Tubular Linear Motor Market Size, Statistics, Growth Trend Analysis, and Forecast Report, 2022 - 2032

Tubular Linear Motor Market is segmented By Type (AC, DC), By Sales Channel (OEM, System Integrator, Aftermarket), By Application (Construction/Manufacturing, Food Processing Industry, Medical Equipment/Lab Process Equipment, Automotive Industry, Electronics/Semiconductor Industry, Wood Processing, Textile Industry, Other Applications) and By Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa)

- Report ID : MD1139 |

- Pages : 191 |

- Tables : 86 |

- Formats :

The Tubular Linear Motor was estimated at USD XX Billion in 2021 and is expected to reach USD XX Billion by the end of 2032 with a CAGR of 6.7% during the forecast period.

The tubular linear motor is a type of linear electric motor, that is gaining traction in industrial applications. The pandemic highlighted the importance of manufacturers to remain adaptive to the changing needs of their market. Modifying needs, ensuring consistent higher quality, reducing unplanned breakdowns, and shortage of skilled labour are some of the key challenges faced by the industry.

Cylindrical Design, Better Features and High Efficiency Drives Market Growth

The cylindrical design of the tubular linear motor provides an alternative to pneumatic or screw-driven rod-type actuators as it provides high speed and acceleration, with the ability to withstand high-duty cycles and precise positioning. The key advantage of the tubular linear motor is that it uses all of the currents to generate force in the direction of travel, maximizing its efficiency. High efficiency causes lesser heat generation, so less cooling is needed. This leads to less expansion and contraction of components due to thermal effects, so less heat is transferred to the external load. The result is better positioning accuracy, which is important for cutting, or dispensing applications. The installation and assembly of tubular linear motors is much easier than other linear motor types, owing to the air gap and round design. Most tubular motors are ironless, so they have no cogging effects and produce very smooth motion.

Tremendous Growth of Packaging, Construction and Manufacturing Industries Boosts Demand

The demand for tubular linear motors is being stimulated by swift uptake across the automotive sector, particularly from production giants such as China. A significant development in this sector has been the rapid demand for ironless linear motors as these motors have low mass, no cogging and can generate highly dynamic movement, making the tubular linear motors more suitable for semiconductors, packaging, and other general automation applications. For instance, Baumuller’s LSC ironless tubular linear motors provide maximum current and force rise, which makes them ideal for highly dynamic applications with maximum stiffness relative to disturbing forces. Tubular linear motors come with an IP67 rating standard, so they can withstand harsh environments at no additional cost. The packaging industry has been a hotbed of innovation, as traditional pneumatic solutions are incapable of high control or dynamic positioning, while tube motors maximize machine functionality for both OEMs and users. The food and beverage industry has always sought a safer, more energy-efficient means to convey product with less spillage, breakage, or downtime due to necessary cleaning and maintenance. Tubular linear motors have offered these desired attributes compared to pneumatic systems. Aerospace, medical, biomedical and 3D printing industries are also utilising more tubular linear motors which is driving design improvements. Other industries that use tubular linear motor include semiconductors, machine tools, automotive materials, medical instruments and lab automation, logistics, packaging, automated pharmacy and automated assembly. The combined demand from these sectors is likely to boost the market growth manifolds.

Gantry System Provides Added Advantage

As with other linear motor types, tubular motors are often integrated with a linear bearing system to provide not only driving force but also guidance for a load. Their round design makes them ideal for integration with a single guide rail. In gantry systems, with two actuators on an axis, single-rail actuators are preferred over dual-rail designs because systems with more than two rails operating in parallel are much more likely to experience misalignment between rails, which causes binding and premature wear. Tubular designs can drive more than one stator on a single thrust rod for multiple, independent movements on the same axis.

OEM Dominates the Sales Channel Segment

According to the sales channel, the main segments are OEM, system integrator, and aftermarket. The tubular linear motor market report forecasts that the OEM segment is expected to hold the highest market share in terms of value and volume, while the aftermarket segment is expected to lead the market with the highest CAGR in the worldwide market. In the global market, the limited life span of the tubular linear motor is expected to increase its demand in the aftermarket over the forecast period. Due to increasing automation needs, companies are now focussing on retrofit designs that can easily be integrated into existing machinery and process.

Analysis by Application

According to the application, the main segments are Construction/Manufacturing, Food Processing Industry, Medical Equipment/Lab Process Equipment, Automotive Industry, Electronics/Semiconductor Industry, Wood Processing, Textile Industry, and Other Applications. The advancement in the market from the leading manufacturing companies in terms of advancement of product materials and downsizing of products are expected to enhance the demand. Tubular linear motors are also looked at as an alternative to ball screw motors which holds immense potential in various industrial sectors.

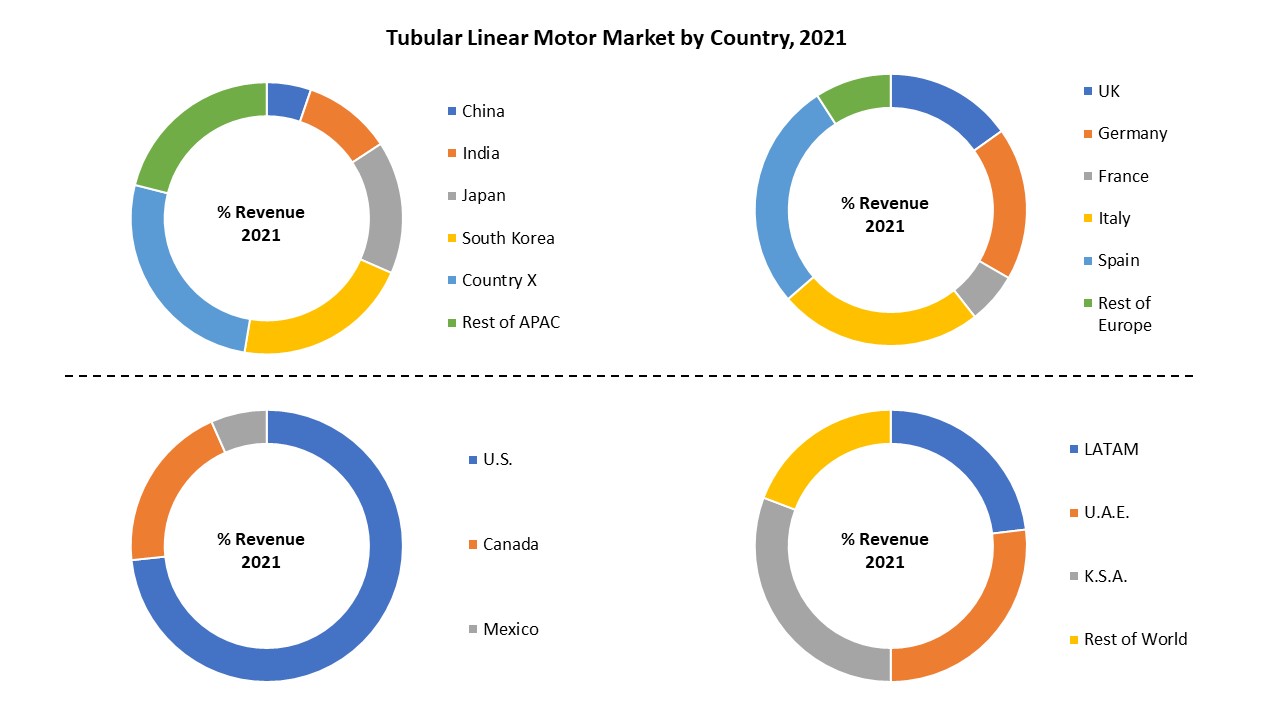

North America and APAC Dominate the Market

North America is expected to hold the largest market share in terms of value and volume in the global tubular linear motor market and is further expected to raise the demand during the forecast period. The tremendous growth across the US packaging, construction and manufacturing industries is further expected to lead to its dominance.

The demand from the Asia-Pacific region is estimated to grow at a rapid pace in the upcoming period owing to the presence of emerging economies such as China, Japan, and India. The rapid advancement in urbanization and indoctrination are primarily enhancing the construction/manufacturing and automotive industry in the region further influencing the demand for the tubular linear motor during the forecast period.

Competitive Landscape:

Prominent Tubular Linear Motor providers are reliant on partnerships, collaborations, acquisitions, and new software launches to stay afloat in the global market. Constant innovations to ensure a seamless client-customer relationship are the main focus of eminent market players.

•In February 2021, ETEL S.A. introduced the DXRH Rotary Axis, featuring a 360’000 lines encoder. This is a 1 DOF mechanical bearing based rotary axis providing outstanding performance in terms of accuracy and precision. The module can be integrated to the CHARON2 and the VULCANO2 stacked platforms.

• HIWIN Corporation launched an interactive microsite titled linearstages.hiwin.us which would help choose amongst their most popular linear stages. Engineers can save time in design and installation by specifying linear stages, instead of all individual components to build the stage.

• In 2019, ANCA Motion has launched its new tubular linear motor LinX M Series, which features an integrated position sensor with 10um of resolution at a peak force range of up to 1,200, eliminating the need for an external encoder, simplifying the system design and reducing the overall cost.

• Irwin, PA - Parker’s Electromechanical Automation Division, a leading supplier of motion control technology, has released the Electric Thrust Tubular (ETT) linear motor actuator series, with dramatically increased performance in a cost-effective, energy-efficient, low–maintenance package.

• LinMot USA demonstrated the applications of its tubular linear motor suitable for various sanitary systems, including product handling, pick and place, inserting, assembly, capping, slicing, and more.

• Nippon Pulse SLP Linear Shaft Stages integrate a Linear Tubular Motor, encoder, and linear shaft support to replace certain conventional ballscrew systems for servo applications. A high force-to-volume ratio and smaller dead zone make for design compactness. Variations include the Acculine SLP stages and Nanopositioning SCR stages.

Years considered for this report

• Historical Years: 2019-2021

• Base Year: 2021

• Forecast Period: 2022-2032

Tubular Linear Motor Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/ projections/ forecast for revenue and unit sales (2022 - 2032)

• Data breakdown for application Industries (2022 - 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown

Type Analysis (Revenue, USD Million, 2022 - 2032)

• AC

• DC

Sales Channel Analysis (Revenue, USD Million, 2022 - 2032)

• OEM

• System Integrator

• Aftermarket

Application Analysis (Revenue, USD Million, 2022 - 2032)

• Construction/Manufacturing

• Food Processing Industry

• Medical Equipment/Lab Process Equipment

• Automotive Industry

• Electronics/Semiconductor Industry

• Wood Processing

• Textile Industry

• Other Applications

Region Type Analysis (Revenue, USD Million, 2022 - 2032)

• North America (United States, Mexico, and Canada)

• Latin America (Brazil & Mexico)

• Europe (Germany, United Kingdom, France, Italy, Spain, Russia, Netherlands, and others)

• Middle East & Africa

• Asia Pacific (China, India, South Korea, Indonesia, Australia, Vietnam, and others)

Key Companies

• Company 1

• Company 2

• Company 3

• Company 4

• Company 5

• Company 6

• Company 7

• Company 8

• Company 9

• Company 10

Available Versions of Tubular Linear Motor Market Report:

The United States Tubular Linear Motor Market Research Report

Europe Tubular Linear Motor Market Research Report

Asia Pacific Tubular Linear Motor Market Research Report

India Tubular Linear Motor Market Research Report

• Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply).

• Send us a query to get the Table of Contents and Research Scope along with the research proposal.

Fill out the sample request form OR reach out directly to David Correa at his email: -

david@marketdecipher.com

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. TUBULAR LINEAR MOTOR MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL TUBULAR LINEAR MOTOR MARKET DEMAND SIDE ANALYSIS

2.1. TUBULAR LINEAR MOTOR MARKET CONSUMPTION VOLUME (MILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (MILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.6. TUBULAR LINEAR MOTOR MARKET REVENUE SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL TUBULAR LINEAR MOTOR MARKET SUPPLY SIDE ANALYSIS

3.1. TUBULAR LINEAR MOTOR MARKET PRODUCTION VOLUME (MILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL TUBULAR LINEAR MOTOR MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL TUBULAR LINEAR MOTOR MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL TUBULAR LINEAR MOTOR MARKET BY APPLICATION

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY APPLICATION, $MILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY APPLICATION, MILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY APPLICATION, MILLION UNITS, 2018 – 2025

6.4. CONSTRUCTION

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. MANUFACTURING

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. OTHERS

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL TUBULAR LINEAR MOTOR MARKET BY REGIONS

7.1. REGIONAL OUTLOOK

7.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

7.3. NORTH AMERICA

7.3.1. Current Trends and Future Prospects

7.3.2. North America market revenue, sales and production volume, 2018 – 2025

7.3.3. U.S.

7.3.3.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.3.3.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.3.3.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.3.4. Canada

7.3.4.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.3.4.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.3.4.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.3.5. Mexico

7.3.5.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.3.5.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.3.5.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.4. EUROPE

7.4.1. Current Trends and Future Prospects

7.4.2. Europe market revenue, sales and production volume, 2018 – 2025

7.4.3. U.K

7.4.3.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.4.3.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.4.3.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.4.4. Germany

7.4.4.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.4.4.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.4.4.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.4.5. France

7.4.5.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.4.5.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.4.5.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.4.6. Italy

7.4.6.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.4.6.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.4.6.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.4.7. Rest of Europe

7.4.7.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.4.7.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.4.7.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.5. ASIA PACIFIC

7.5.1. Current Trends and Future Prospects

7.5.2. Europe market revenue, sales and production volume, 2018 – 2025

7.5.3. India

7.5.3.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.5.3.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.5.3.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.5.4. Japan

7.5.4.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.5.4.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.5.4.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.5.5. China

7.5.5.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.5.5.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.5.5.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.5.6. South Korea

7.5.6.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.5.6.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.5.6.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.5.7. Rest of APAC

7.5.7.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.5.7.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.5.7.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.6. REST OF THE WORLD

7.6.1. Current Trends and Future Prospects

7.6.2. Europe market revenue, sales and production volume, 2018 – 2025

7.6.3. Latin America

7.6.3.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.6.3.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.6.3.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.6.4. Middle East

7.6.4.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.6.4.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.6.4.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

7.6.5. Africa

7.6.5.1. Tubular Linear Motor Market Revenue $Million (2018 – 2025)

7.6.5.2. Tubular Linear Motor Market Consumption Million Units (2018 – 2025)

7.6.5.3. Tubular Linear Motor Market Production Million Units (2018 – 2025)

CHAPTER 8. KEY VENDOR PROFILES

8.1. C

8.1.1. Company overview

8.1.2. Portfolio Analysis

8.1.3. Estimated revenue from tubular linear motor business and market share

8.1.4. Regional & business segment Revenue Analysis

8.2. C

8.2.1. Company overview

8.2.2. Portfolio Analysis

8.2.3. Estimated revenue from tubular linear motor business and market share

8.2.4. Regional & business segment Revenue Analysis

8.3. C

8.3.1. Company overview

8.3.2. Portfolio Analysis

8.3.3. Estimated revenue from tubular linear motor business and market share

8.3.4. Regional & business segment Revenue Analysis

8.4. C

8.4.1. Company overview

8.4.2. Portfolio Analysis

8.4.3. Estimated revenue from tubular linear motor business and market share

8.4.4. Regional & business segment Revenue Analysis

8.5. C

8.5.1. Company overview

8.5.2. Portfolio Analysis

8.5.3. Estimated revenue from tubular linear motor business and market share

8.5.4. Regional & business segment Revenue Analysis

8.6. C

8.6.1. Company overview

8.6.2. Portfolio Analysis

8.6.3. Estimated revenue from tubular linear motor business and market share

8.6.4. Regional & business segment Revenue Analysis

8.7. C

8.7.1. Company overview

8.7.2. Portfolio Analysis

8.7.3. Estimated revenue from tubular linear motor business and market share

8.7.4. Regional & business segment Revenue Analysis

8.7. C

8.7.1. Company overview

8.7.2. Portfolio Analysis

8.7.3. Estimated revenue from tubular linear motor business and market share

8.7.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved