Toy collectibles Market Size, Statistics, Growth Trend Analysis and Forecast Report, 2022 - 2032

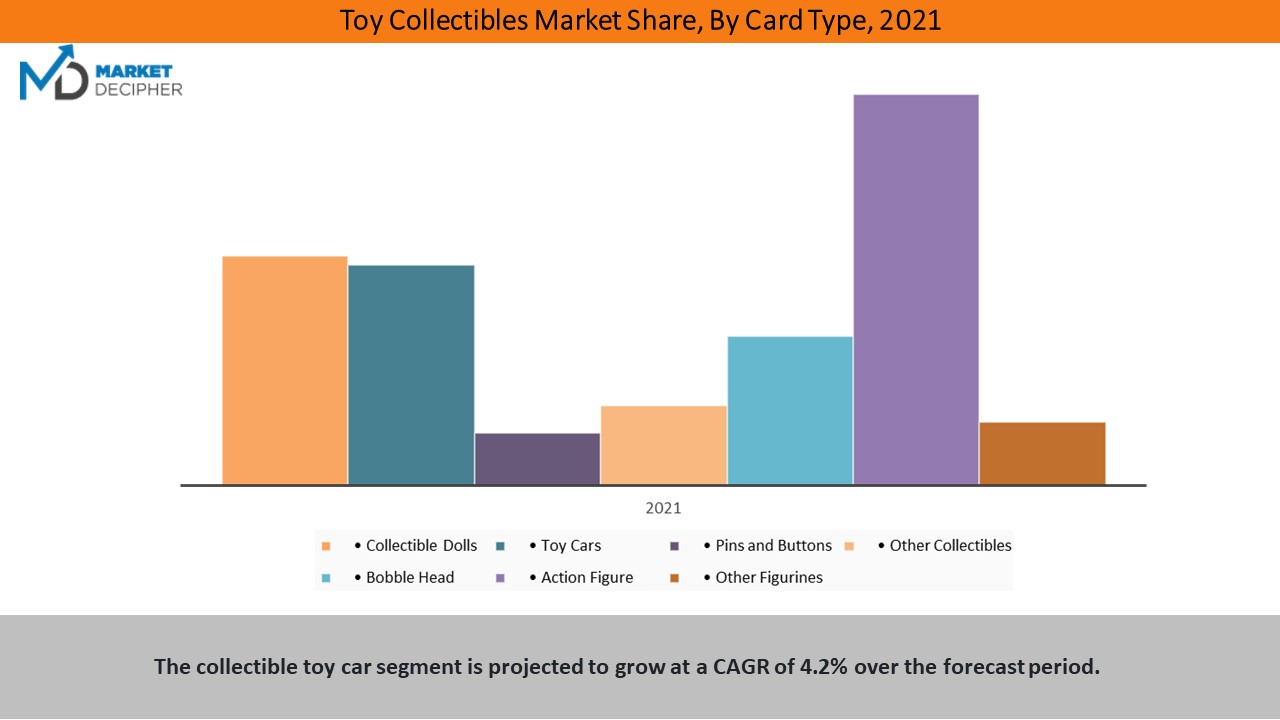

Toy collectibles Market is segmented by Product Type (Collectible dolls, Bobble head, Action Figures, Other Figurines, Toy Cars, Pins & buttons, and Other Collectibles), by Buyer Type (Kids, and Adults), by Sales Channel (Licensed Collectible Manufacturers, Specialized Collectibles Marketplace, E-commerce Portals, and Offline Retails and Auction Houses), by Region (United States, Canada, Mexico, France, Germany, Italy, Spain, United Kingdom, Russia, China, India, Philippines, Malaysia, Australia, Austria, South Korea, Middle East, Japan, Africa, Rest of World) and Toy collectibles Market companies (Mattel, Inc., The Lego Group, HASBRO, Inc., HASBRO, Inc., MGA Entertainment, Inc., FUNKO, Spin Master, WOWEE, MOOSE, Storm Collectibles, National Entertainment Collectibles, Happy Worker Inc, JADA Toys Inc.)

- Report ID : MD2845 |

- Pages : 220 |

- Tables : 60 |

- Formats :

Generally, collectibles in the toy sector are meant for kids & adults. Unlike traditional toys, the purchase motivation is based on financial gain as opposed to play and entertainment. Although most collectible products dont turn out to be profitable investments, some definitely are. For instance, the original GI Joe figures from 1963 trade for $200,000 now. The 1969 Hot Wheels Rear Loader Beach Bomb sells for $100,000. Currently, the 1980 Teddy Ruxbin is worth $1400 and an original 1998 Furby recently sold for $700.

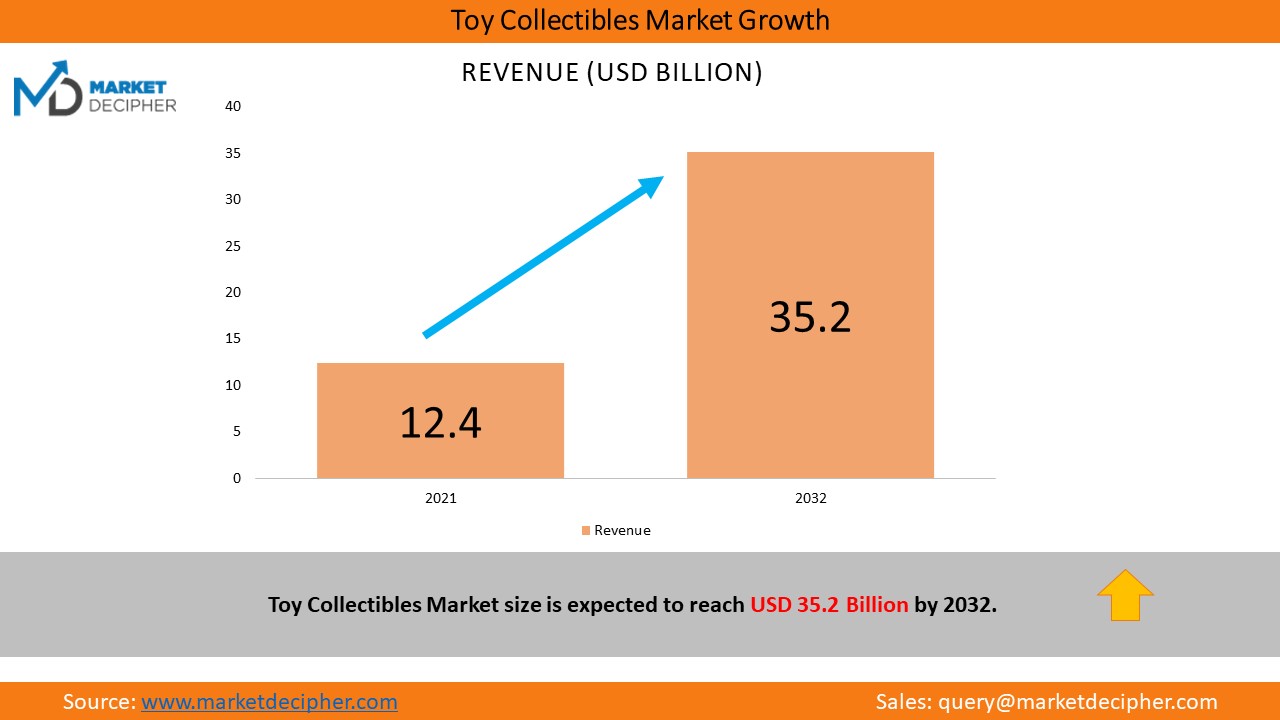

The Toy collectibles Market was estimated at USD 12,453.2 million (12.5 Billion) in 2021 and is forecast to reach a market value of USD 35,355.5 million (35.3 Billion) by 2032, growing at a CAGR of 10.1 %.

Collectible toys are primarily driven by movie IPs such as Star Wars, Avengers, etc. The interest in collecting toys has skyrocketed since adults who played with them started to rebuild their childhood collections decades ago. These toys are no longer played with by most adults, and interest has waned in them. This significant growth is attributed to the COVID-fuelled demand for vintage toys, comic books, sports cards, and collectible cards. Even though the virus is slowing down, most collectibles are in high demand, resulting in high prices.

Internet access and digital content in the entertainment industry are driving the market growth for toy collectibles. The number of toys associated with movies and TV shows is predicted to grow enormously in the near future through offline and online distribution channels. Moreover, e-commerce and rapid urbanization are driving market growth. Toy collectibles have entered the NFT space in recent years. NFTs are available for purchase on OpenSea since 2021, and buyers are redeeming toys on the TOYMINT website.

Various artists entering the world of toy collectibles and creating limited edition art toys will boost the toy collectibles market sales during the forecast period.

Brian Donnelly aka KAWS became popular and started displaying and selling figurines of his characters. Nearly all of KAWS figurines today feature the character, Companion. Considering demand and value, it is the only product that dominates this market. KAWS figurines start at around $350 USD (roughly Rs 25,000). An average four-foot Companion can sell for approximately Rs 84 lakh. YouTuber and Indian streetwear personality Karan Khatri owns two Companions and discusses his love for them in his videos.

The increasing number of young adults collecting toys is anticipated to create lucrative opportunities for industry players.

The number of young people collecting toys has increased significantly around the world. Limited edition toy collectibles are the most popular among them. They are interested in something unique to collect. Further, the growing demand for custom-made, limited edition designer collectibles has also spurred the creation of unique and visually stunning concepts across various size categories. With the number of smaller companies popping up all over the world, it is clear that the toy collectibles market is growing in mainstream popularity. This presents a lot of opportunities for the collectors.

"Currently, GameStop (GME) is the largest retailer in the U.S. for toy collectibles overall, dedicating half of its approximately 4000 U.S. stores to the category."

In total, GameStop sells approximately $650 million in collectibles, of which about a third consists of collectible toys and accessories. It would give GameStop a market share of about 28% of the U.S. Collectible Toys market. It is estimated that Amazon (AMZN) has a market share of 24%, while Target (TGT) and Walmart (WMT) have each about 6% to 10%.

Chinas toy market is hoping to ride the trend in Asia for so-called pop toys - collectible cartoon figures aimed at adults - as it, along with other Chinese companies, seeks to recover from the pandemic. Prior to POP MART, collectibles in China were a niche subculture that was sold in specialty stores. POP MART created the boom for the collectible toys industry in the country with blind boxes, a form they used to sell collectibles. Blind boxes are like unboxing a surprise toy in which you dont know which figure youll receive. There are many opportunities both domestically and internationally for toy manufacturers because of its potential growth. In recent years, collectible toys have grown in popularity among collectors, positively affecting the toy market.

| Report Attribute | Details |

| Historical Years | 2018-2021 |

| Forecast Years | 2022-2032 |

| Base Year (2021) Market Size | $12,453.2 Million |

| Market Size Forecast in 2032 | $35,355.5 Million |

| Forecast Period CAGR | 10.1% |

| Report Coverage |

Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast; Segmentation Analysis; Impact of COVID-19;Companies’ Strategic Developments; End User Capacity & Workforce Analysis; Company Profiling |

| Market Size by Segments | By Product Type, By Buyer Type, By Sales Channel |

New start-ups are aggressively entering the Collectible Toys market by going head-on against Funko leading to intense competition.

Leading companies in this industry include Mattel, Inc., The Lego Group, HASBRO, Inc., HASBRO, Inc., MGA Entertainment, Inc., FUNKO, Spin Master, WOWEE, MOOSE, Storm Collectibles, National Entertainment Collectibles, Happy Worker Inc, JADA Toys Inc. Additionally, the famous online auction houses such as shopgoodwill.com, Ruby Lane, Etsy, eBid Online Auctions, and Bonanza boosted the collectibles sales in recent years.

Funko is a leading company in the collectibles field for licensed action figures. A few other players include Mattel (MAT) for Barbie, Hasbro (HAS) for movie action figures, Spin Master for Hatchimals, MGA for LOL, and Wowee for Fingerlings, but they are not actively marketing their products as collectibles. However, the situation is now changing.

Mattel and Hasbro are competing in the collectibles market. The Mattel campaign for International Womens Day consists of 17 Barbie collectible dolls, three Barbie dolls featuring the main actresses from Wrinkle in Time, and a Barbie doll portraying Laura Croft from Tomb Raider. Funkos main focus in Collectible Toys is Action Figures, which none of these directly compete with.

Years considered for this report

• Historical Years: 2018-2021

• Base Year: 2021

• Forecast Period: 2022-2032

Toy collectibles Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

• Data breakdown for application Industries (2022 – 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown

Product Type Analysis (Revenue, USD Million, 2022 - 2032)

• Collectible dolls

• Game CDs/Cassettes

• Animation Collectibles

• Cartoon Figurines

• Bobble Head

• Action Figures

• Other Figurines

• Toy Cars

• Pins & buttons

• Other Collectibles

Buyer Type Analysis (Revenue, USD Million, 2022 - 2032)

• Kids

• Adults

Sales Channel Analysis (Revenue, USD Million, 2022 - 2032)

• Licensed Collectible Manufacturers

• Specialized Collectibles Marketplace

• E-commerce Portals

• Offline Retails and Auction Houses

Country Analysis (Revenue, USD Million, 2022 – 2032)

• North America

• United States

• Canada

• Mexico

• Europe

• France

• Germany

• Italy

• Spain

• United Kingdom

• Rest of the Europe

• APAC

• China

• India

• Philippines

• Malaysia

• Australia

• Austria

• South Korea

• Rest of the APAC

• Rest of the World

• Middle East

• Japan

• Africa

• Rest of the World

Toy Collectibles Market companies:

• Mattel, Inc.

• The Lego Group

• HASBRO, Inc.

• HASBRO, Inc.

• MGA Entertainment, Inc.

• FUNKO

• Spin Master

• WOWEE

• MOOSE

• Storm Collectibles

• National Entertainment Collectibles

• Happy Worker Inc

• JADA Toys Inc.

Available Versions of Toy Collectibles Market Report: -

United States Toy Collectibles Market Research Report

Europe Toy Collectibles Market Research Report

Asia Pacific Toy Collectibles Market Research Report

India Toy Collectibles Market Research Report

• Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email:- david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved