Saudi Arabia Fitness Equipment Market Size, Share, Trend Analysis and Forecast Report, 2020 - 2027

- Report ID : MD1618 |

- Pages : 200 |

- Tables : 99 |

- Formats :

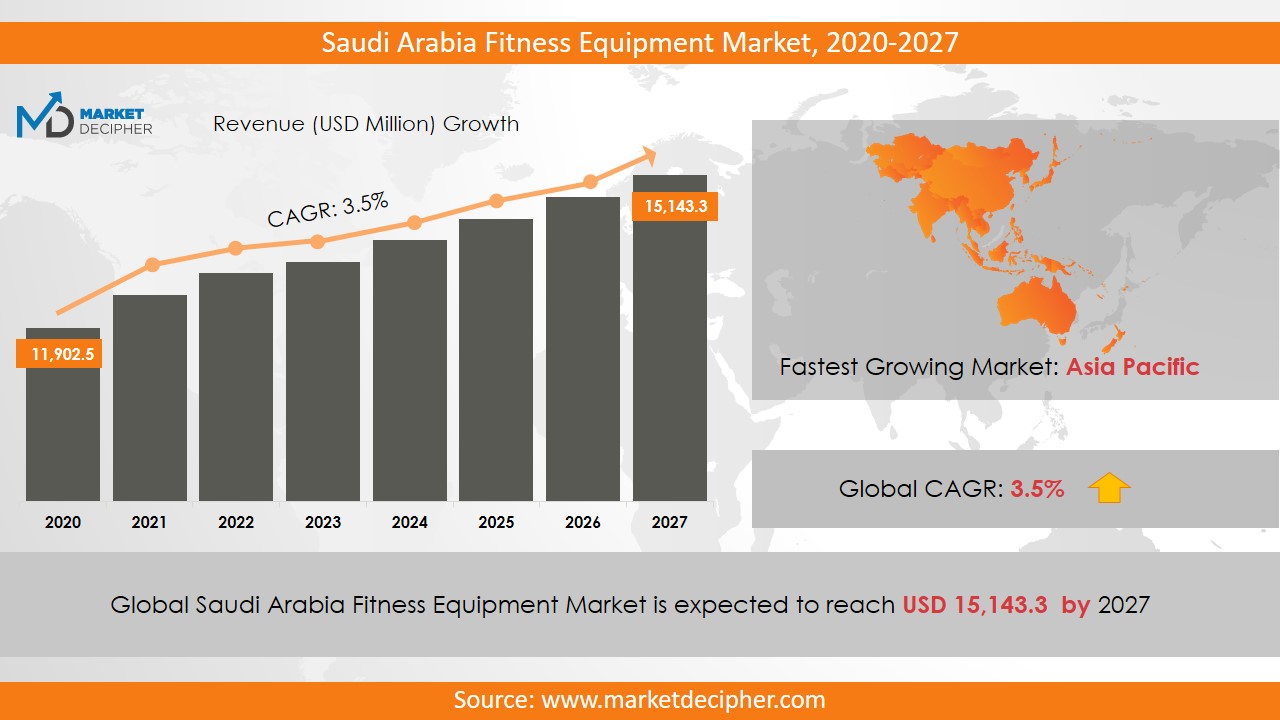

Saudi Arabia fitness equipment market size was estimated at USD _43.7 million in 2020 and is forecast to reach USD _87.9 million by 2027.

Greater inclination towards fitness and workout, especially among the younger generation, healthcare centres, and homebound consumers who seek healthy living are the critical factors driving up the demand in the fitness equipment market of Saudi Arabia. A positively good rate of growth of the youth population is bringing about a great wave of fitness consciousness in Saudi Arabia. The varied uses of fitness equipment allow users to perform exercises related to physical wellbeing, weight management, stamina, and core strength. Rapid urbanization and increasing health awareness amongst the people are expected to drive the global market.

Rights of women in Middle Eastern countries are still on a prudential side, and hence the ratio of women going to commercial gyms and health clubs being low as compared to males. On the contrary, with positive changes in lifestyle, mentality and health consciousness in addition to the lifting of bans on women, the situation is gradually changing. The demand for female-specific fitness centres is gradually rising, opening newer doors for the fitness equipment market.

Saudi Arabia Fitness Equipment Market Growth and Trends

The fitness equipment market in Saudi Arabia has boomed primarily because of ease in the laws for women, where, unlike earlier when gyms and physical fitness centres were primarily driven by the male population, women-specific gyms have been started and are witnessing tremendous growth—effected by changing outlook, lifting bans imposed on women population, progressive mindsets and overall health consciousness. Expansion of service portfolio along with the launch of fitness service centres in organized as well as unorganized the fitness services sector, alarming rise in cases of ailments such as cardiac issues, diabetes, and asthma, with increasing rate of obesity are key factors driving the market growth. The youth population in Saudi Arabia has increased steadily, which in turn has resulted in significant increase in the fitness-centre-going population. An increase in the consciousness about personal health has propelled the momentum of market growth. The growth of the population inspired by health and fitness regimes, the initiative of the government in constructing more parks, running lanes, and cycling lanes for the public to support and promote a healthy lifestyle has brought about a significant positive change in the mindsets of people towards fitness that has encouraged regular participation of people in gyms. It has acquired the importance of being an integral part of their lives. While there was already a demand for male-specific fitness equipment, there is a strong demand for female-specific services creating an upward-trending demand for female-specific equipment which is anticipated to continue in the future. A wider customer base is generated as a result of lower fees charged by unorganized centres, thus boosting the market.

Although there is an increasing demand when it comes to fitness equipment in the Saudi Arabian market, the Covid-19 pandemic has led to bottlenecks across sales funnels, industry pipelines, and supply chain activities.On a commercial note, health clubs and gyms for males drive the product market even further. These ventures account for the major portion of the market for fitness equipment. Though such share is expected to fall with the onset of COIVD-19. Coronavirus has made consumers homebound and social distancing protocols discourage going to gyms for a long time. Hence, a shift may be seen from commercial to non-commercial market share.

However, lack of space at home, higher cost of equipment, conservative women-centric ideology and lack of maintenance skill are major restrictions for the growth attributable to homebound use as well. Another threat is the large-scale resale of second-hand devices. Nevertheless, a rising youth population coupled with more disposable income in hands is expected to nullify the above threats.

Saudi Arabia Fitness Equipment Market Regional Analysis

There was a spontaneous growth in Saudi Arabia Fitness Equipment Market, mainly in cities like Dhahran and Kho bar. Jeddah revenue has increased due to flexibility in women laws and awareness among people regarding health diseases, which boomed the fitness equipment market. Various regions like Riyadh contribute a significant part of the Fitness Equipment Market. Many fitness centres are located in KSA as it is the commercial capital of Saudi Arabia. Due to its wealthy urban population, Makkah accounts for the second significant portion of its growth. The rapid growth is seen in the posh areas as they have resources to spend on fitness and prefer a healthy life. For instance, Dammam and Madinah are proliferating; other regions include Jizan, Hail, Jawf, Tabuk, and Asir.

Saudi Arabia Fitness Equipment Market Coverage Highlights

• Saudi Arabia Fitness Equipment Market Revenue Estimation and Forecast (2020 – 2027)

• Production Estimation and Forecast (2020 – 2027)

• Sales/Consumption Volume Estimation and Forecast (2020 – 2027)

• Breakdown of Revenue by Segments (2020 – 2027)

• Breakdown of Production by Segments (2020 – 2027)

• Breakdown of Sales Volume by Segments (2020 – 2027)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

Saudi Arabia Fitness Equipment Market Segmentation

Product Outlook (Revenue, USD Million, 2020 - 2027)

• Treadmills

• Elliptical Machines

• Stationary Cycles

• Rowing Machines

• Dumbbells

• Strength Training Equipment

• Other Product Types

Distribution Outlook (Revenue, USD Million, 2020 - 2027)

• Offline Channels

• Online Channels

Saudi Arabia Fitness Equipment Market Companies

• Nautilus Inc.

• Johnson Health Tech Co.

• Technogym SpA.

• NordicTrak

• Precor, Inc.

• BRUNSWICK CORPORATION

• Amer Sports

• Core Health & Fitness LLC

• Fitness EM

• LLC

• HOIST Fitness Systems

• Icon Health and Fitness

• Torque Fitness

• True Fitness

• Cybex International

• Precor

• Fitnessathome

• Fitness World

• ProForm

• TRUE Fitness

• Vectra Fitness

• Woodway

Available Versions of the Report:

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved