Pressure Sensors Market

By Product (Absolute, Vacuum, Differential, Gauge, and Sealed), By Technology (Piezoresistive, Capacitive, Resonant and Electromagnetic), By Application (Medical, Industrial, Automotive and Utilities) By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1039 |

- Pages : 96 |

- Tables : 87 |

- Formats :

Pressure sensors are used to check and maintain fluid pressure in various industries, such as the automotive industry. They are widely used in devices like tablets, smartphones, and watches. In addition, increasing acceptance of these sensors in the industries is expected to enhance the pressure sensors market growth. To ensure the safety of passengers in the automotive sector, many stringent rules and regulations have been implemented by the government to adopt pressure sensors. Apart from this, due to the rapid urbanization, the need for these sensors’ efficient performance is greatly increased. The affordable cost of these sensors is playing a vital role in increasing the pressure sensors market sales to a great extent.

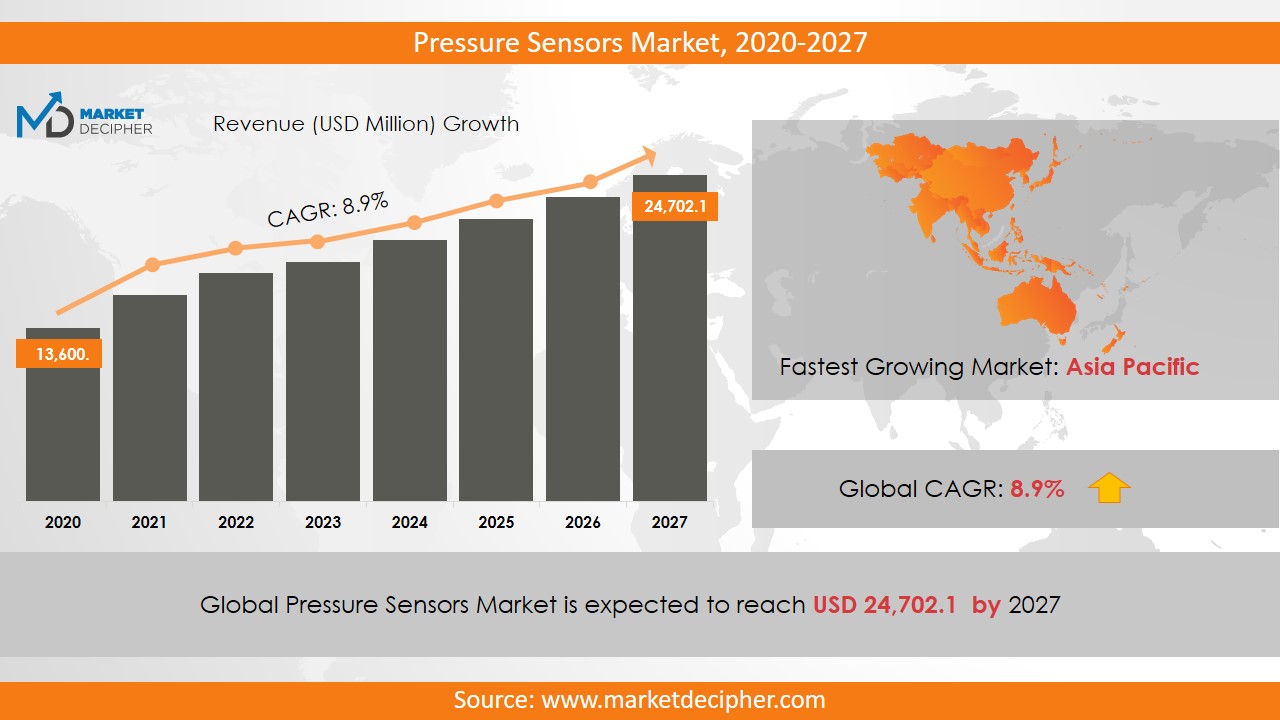

Pressure Sensors market revenue shall reach a value of $11,942.10 Million in 2031, growing with a CAGR of 4.98% during the forecast period of 2022 to 2031. In terms of volume sales, the market is anticipated to reach XX Units.

Pressure sensors are extensively used in monitoring appliances. The ongoing advancements and innovations in the micro and Nano-technology are expected to drive the pressure sensors market shares during the forecast period. Additionally, the consistent development activities in the infrastructure of the medical sector contribute to market development significantly. Different medical devices like respiratory sensors, ventilators, oxygen concentrations, spirometer sand oxidation tanks use the pressure sensors. Due to the growing demand for portable healthcare monitoring products and low-cost MEMS, these sensors are becoming more popular among consumers and therefore ultimately boosting the market growth.

REGIONAL ANALYSIS

The Asia Pacific region is anticipated to garner the highest revenue throughout the forecast period owing to the increasing automation in developing nations such as China, India, and Japan. Further, North America and Europe region are supporting the growth of the market substantially over the last few years and is anticipated to continue the same trend over the forecast period. The growth of the pressure sensor market is attributed to the highly developed medical infrastructure in this region.

SEGMENT ANALYSIS

On the basis of products, the pressure sensors market report provides a detailed analysis of absolute, vacuum, differential, gauge, and sealed. The differential segment is anticipated to grow at the highest CAGR during the forecast period. Technologies used in manufacturing pressure sensors are piezoresistive, capacitive, resonant and electromagnetic. These sensors find their extensive application in various sectors such as medical, industrial, automotive and utilities. Further, the automotive segment dominated the market revenue. Reduction of radio frequency interference in the pressure sensor, compact size, low power consumption and lower cost as compared to wireless pressure sensors has led to the dominance of wired sensors in terms of revenue.

Capacitive technology is used in motion sensing, mass-touch sensing, and position sensing applications. Due to the wide application of the capacitive segment, this is predicted to garner notable revenue during the forecast period. Owing to the high demand for tire pressure measurement systems and automobile automation around the world, the automotive segment is expected to dominate the growth of the market. The sensors further help in emission control, battery control, and live location detection in the automotive app which held the largest revenue of 25.3% of total revenue in 2017.

MARKET PLAYER ANALYSIS

Major market players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These market players include Honeywell, ABB, Infineon Technologies, Emerson Electric, NXP Semiconductors, General Electric, STMicroelectronics, Robert Bosch, and Siemens.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Forecast (2022 – 2031)

• Market Production Estimation and Forecast (2022 – 2031)

• Market Sales/Consumption Volume Estimation and Forecast (2022 – 2031)

• Breakdown of Revenue by Segments (2022 – 2031)

• Breakdown of Production by Segments (2022 – 2031)

• Breakdown of Sales Volume by Segments (2022 – 2031)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Product Outlook ($Revenue and Unit Sales, 2022-2031)

• Absolute

• Vacuum

• Differential

• Gauge

• Sealed

By Technology Outlook ($Revenue and Unit Sales, 2022-2031)

• Piezoresistive

• Capacitive

• Resonant

• Electromagnetic

By Application Outlook ($Revenue and Unit Sales, 2022-2031)

• Medical

• Industrial

• Automotive

• Utilities

By Regional Outlook ($Revenue and Unit Sales, 2022-2031)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the World

• Latin America

• The Middle East and Africa

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. PRESSURE SENSOR MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL PRESSURE SENSOR MARKET DEMAND SIDE ANALYSIS

2.1. PRESSURE SENSOR MARKET CONSUMPTION VOLUME (MILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (MILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.6. PRESSURE SENSOR MARKET REVENUE SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL PRESSURE SENSOR MARKET SUPPLY SIDE ANALYSIS

3.1. PRESSURE SENSOR MARKET PRODUCTION VOLUME (MILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL PRESSURE SENSOR MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL PRESSURE SENSOR MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL PRESSURE SENSOR MARKET BY PRODUCT

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY PRODUCT, $MILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY PRODUCT, MILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY PRODUCT, MILLION UNITS, 2018 – 2025

6.4. ABSOLUTE

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. Vacuum

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. Differential

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

6.7. Gauge

6.7.1. Market determinants and trend analysis

6.7.2. Market revenue, sales and production volume, 2018 – 2025

6.8. Sealed

6.8.1. Market determinants and trend analysis

6.8.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL PRESSURE SENSOR MARKET BY TECHNOLOGY

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY TECHNOLOGY, $MILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY TECHNOLOGY, MILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY TECHNOLOGY, MILLION UNITS, 2018 – 2025

7.4. PIEZORESISTIVE

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. CAPACITIVE

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. RESONANT

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

7.7. ELECTROMAGNETIC

7.7.1. Market determinants and trend analysis

7.7.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL PRESSURE SENSOR MARKET BY APPLICATION

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY APPLICATION, $MILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY APPLICATION, MILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY APPLICATION, MILLION UNITS, 2018 – 2025

8.4. MEDICAL

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. INDUSTRIAL

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. AUTOMOTIVE

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

8.7. UTILITIES

8.7.1. Market determinants and trend analysis

8.7.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL PRESSURE SENSOR MARKET BY REGIONS

9.1. REGIONAL OUTLOOK

9.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

9.3. NORTH AMERICA

9.3.1. Current Trends and Future Prospects

9.3.2. North America market revenue, sales and production volume, 2018 – 2025

9.3.3. U.S.

9.3.3.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.3.3.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.3.3.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.3.4. Canada

9.3.4.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.3.4.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.3.4.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.3.5. Mexico

9.3.5.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.3.5.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.3.5.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.4. EUROPE

9.4.1. Current Trends and Future Prospects

9.4.2. Europe market revenue, sales and production volume, 2018 – 2025

9.4.3. U.K

9.4.3.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.4.3.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.4.3.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.4.4. Germany

9.4.4.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.4.4.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.4.4.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.4.5. France

9.4.5.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.4.5.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.4.5.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.4.6. Italy

9.4.6.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.4.6.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.4.6.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.4.7. Rest of Europe

9.4.7.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.4.7.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.4.7.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.5. ASIA PACIFIC

9.5.1. Current Trends and Future Prospects

9.5.2. Europe market revenue, sales and production volume, 2018 – 2025

9.5.3. India

9.5.3.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.5.3.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.5.3.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.5.4. Japan

9.5.4.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.5.4.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.5.4.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.5.5. China

9.5.5.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.5.5.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.5.5.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.5.6. South Korea

9.5.6.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.5.6.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.5.6.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.5.7. Rest of APAC

9.5.7.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.5.7.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.5.7.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.6. REST OF THE WORLD

9.6.1. Current Trends and Future Prospects

9.6.2. Europe market revenue, sales and production volume, 2018 – 2025

9.6.3. Latin America

9.6.3.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.6.3.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.6.3.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.6.4. Middle East

9.6.4.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.6.4.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.6.4.3. Pressure Sensor Market Production Million Units (2018 – 2025)

9.6.5. Africa

9.6.5.1. Pressure Sensor Market Revenue $Million (2018 – 2025)

9.6.5.2. Pressure Sensor Market Consumption Million Units (2018 – 2025)

9.6.5.3. Pressure Sensor Market Production Million Units (2018 – 2025)

CHAPTER 10. KEY VENDOR PROFILES

10.1. Honeywell

10.1.1. Company overview

10.1.2. Portfolio Analysis

10.1.3. Estimated revenue from pressure sensor business and market share

10.1.4. Regional & business segment Revenue Analysis

10.2. ABB

10.2.1. Company overview

10.2.2. Portfolio Analysis

10.2.3. Estimated revenue from pressure sensor business and market share

10.2.4. Regional & business segment Revenue Analysis

10.3. Infineon Technologies

10.3.1. Company overview

10.3.2. Portfolio Analysis

10.3.3. Estimated revenue from pressure sensor business and market share

10.3.4. Regional & business segment Revenue Analysis

10.4. Emerson Electric

10.4.1. Company overview

10.4.2. Portfolio Analysis

10.4.3. Estimated revenue from pressure sensor business and market share

10.4.4. Regional & business segment Revenue Analysis

10.5. NXP Semiconductors

10.5.1. Company overview

10.5.2. Portfolio Analysis

10.5.3. Estimated revenue from pressure sensor business and market share

10.5.4. Regional & business segment Revenue Analysis

10.6. General Electric

10.6.1. Company overview

10.6.2. Portfolio Analysis

10.6.3. Estimated revenue from pressure sensor business and market share

10.6.4. Regional & business segment Revenue Analysis

10.7. STMicroelectronics

10.7.1. Company overview

10.7.2. Portfolio Analysis

10.7.3. Estimated revenue from pressure sensor business and market share

10.7.4. Regional & business segment Revenue Analysis

10.8. Robert Bosch

10.8.1. Company overview

10.8.2. Portfolio Analysis

10.8.3. Estimated revenue from pressure sensor business and market share

10.8.4. Regional & business segment Revenue Analysis

10.9. Siemens

10.9.1. Company overview

10.9.2. Portfolio Analysis

10.9.3. Estimated revenue from pressure sensor business and market share

10.9.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved