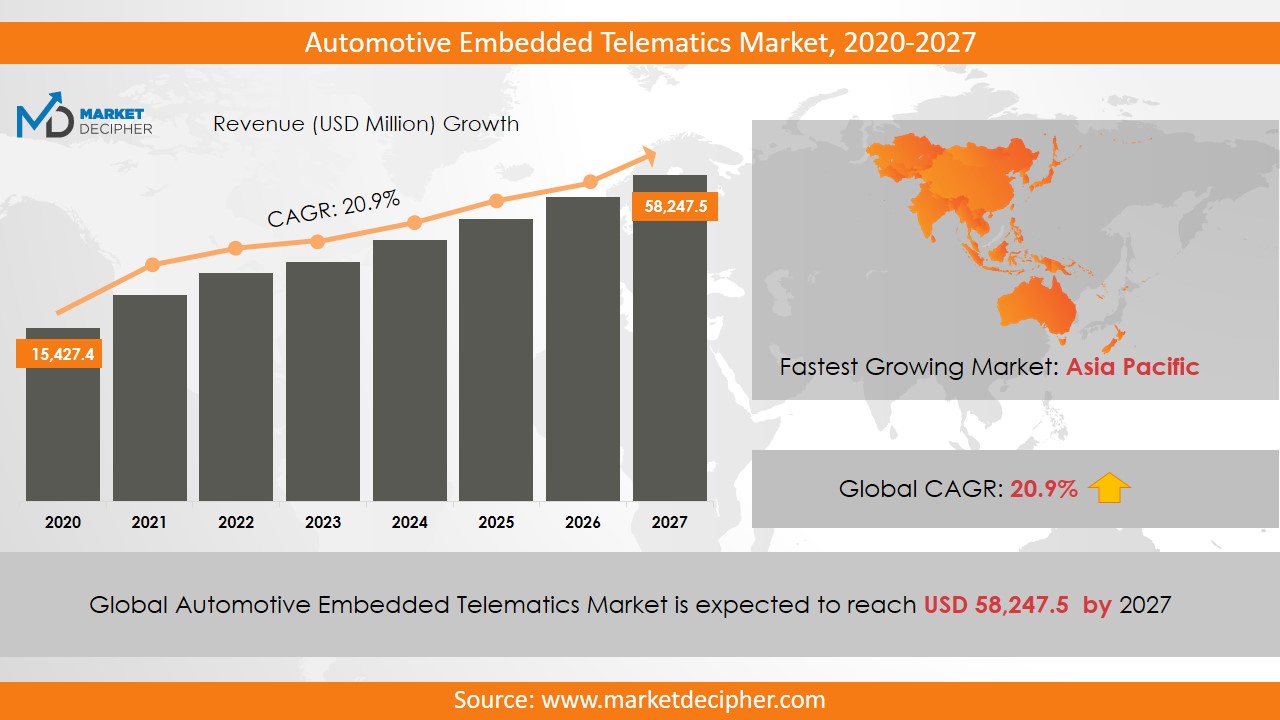

Automotive Embedded Telematics market revenue shall reach a value of $XX Million in 2026, growing with a CAGR of XX.X% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

Automotive Embedded Telematics is a technology that helps in connecting vehicles with each other or with other devices. It is an accident-resistant box which provides advanced information and is helpful in various aspects like at the time of the accidents it automatically dials 911 and automatically charges if rates are cheaper. Also, there is a cellular modem in it. A cellular modem is quite often embedded in vehicles with a safeguard to achieve a continued operation even after serious accidents. Emergency Accident Notification in the automotive sector is also an amazing feature of Telematics, as it automatically sends a message to customer care for help in case of accidents and proves to be quite beneficial. Another effective feature is that certain telematics functions can be controlled with the use of smartphones. Growing awareness among consumers and the great advantages of this technology in several fields such as GPS, smartphones, and high-speed internet connections are the key factors driving the automotive embedded telematics market sales.

Rapid & injudicious development in the transportation sector has somehow lead to an increased number of accidents, thus, many automobile companies are taking precautionary measures. For example, Toyota has recently introduced a set of services namely Toyota Fleet Management and Toyota Safety Connect providing automatic collision notice, emergency help, roadside assistance, and several other benefits. Therefore, with an increased awareness for safety measures and strict government rules for implementation of telematics to ensure passengers safety and the need for high efficiency for operations in the automotive sector are anticipated to register commendable market growth. However, owing to some technical defects and the high cost of the automotive embedded telematics market growth is expected to hamper to a certain extent.

REGIONAL ANALYSIS

North America and Europe have contributed significantly to increasing automotive embedded telematics market size in 2018 owing to the stringent rules and regulations imposed by the government in the region to ensure the driver’s safety and passenger’s experience. The Asia Pacific region is expected to contribute substantially to the overall revenue owing to the rapid increase in the disposable income of the consumers in the developing economies such as India and China. Further, the ongoing technological advancements are anticipated to fuel up the market shares substantially.

SEGMENT ANALYSIS

In terms of services, the automotive embedded telematics market reports analyze security and safety, information and navigation, entertainment and remote diagnostics. Based on vehicle type, there are heavy commercial vehicles, passenger cars, and light commercial vehicles. Due to the increase in cases of accidents, there is a great need to lease vehicles with highly skilled and network lover systems. Of which the commercial vehicle segment is anticipated to increase the market shares tremendously over the forecast period owing to the rapid growth of the transportation sector over the last few years. The fact is that many telematics can be controlled remotely by using smartphones, tablets, etc.

MARKET PLAYERS

Major market players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These market players include Teletrac Navman Group Omnitracs, Autotrac, Fleetmatics, Masternaut Limited, Digicore Technologies, TomTom Telematics BV, Telogis, Trimble Incorporated, and MiX Telematics. Various industry players are adopting advanced strategies to increase the automotive embedded Telematics business size. Other industries in this domain that is growing at a high CAGR include Truck Telematics Market and Automotive Immobilizer Market.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Automotive Embedded Telematics Market Forecast (2018 – 2026)

• Market Production Estimation and Forecast (2018 – 2026)

• Market Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Service Outlook ($Revenue and Unit Sales, 2018-2026)

• Safety and Security

• Information and Navigation

• Entertainment

• Remote Diagnostics

By Vehicle Type Outlook ($Revenue and Unit Sales, 2018-2026)

• Heavy Commercial Vehicle

• Passenger Car

• Light Commercial Vehicle

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the World

• Latin America

• Middle East

• Africa

Market Players

• Teletrac Navman Group Omnitracs

• Autotrac, Fleetmatics

• Masternaut Limited

• Digicore Technologies

• TomTom Telematics BV

• Telogis

• Trimble Incorporated

• MiX Telematics

CHAPTER 1: INTRODUCTION

1.1. Research Methodology

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Global Market Outlook

2.2. Core Insights - Service

2.3. Core Insights – Vehicle Type

2.4. Core Insights – Geography

CHAPTER 3: MARKET OVERVIEW

3.1. Market Definition and Scope

3.2. Key Forces Shaping the Industry

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Industry Landscape - PESTEL Analysis

3.4.1. Political Landscape

3.4.2. Environmental Landscape

3.4.3. Social Landscape

3.4.4. Technology Landscape

3.4.5. Economic Landscape

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2018-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: GLOBAL AUTOMOTIVE EMBEDDED TELEMATICS MARKET, BY SERVICE

5.1. Overview

5.1.1. Market Volume and Forecast, 2018-2026

5.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

5.2. Safety and Security

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Volume and Forecast, By Region

5.2.3. Market Revenue (US$ Million) and Forecast, By Region

5.3. Information and Navigation

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Volume and Forecast, By Region

5.3.3. Market Revenue (US$ Million) and Forecast, By Region

5.4. Entertainment

5.4.1. Key Market Trends, Growth Factors and Opportunities

5.4.2. Market Volume and Forecast, By Region

5.4.3. Market Revenue (US$ Million) and Forecast, By Region

5.5. Remote Diagnostics

5.5.1. Key Market Trends, Growth Factors and Opportunities

5.5.2. Market Volume and Forecast, By Region

5.5.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: GLOBAL AUTOMOTIVE EMBEDDED TELEMATICS MARKET, BY VEHICLE TYPE

6.1. Overview

6.1.1. Market Volume and Forecast, 2018-2026

6.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

6.2. Heavy Commercial Vehicle

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Volume and Forecast, By Region

6.2.3. Market Revenue (US$ Million) and Forecast, By Region

6.3. Passenger Car

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Volume and Forecast, By Region

6.3.3. Market Revenue (US$ Million) and Forecast, By Region

6.4. Light Commercial Vehicle

6.4.1. Key Market Trends, Growth Factors and Opportunities

6.4.2. Market Volume and Forecast, By Region

6.4.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: GLOBAL AUTOMOTIVE EMBEDDED TELEMATICS MARKET, BY GEOGRAPHY

7.1. Overview

7.2. North America

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Volume and Forecast, By Service

7.2.3. Market Volume and Forecast, By Vehicle Type

7.2.4. Market Revenue and Forecast, By Service

7.2.5. Market Revenue and Forecast, By Vehicle Type

7.2.6. Market Revenue and Forecast, By Country

7.2.7. U.S.

7.2.7.1. Market Volume and Forecast

7.2.7.2. Market Revenue and Forecast

7.2.8. Canada

7.2.8.1. Market Volume and Forecast

7.2.8.2. Market Revenue and Forecast

7.2.9. Mexico

7.2.9.1. Market Volume and Forecast

7.2.9.2. Market Revenue and Forecast

7.3. Europe

7.3.1. Market Volume and Forecast, By Service

7.3.2. Market Volume and Forecast, By Vehicle Type

7.3.3. Market Revenue and Forecast, By Service

7.3.4. Market Revenue and Forecast, By Vehicle Type

7.3.5. Market Revenue and Forecast, By Country

7.3.6. Germany

7.3.6.1. Market Volume and Forecast, By Service

7.3.6.2. Market Revenue and Forecast, By Vehicle Type

7.3.7. UK

7.3.7.1. Market Volume and Forecast, By Service

7.3.7.2. Market Revenue and Forecast, By Vehicle Type

7.3.8. France

7.3.8.1. Market Volume and Forecast, By Service

7.3.8.2. Market Revenue and Forecast, By Vehicle Type

7.3.9. Italy

7.3.9.1. Market Volume and Forecast, By Service

7.3.9.2. Market Revenue and Forecast, By Vehicle Type

7.3.10. Rest of Europe

7.3.10.1. Market Volume and Forecast, By Service

7.3.10.2. Market Revenue and Forecast, By Vehicle Type

7.4. Asia-Pacific

7.4.1. Market Volume and Forecast, By Service

7.4.2. Market Volume and Forecast, By Vehicle Type

7.4.3. Market Revenue and Forecast, By Service

7.4.4. Market Revenue and Forecast, By Vehicle Type

7.4.5. Market Revenue and Forecast, By Country

7.4.6. China

7.4.6.1. Market Volume and Forecast, By Service

7.4.6.2. Market Revenue and Forecast, By Vehicle Type

7.4.7. India

7.4.7.1. Market Volume and Forecast, By Service

7.4.7.2. Market Revenue and Forecast, By Vehicle Type

7.4.8. Japan

7.4.8.1. Market Volume and Forecast, By Service

7.4.8.2. Market Revenue and Forecast, By Vehicle Type

7.4.9. South Korea

7.4.9.1. Market Volume and Forecast, By Service

7.4.9.2. Market Revenue and Forecast, By Vehicle Type

7.4.10. Rest of Asia-Pacific

7.4.10.1. Market Volume and Forecast, By Service

7.4.10.2. Market Revenue and Forecast, By Vehicle Type

7.5. REST OF THE WORLD

7.5.1. Market Volume and Forecast, By Service

7.5.2. Market Volume and Forecast, By Vehicle Type

7.5.3. Market Revenue and Forecast, By Service

7.5.4. Market Revenue and Forecast, By Vehicle Type

7.5.5. Market Revenue and Forecast, By Country

7.5.6. Latin America

7.5.6.1. Market Volume and Forecast, By Service

7.5.6.2. Market Revenue and Forecast, By Vehicle Type

7.5.7. Middle East

7.5.7.1. Market Volume and Forecast, By Service

7.5.7.2. Market Revenue and Forecast, By Vehicle Type

7.5.8. Africa

7.5.8.1. Market Volume and Forecast, By Service

7.5.8.2. Market Revenue and Forecast, By Vehicle Type

CHAPTER 8: COMPETITIVE LANDSCAPE

8.1. Automotive Embedded Telematics Market Share Analysis, 2018

CHAPTER 9: COMPANY PROFILES

9.1. Teletrac Navman Group Omnitracs

9.1.1. Company Overview

9.1.2. Financial Performance

9.1.3. SWOT Analysis

9.2. Autotrac, Fleetmatics

9.2.1. Company Overview

9.2.2. Financial Performance

9.2.3. SWOT Analysis

9.3. Masternaut Limited

9.3.1. Company Overview

9.3.2. Financial Performance

9.3.3. SWOT Analysis

9.4. Digicore Technologies

9.4.1. Company Overview

9.4.2. Financial Performance

9.4.3. SWOT Analysis

9.5. TomTom Telematics BV

9.5.1. Company Overview

9.5.2. Financial Performance

9.5.3. SWOT Analysis

9.6. Telogis

9.6.1. Company Overview

9.6.2. Financial Performance

9.6.3. SWOT Analysis

9.7. Trimble Incorporated

9.7.1. Company Overview

9.7.2. Financial Performance

9.7.3. SWOT Analysis

9.8. MiX Telematics

9.8.1. Company Overview

9.8.2. Financial Performance

9.8.3. SWOT Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved