- Report ID : MD1195 |

- Pages : 193 |

- Tables : 85 |

- Formats :

By Hybridization (Mid and Full), By Type (Sedan and Hatchback), By Battery (Li-ion and NiMH), By Region (North America, Europe, APAC and Rest of the World)

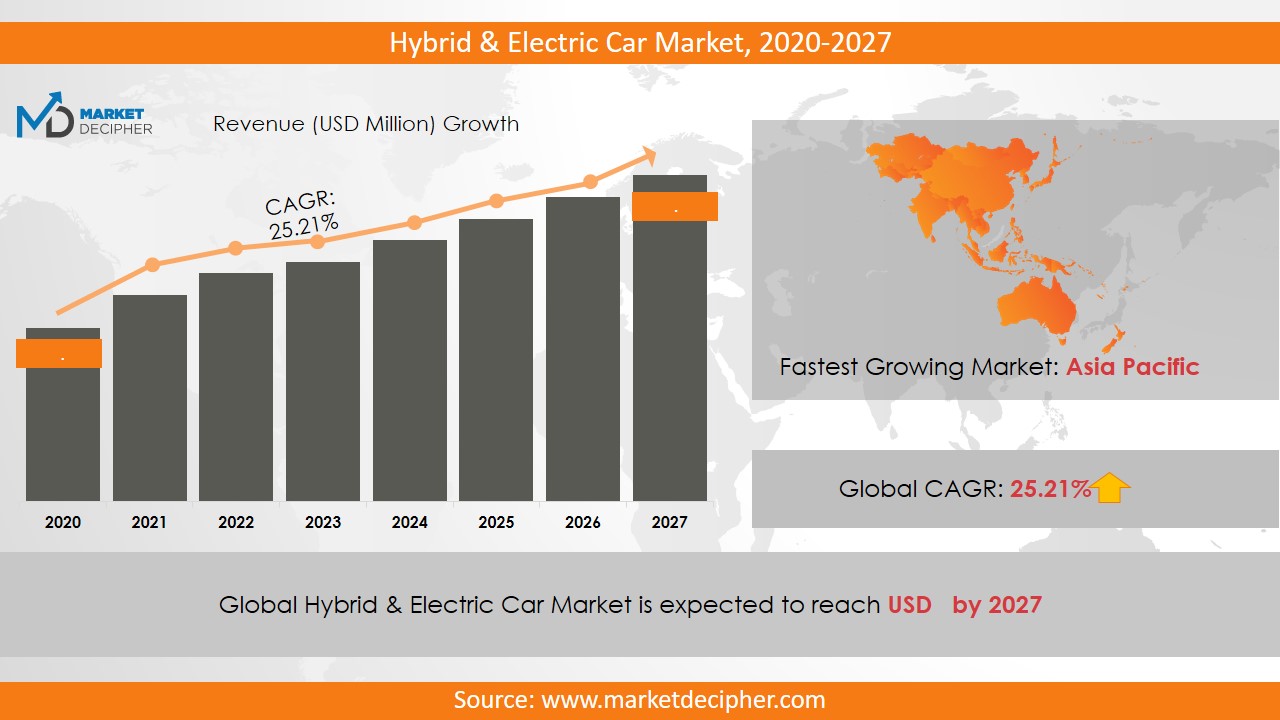

Hybrid & Electric Car Market revenue shall reach value of $XX.X Billion in 2026, growing with a CAGR of X.X% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

A hybrid electric car have internal combustion engine along with a battery for propulsion. The battery used in these cars are chargeable and recyclable. These are fully equipped with latest and advanced technologies. Further, hybrid and electric cars use fuel efficiently as compared to the conventional cars. However, hybrid cars are $2,500-$3,500 costlier than the latter one. This may pose restrictions in the hybrid & electric car market growth. Further, the main aim of launching hybrid & electric cars is to enhance the air quality and to save the fuel cost.

Carbon dioxide emissions is increasing at an exponential last few years. Conventional cars release large amount of carbon dioxide ultimate Lee increase the commercial card for cost consumer is will get attracted towards hybrid electric cars as they have fuel-saving and low emission properties. Altogether, these factors are driving the expansion of global hybrid electric car market size. According to a recent hybrid electric car market research report, total market sales since their emergence in 1997, is estimated to be more than 12 million in 2017. Further, the Toyota Prius lift back dominated the market in terms of revenue, with a total sale of 4 billion units in 2017.

TRENDS AND GROWTH

The Trend in the Global Hybrid and Electric Car Market has been estimated at $ 57.2 Billion in the year 2017 witnessing a compound annual growth rate of 16.7% within its forecast period from 2018 to 2023.Its size has also been predicted to be around $ 138 Billion by the end of 2023.

The Key drivers for this market include:

• The increased demand for hybrid electric vehicles with an increase in population because it has become the major preference for any consumer willing to buy a car in the 21st century commuter.

• The rising number of environmental conservation concern among customers willing to buy a car due to its zero-emission of CFC s incorporated among any other car in the industry.

• The decline is profit gained by diesel cars sold or none sold at all due to the upcoming trends which have manipulated companies to opt for the Hybrid electric cars.

• The escalating prices in fuel that most of the time is either non-affordable or not worth the price paid by consumers in the market that will catalyzed the necessity for electric cars.

• The long-term strategies brought up by countries to produce a greener future by eradicating the conventional passenger cars that run on fuel and gas.

• The rate of rising acceptance of mild hybrid cars across the globe

• The ability to offer an effective and equitable cost-to-benefit ratio than the conventional car market. Electric cars bring forward a relatively low cost in the long run

• Its ability to meet up on a normal vehicle’s emission targets that will reduce cost of pumping fuel and safety from gas or liquid leakages as well.

• The diversification of key features incorporated in the car during manufacture that makes it the ideal preference for consumers looking for cars that don’t always require high maintenance levels.

• The mechanical integration at ease of its components and features like power steering, electric turbochargers, advancement in gear technology, air conditioning all at a reasonable cost.

• The rising number of initiatives taken up by the government like subsidies and benefits that elevate the demand for high-performance electric vehicles.

• The Factors such as an increase in demand for more fuel-efficient, high-performance, andlow-emission vehicles that can meet up with the firm governmental rules and regulations.

• Advancement in technology and industrialization to bring up technological knowledge and equipment to rural countries as well.

• the high sensitivity of consumers towards a healthy environment for passengers with breathing problems, respiratory difficulties to have a longer life with less difficulty with the ailment.

• Heavy investments from all over the world like from automakers that reinforces that electric vehicles are ideal for the future’s benefit.

• The diverse options offered by electric cars like the possibility of getting the vehicle charged at home using high voltage ports as required so that consumers don’t have to travel to public charging ports to get the vehicles charged on daily basis.

Challenges:

Some challenges witnessed in this market include:

• High Manufacturing cost and serviceability.

• Reduced fuel economy.

• Lack of standardization and specific methodologies to use when implementing the charging infrastructure like the actual voltage that home plug points can offer for these vehicles and any threats if used the incorrect way.

• Lack of a globally shared vision for its future in comparison to its alternative – the conventional cars running on fuel.

• A smaller driving range with high costs to train divers on how each feature is properly run.

• Lack of power semiconductors as required.

• Tax imposed by outdoor charging ports for public.

• The conventional cars that run on fuel are largely better at cutting the prices for the maintenance of electric cars.

REGIONAL ANALYSIS

Asia-Pacific region has emerged as the dominant region in contributing for the hybrid & electric car business revenue and held a share of 57% of the overall revenue generated. More specifically, Chinese hybrid & electric business size has expanded at a rate of 72% in recent years. Thus, this region is dominating over the revenue garnered by United States combined with Europe since last few years. Further, the Asia Pacific region is expected to reach a market sales of $8000 million by the end of forecast period. North America is investing at hybrid &electric cars at a significant pace owing to the presence of advanced technologies in the region.

SEGMENT ANALYSIS

On the basis of battery, hybrid and electric cars has been classified as Nickel-metal hydride and Lithium ion. Nickel metal hydride batteries dominated the market in terms of revenue. These batteries are getting preference owing to the high durability, low cost and enhance safety features as compared to the Lithium ion batteries. Further, lithium-ion batteries are anticipated to grow with a CAGR of 29.2% in the years to come due to its reducing cost, compact size, light weight, low rate of self discharge and low maintenance cost.

Other than hatchback, and Sedan, the hybrid & electric car market can be classified as multi-purpose vehicles (MPVs), sport utility vehicles (SUVs), and crossovers on the basis of type. In 2017, hatchback segment has shown its dominance over sedan. This is mainly due to the consumer’s interest in small cars in major hybrid electric car market. Ford Corporation hybrid cars sales increased by three times in the time span of one year. That is, this company registered a total sale of 80,000 units in 2013 which is almost triple of the sales in the year 2012.

HYBRID & ELECTRIC CAR COMPANIES:

Toyota Motor Corporation, Ford Motor Company, Volkswagen AG, Honda Motor Corporation Limited, Bayerische Motoren Werke (BMW) Group, Hyundai Motor Company and General Motors Company are the leading industry players which adopted new strategies to acquire acquisition all over the world. In 2017, Total motor corporation dominated the hybrid & electric car market sales with the total sales of 10 million. Further, North American hybrid & electric car manufacturers are leading the market in terms of revenue and sales. Lexus, a leading market vendor launched its hybrid electric version of Sports Sedan in 2007 which gained appreciable popularity. Other industries in this domain that are growing at a high CAGR include Intensive Care monitoring systems Market and Non-pneumatic Tires Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS

By Hybridisation Outlook ($Revenue and Unit Sales, 2018-2026)

• Mi

• Full

By Type Outlook ($Revenue and Unit Sales, 2018-2026)

• Sedan

• Hatchback

By Battery Outlook ($Revenue and Unit Sales, 2018-2026)

• Li-ion

• NiMH

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

HYBRID & ELECTRIC CAR COMPANIES:

• Toyota Motor Corporation

• Ford Motor Company

• Volkswagen AG

• Honda Motor Co. Ltd.

• Bayerische Motoren Werke (BMW) Group

• Hyundai Motor Company

• General Motors Company

CHAPTER 1: INTRODUCTION

1.1. Research Methodology

1.1.1. Desk Research

1.1.2. Data Synthesis

1.1.3. Data Validation & Market Feedback

1.1.4. Data Sources

CHAPTER 2: EXECUTIVE SUMMARY

2.1. Global Market Outlook

2.2. Core Insights - Hybridisation

2.3. Core Insights – Type

2.4. Core Insights – Battery

2.5. Core Insights – Geography

CHAPTER 3: MARKET OVERVIEW

3.1. Market Definition and Scope

3.2. Key Forces Shaping the Industry

3.2.1. Bargaining Power of Suppliers

3.2.2. Bargaining Power of Buyers

3.2.3. Threat of Substitutes

3.2.4. Threat of New Entrants

3.3. Market Dynamics

3.3.1. Drivers

3.3.1.1. Supply-side Drivers

3.3.1.2. Demand-side Drivers

3.3.2. Restraints

3.3.3. Opportunities

3.4. Industry Landscape - PESTEL Analysis

3.4.1. Political Landscape

3.4.2. Environmental Landscape

3.4.3. Social Landscape

3.4.4. Technology Landscape

3.4.5. Economic Landscape

CHAPTER 4: MARKET BACKGROUND

4.1. Industry Value Chain Analysis

4.1.1. Upstream Participants

4.1.2. Downstream participants

4.2. Pricing Analysis and Forecast, 2018-2026

4.2.1. By Type

4.2.2. By Region

CHAPTER 5: GLOBAL HYBRID & ELECTRIC CAR MARKET, BY HYBRIDISATION

5.1. Overview

5.1.1. Market Volume and Forecast, 2018-2026

5.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

5.2. Mi

5.2.1. Key Market Trends, Growth Factors and Opportunities

5.2.2. Market Volume and Forecast, By Region

5.2.3. Market Revenue (US$ Million) and Forecast, By Region

5.3. Full

5.3.1. Key Market Trends, Growth Factors and Opportunities

5.3.2. Market Volume and Forecast, By Region

5.3.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 6: GLOBAL HYBRID & ELECTRIC CAR MARKET, BY TYPE

6.1. Overview

6.1.1. Market Volume and Forecast, 2018-2026

6.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

6.2. Sedan

6.2.1. Key Market Trends, Growth Factors and Opportunities

6.2.2. Market Volume and Forecast, By Region

6.2.3. Market Revenue (US$ Million) and Forecast, By Region

6.3. Hatchback

6.3.1. Key Market Trends, Growth Factors and Opportunities

6.3.2. Market Volume and Forecast, By Region

6.3.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 7: GLOBAL HYBRID & ELECTRIC CAR MARKET, BY BATTERY

7.1. Overview

7.1.1. Market Volume and Forecast, 2018-2026

7.1.2. Market Revenue (US$ Million) and Forecast, 2018-2026

7.2. Li-ion

7.2.1. Key Market Trends, Growth Factors and Opportunities

7.2.2. Market Volume and Forecast, By Region

7.2.3. Market Revenue (US$ Million) and Forecast, By Region

7.3. NiMH

7.3.1. Key Market Trends, Growth Factors and Opportunities

7.3.2. Market Volume and Forecast, By Region

7.3.3. Market Revenue (US$ Million) and Forecast, By Region

CHAPTER 8: GLOBAL HYBRID & ELECTRIC CAR MARKET, BY GEOGRAPHY

8.1. Overview

8.2. North America

8.2.1. Key Market Trends, Growth Factors and Opportunities

8.2.2. Market Volume and Forecast, By Hybridisation

8.2.3. Market Volume and Forecast, By Type

8.2.4. Market Volume and Forecast, By Battery

8.2.5. Market Revenue and Forecast, By Hybridisation

8.2.6. Market Revenue and Forecast, By Type

8.2.7. Market Revenue and Forecast, By Battery

8.2.8. Market Revenue and Forecast, By Country

8.2.9. U.S.

8.2.9.1. Market Volume and Forecast

8.2.9.2. Market Revenue and Forecast

8.2.10. Canada

8.2.10.1. Market Volume and Forecast

8.2.10.2. Market Revenue and Forecast

8.2.11. Mexico

8.2.11.1. Market Volume and Forecast

8.2.11.2. Market Revenue and Forecast

8.3. Europe

8.3.1. Market Volume and Forecast, By Hybridisation

8.3.2. Market Volume and Forecast, By Type

8.3.3. Market Volume and Forecast, By Battery

8.3.4. Market Revenue and Forecast, By Hybridisation

8.3.5. Market Revenue and Forecast, By Type

8.3.6. Market Revenue and Forecast, By Battery

8.3.7. Market Revenue and Forecast, By Country

8.3.8. Germany

8.3.8.1. Market Volume and Forecast, By Hybridisation

8.3.8.2. Market Revenue and Forecast, By Type

8.3.9. UK

8.3.9.1. Market Volume and Forecast, By Hybridisation

8.3.9.2. Market Revenue and Forecast, By Type

8.3.10. France

8.3.10.1. Market Volume and Forecast, By Hybridisation

8.3.10.2. Market Revenue and Forecast, By Type

8.3.11. Italy

8.3.11.1. Market Volume and Forecast, By Hybridisation

8.3.11.2. Market Revenue and Forecast, By Type

8.3.12. Rest of Europe

8.3.12.1. Market Volume and Forecast, By Hybridisation

8.3.12.2. Market Revenue and Forecast, By Type

8.4. Asia-Pacific

8.4.1. Market Volume and Forecast, By Hybridisation

8.4.2. Market Volume and Forecast, By Type

8.4.3. Market Volume and Forecast, By Battery

8.4.4. Market Revenue and Forecast, By Hybridisation

8.4.5. Market Revenue and Forecast, By Type

8.4.6. Market Revenue and Forecast, By Battery

8.4.7. Market Revenue and Forecast, By Country

8.4.8. China

8.4.8.1. Market Volume and Forecast, By Hybridisation

8.4.8.2. Market Revenue and Forecast, By Type

8.4.9. India

8.4.9.1. Market Volume and Forecast, By Hybridisation

8.4.9.2. Market Revenue and Forecast, By Type

8.4.10. Japan

8.4.10.1. Market Volume and Forecast, By Hybridisation

8.4.10.2. Market Revenue and Forecast, By Type

8.4.11. South Korea

8.4.11.1. Market Volume and Forecast, By Hybridisation

8.4.11.2. Market Revenue and Forecast, By Type

8.4.12. Rest of Asia-Pacific

8.4.12.1. Market Volume and Forecast, By Hybridisation

8.4.12.2. Market Revenue and Forecast, By Type

8.5. REST OF THE WORLD

8.5.1. Market Volume and Forecast, By Hybridisation

8.5.2. Market Volume and Forecast, By Type

8.5.3. Market Volume and Forecast, By Battery

8.5.4. Market Revenue and Forecast, By Hybridisation

8.5.5. Market Revenue and Forecast, By Type

8.5.6. Market Revenue and Forecast, By Battery

8.5.7. Market Revenue and Forecast, By Country

8.5.8. Latin America

8.5.8.1. Market Volume and Forecast, By Hybridisation

8.5.8.2. Market Revenue and Forecast, By Type

8.5.9. Middle East

8.5.9.1. Market Volume and Forecast, By Hybridisation

8.5.9.2. Market Revenue and Forecast, By Type

8.5.10. Africa

8.5.10.1. Market Volume and Forecast, By Hybridisation

8.5.10.2. Market Revenue and Forecast, By Type

CHAPTER 9: COMPETITIVE LANDSCAPE

9.1. Hybrid & Electric Car Market Share Analysis, 2018

CHAPTER 10: COMPANY PROFILES

10.1. Toyota Motor Corporation

10.1.1. Company Overview

10.1.2. Financial Performance

10.1.3. SWOT Analysis

10.2. Ford Motor Company

10.2.1. Company Overview

10.2.2. Financial Performance

10.2.3. SWOT Analysis

10.3. Volkswagen AG

10.3.1. Company Overview

10.3.2. Financial Performance

10.3.3. SWOT Analysis

10.4. Honda Motor Co. Ltd.

10.4.1. Company Overview

10.4.2. Financial Performance

10.4.3. SWOT Analysis

10.5. Bayerische Motoren Werke (BMW) Group

10.5.1. Company Overview

10.5.2. Financial Performance

10.5.3. SWOT Analysis

10.6. Hyundai Motor Company

10.6.1. Company Overview

10.6.2. Financial Performance

10.6.3. SWOT Analysis

10.7. General Motors Company

10.7.1. Company Overview

10.7.2. Financial Performance

10.7.3. SWOT Analysis

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved