Health and Medical Insurance Market

Health and Medical Insurance Market is Segmented by Product Outlook (Revenue, USD Million, 2022 - 2031) Individual/Family Health Insurance Products, Group Health Insurance Products. Application Outlook (Revenue, USD Million, 2022 - 2031) Comprehensive Plan, Treatment and Care and Other (Dental, Child, etc.).

- Report ID : MD1547 |

- Pages : 200 |

- Tables : 90 |

- Formats :

Health insurance covers the holders surgical and medical expenses. Numerous factors driving the health insurance market expansion include initiatives by governments for reimbursement policies, expensive medical cost, greater prevalence of chronic diseases, growing elderly population, increasing healthcare expenditure, better GDP, and rising participation of key players. High incidence of uncertain large and small disorders that are caused by ecological changes, accidents and injuries are creating greater worldwide demand for the health of the medical insurance market. The worldwide health and medical insurance market are expected to reach 141.3billion US dollars by 2025.

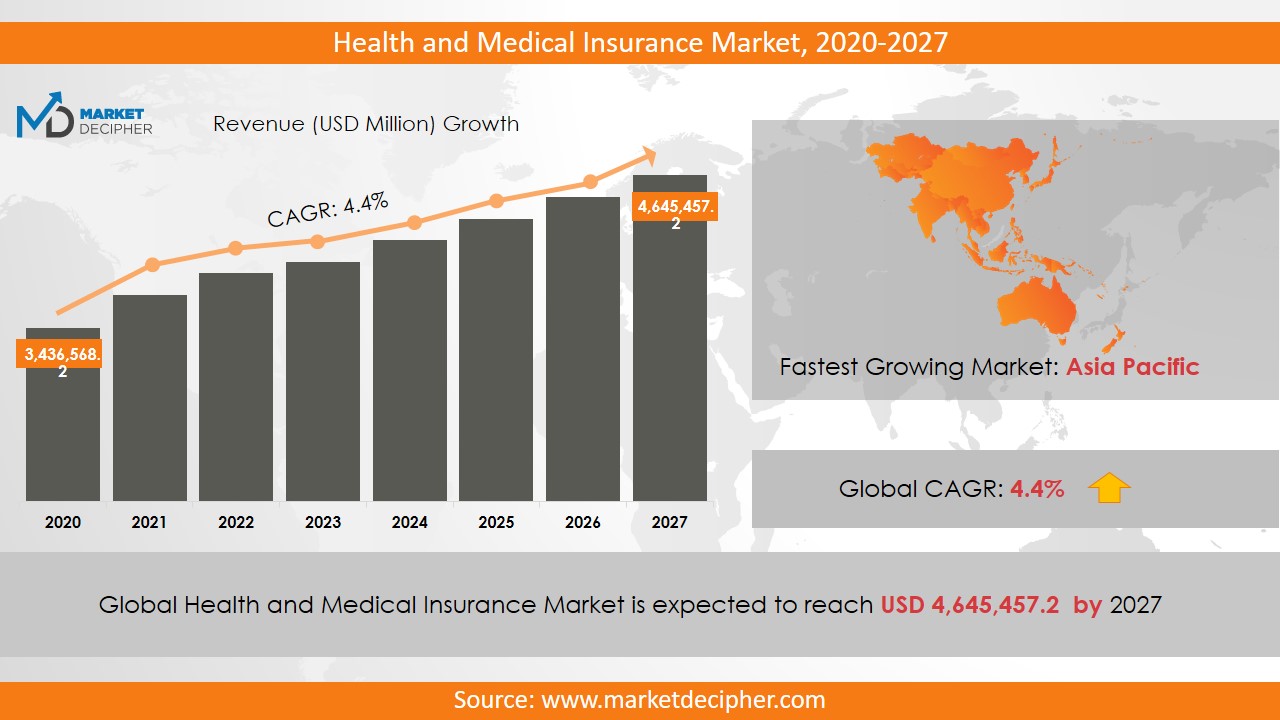

Health and Medical Insurance Market size shall reach a value of $4645,457.2 Million in 2031, growing with a CAGR of 4.4% during the forecast period of 2022 to 2031.

The US market share is expected to skyrocket because insurers are introducing new insurance schemes for people’s welfare and raising awareness about chronic diseases. Factors adding to the health insurance market growth in the developed nations include greater expenditure made by the government on healthcare, favourable reimbursement conditions, funding of research and development and continuous technological advances. On the other hand, key enablers fueling the health insurance market growth in the developing nations are rising medical tourism, budding innovations and technologies, lenient regulations, the rising requirement of chronic disease treatment, and rising participation of major enterprises in bringing forth advanced health insurance policies. In India, concentration on the rural population and China on the elderly population are key drivers in developing economies.

On the flip side, a delayed claim reimbursement rollout, stringent regulations, high documentation, complicated administrative procedures, loopholes in the claim processing criteria and the increasing price of healthcare insurance products are factors that may restrict the growth of the medical and health insurance market. To counteract these possible threats, the greater awareness about economical healthcare amongst the growing population coupled with the onset of newer ailments caused by COVID-19, Zika, Ebola, and others is expected to push the product demand during the upcoming years to come.

Health and Medical Insurance Market Growth and Trend

Medical expenses incurred owing to physician consultation charges and treatment done for disease, injury and other impairment and compensated for by health insurance schemes in exchange of a premium, also providing tax benefits, drives the market for health and medical insurance. The availability of coverage for several factors, including diseases, age group, government policies, and others increases their demand. Quick reimbursement for individuals suffering from diseases with minimum premium amount being paid fosters high demand for insurance policies. In addition, health insurance market growth due to coverage for all treatments under the categories of critical illness and large and small surgeries with less amount of premium, and also because it offers affordable health services such as hospitalizaton, immunizations, and others is on a steep rise. However, although public providers do not cover insurance for very expensive treatment and for certain diseases and dental recovery, arrangements are made for numerous wellness programmes including gym membership, weight loss programmes, and chiropractic services. Furthermore, health insurance permits policyholders to visit any doctors or licensed doctors within a given network where visiting an in-network doctor may facilitate better treatment alongside easier processing of the insurance policy. Major factors that propel the growth of the health insurance market include increase in expenses on healthcare and rise in the prevalence of chronic diseases. The compulsory provision of health insurance for public and private sector employees propel the growth of the health insurance market. Conversely, the introduction of advanced technology in healthcare settings is anticipated to provide profitable opportunity for the expansion of the health insurance market. Now with the pandemic, demand for medical and health insurance is soaring high, bolstering market growth.

Limited availability of health insurance policies for specific hospitals and clinics and exclusion of certain expensive medical treatment are restraining factors in market growth.

Health and Medical Insurance Market Competition

Key companies operating in this industry are Anthem, UnitedHealth Group, BUPA, Chinalife, Aetna, PICC, PingAn, Star Health & Allied Insurance, Cigna, Essential Med and Kunlun.

Coverage Highlights

• Health and Medical Insurance Market Revenue Estimation and Forecast (2022 – 2031)

• Production Estimation and Forecast (2022 – 2031)

• Sales/Consumption Volume Estimation and Forecast (2022 – 2031)

• Breakdown of Revenue by Segments (2022 – 2031)

• Breakdown of Production by Segments (2022 – 2031)

• Breakdown of Sales Volume by Segments (2022 – 2031)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

Health and Medical Insurance Market Segmentation

Product Outlook (Revenue, USD Million, 2022 - 2031)

• Individual/Family Health Insurance Products

• Group Health Insurance Products

Application Outlook (Revenue, USD Million, 2022 - 2031)

• Comprehensive Plan

• Treatment and Care

• Other (Dental, Child, etc.)

Country (Revenue, USD Million, 2022 - 2031)

North America

• United States

• Canada

• Mexico

Asia-Pacific

• China

• Japan

• South Korea

• India

• Philippines

• Malaysia

• Australia

• Rest of Asia Pacific

Europe

• Italy

• Spain

• France

• UK

• Germany

• Belgium

• Netherlands

• Switzerland

• Russia

• Rest of Europe

South America

• Brazil

• Peru

• Chile

• Rest of South America

Middle East and Africa

• Iran

• Israel

• Saudi Arabia

• Turkey

• Africa

Health and Medical Insurance Market Companies

• Anthem

• UnitedHealth Group

• DKV

• BUPA

• Chinalife

• Aetna

• PICC

• PingAn

• Star Health & Allied Insurance

• Cigna

• Essential Med

• Kunlun

Need Report on a particular Country OR need a Tailored/Customized Research? Budget Limits/Price Discounts Query...!

Email to David Correa

OR Fill the below "Sample Request FORM" with your queries in the message box.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved