Gas Sensor Market Revenue, Sales Volume & Trend Forecasts Report, 2019-2026

By Gas Type (Carbon Monoxide, Hydrogen sulphide, Ammonia, Oxygen, Volatile organic compounds, Nitrogen oxide, Chlorine and Hydrocarbons), By Technology (Semiconductor, Electrochemical, PID, Infrared, Catalytic, Solid State/MOS and others), By End-Use (Automotive, Medical, Agriculture, Environmental, Petrochemical, Industrial and others), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1041 |

- Pages : 96 |

- Tables : 87 |

- Formats :

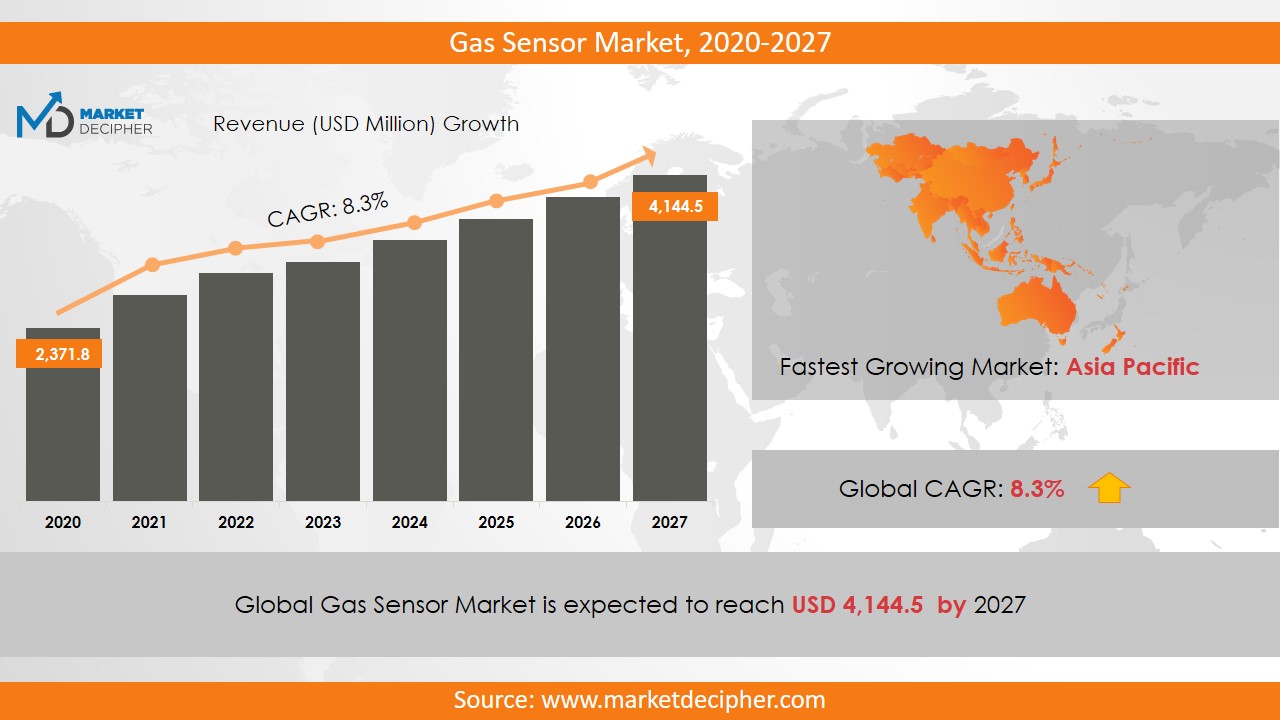

Gas Sensor market revenue shall reach a value of $1,325 Million in 2026, growing with a CAGR of 6.78% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

Gas sensors are devices that are used to detect the presence of gas in a particular area or volume. To prevent gas leakage and to avoid any kind of accident, they are used in various industries. In recent years, these sensors have been adopted at a very fast rate in the mnufacturing industries as they are capable of detecting toxic and explosive gases. Detection of the presence of toxic and explosive gases can potentially eliminate the possibility of any hazardous incident. However, handling large size gas sensors is very inconvenient and the high cost of these sensors can be a hindrance to the development of the market. Major prominent trends like printing sensors, flexible electronics, and construction of small systems are running gas sensor market shares. However, problems related to high energy consumption and temperature variation can negatively influence the gas sensor market trends in the near future.

North America region to support the gas sensor market growth during the forecast period:

The European region has contributed substantially in 2018 owing to the increasing investment in the market by the IT sector and ongoing advancements and innovations in the region. The rise in stringent rules by the government for safety concerns in the region is also responsible for augmenting market sales in the region. Moreover, North America and Asia Pacific regions are supporting the market growth at a substantial rate. According to the gas sensor industry research report, the governments of various countries have taken several steps to adopt these sensors due to rising consumer concerns regarding outdoor and indoor air quality.

INDUSTRY ANALYSIS ON THE BASIS OF SEGMENTS:

In terms of gas type, the report provides a keen analysis of Carbon Monoxide, hydrogen sulphide, ammonia, oxygen, volatile organic compounds, nitrogen oxide, chlorine, and hydrocarbons. Due to strong regulatory initiatives to prevent exhaust emission levels, nitrogen oxide segments can see a significant increase in gas sensor market sales. Apart from this, the installation of these sensors helps to reduce air pollution. On the basis of technology, the bifurcation has been segmented as semiconductor, electrochemical, PID, infrared, catalytic, solid state/MOS and others. Out of which the electrochemical and infrared segment has shown its dominance in 2018. In terms of end use, the market has been segmented as automotive, medical, agriculture, environmental, petrochemical, Industrial and others.

The electrochemical gas sensors are expected to witness remarkable growth over the forecast period. These sensors detect the presence of gases by oxidizing the target gas in the electrode and then measure the magnitude of the current. The amount of gas emitted is directly proportional to the magnitude of the current. These sensors are able to improve indoor air quality, detect landfill gases and control emissions of harmful gases.

MARKET PLAYER ANALYSIS:

Major market players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These market players include Alpha Sense, City Technology Limited, Figaro Engineering, Membrapor AG, Nemoto Corporation Limited, Dynamite Limited, Siemens AG, Robert Bosch LLC, ABB Limited and GfG Europe Limited.

COVERAGE HIGHLIGHTS

• Market Revenue Estimation and Forecast (2018 – 2026)

• Market Production Estimation and Forecast (2018 – 2026)

• Market Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Gas Type Outlook ($Revenue and Unit Sales, 2018-2026)

• Carbon Monoxide

• Hydrogen Sulfide

• Ammonia

• Oxygen

• Volatile Organic Compounds

• Nitrogen Oxide

• Chlorine

• Hydrocarbons

By Technology Outlook ($Revenue and Unit Sales, 2018-2026)

• Semiconductor

• Electrochemical

• PID

• Infrared

• Catalytic

• Solid State/MOS

• Others

By End Use Outlook ($Revenue and Unit Sales, 2018-2026)

• Automotive

• Medical

• Agriculture

• Environmental

• Petrochemical

• Industrial

• Others

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• France

• U.K

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• Rest of Asia Pacific

• Rest of the World

• Middle East

• Africa

• Latin America

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. GAS SENSOR MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL GAS SENSOR MARKET DEMAND SIDE ANALYSIS

2.1. GAS SENSOR MARKET CONSUMPTION VOLUME (MILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (MILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (MILLION UNITS), 2018 – 2025

2.6. GAS SENSOR MARKET REVENUE SPLIT BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL GAS SENSOR MARKET SUPPLY SIDE ANALYSIS

3.1. GAS SENSOR MARKET PRODUCTION VOLUME (MILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (MILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (MILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL GAS SENSOR MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL GAS SENSOR MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL GAS SENSOR MARKET BY GAS TYPE

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY GAS TYPE, $MILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY GAS TYPE, MILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY GAS TYPE, MILLION UNITS, 2018 – 2025

6.4. CARBON MONOXIDE

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. HYDROGEN SULFIDE

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. AMMONIA

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

6.7. OXYGEN

6.7.1. Market determinants and trend analysis

6.7.2. Market revenue, sales and production volume, 2018 – 2025

6.8. VOLATILE ORGANIC COMPOUNDS

6.8.1. Market determinants and trend analysis

6.8.2. Market revenue, sales and production volume, 2018 – 2025

6.9. NITROGEN OXIDE

6.9.1. Market determinants and trend analysis

6.9.2. Market revenue, sales and production volume, 2018 – 2025

6.10. CHLORINE

6.9.1. Market determinants and trend analysis

6.9.2. Market revenue, sales and production volume, 2018 – 2025

6.11. HYDROCARBONS

6.9.1. Market determinants and trend analysis

6.9.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL GAS SENSOR MARKET BY TECHNOLOGY

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY TECHNOLOGY, $MILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY TECHNOLOGY, MILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY TECHNOLOGY, MILLION UNITS, 2018 – 2025

7.4. SEMICONDUCTOR

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. ELECTROCHEMICAL

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. PID

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

7.7. INFRARED

7.7.1. Market determinants and trend analysis

7.7.2. Market revenue, sales and production volume, 2018 – 2025

7.8. CATALYTIC

7.8.1. Market determinants and trend analysis

7.8.2. Market revenue, sales and production volume, 2018 – 2025

7.9. SOLID STATE/MOS

7.9.1. Market determinants and trend analysis

7.9.2. Market revenue, sales and production volume, 2018 – 2025

7.10. OTHERS

7.10.1. Market determinants and trend analysis

7.10.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL GAS SENSOR MARKET BY END USE

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY END USE, $MILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY END USE, MILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY END USE, MILLION UNITS, 2018 – 2025

8.4. AUTOMOTIVE

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. MEDICAL

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. AGRICULTURE

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

8.7. ENVIRONMENTAL

8.7.1. Market determinants and trend analysis

8.7.2. Market revenue, sales and production volume, 2018 – 2025

8.8. PETROCHEMICAL

8.8.1. Market determinants and trend analysis

8.8.2. Market revenue, sales and production volume, 2018 – 2025

8.9. INDUSTRIAL

8.9.1. Market determinants and trend analysis

8.9.2. Market revenue, sales and production volume, 2018 – 2025

8.10. OTHERS

8.10.1. Market determinants and trend analysis

8.10.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL GAS SENSOR MARKET BY REGIONS

9.1. REGIONAL OUTLOOK

9.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

9.3. NORTH AMERICA

9.3.1. Current Trends and Future Prospects

9.3.2. North America market revenue, sales and production volume, 2018 – 2025

9.3.3. U.S.

9.3.3.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.3.3.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.3.3.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.3.4. Canada

9.3.4.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.3.4.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.3.4.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.3.5. Mexico

9.3.5.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.3.5.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.3.5.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.4. EUROPE

9.4.1. Current Trends and Future Prospects

9.4.2. Europe market revenue, sales and production volume, 2018 – 2025

9.4.3. U.K

9.4.3.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.4.3.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.4.3.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.4.4. Germany

9.4.4.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.4.4.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.4.4.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.4.5. France

9.4.5.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.4.5.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.4.5.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.4.6. Italy

9.4.6.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.4.6.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.4.6.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.4.7. Rest of Europe

9.4.7.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.4.7.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.4.7.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.5. ASIA PACIFIC

9.5.1. Current Trends and Future Prospects

9.5.2. Europe market revenue, sales and production volume, 2018 – 2025

9.5.3. India

9.5.3.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.5.3.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.5.3.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.5.4. Japan

9.5.4.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.5.4.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.5.4.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.5.5. China

9.5.5.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.5.5.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.5.5.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.5.6. South Korea

9.5.6.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.5.6.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.5.6.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.5.7. Rest of APAC

9.5.7.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.5.7.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.5.7.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.6. REST OF THE WORLD

9.6.1. Current Trends and Future Prospects

9.6.2. Europe market revenue, sales and production volume, 2018 – 2025

9.6.3. Latin America

9.6.3.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.6.3.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.6.3.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.6.4. Middle East

9.6.4.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.6.4.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.6.4.3. Gas Sensor Market Production Million Units (2018 – 2025)

9.6.5. Africa

9.6.5.1. Gas Sensor Market Revenue $Million (2018 – 2025)

9.6.5.2. Gas Sensor Market Consumption Million Units (2018 – 2025)

9.6.5.3. Gas Sensor Market Production Million Units (2018 – 2025)

CHAPTER 10. KEY VENDOR PROFILES

10.1. Alpha Sense

10.1.1. Company overview

10.1.2. Portfolio Analysis

10.1.3. Estimated revenue from gas sensor business and market share

10.1.4. Regional & business segment Revenue Analysis

10.2. City Technology Limited

10.2.1. Company overview

10.2.2. Portfolio Analysis

10.2.3. Estimated revenue from gas sensor business and market share

10.2.4. Regional & business segment Revenue Analysis

10.3. Figaro Engineering

10.3.1. Company overview

10.3.2. Portfolio Analysis

10.3.3. Estimated revenue from gas sensor business and market share

10.3.4. Regional & business segment Revenue Analysis

10.4. Membrapor AG

10.4.1. Company overview

10.4.2. Portfolio Analysis

10.4.3. Estimated revenue from gas sensor business and market share

10.4.4. Regional & business segment Revenue Analysis

10.5. Nemoto Corporation Limited

10.5.1. Company overview

10.5.2. Portfolio Analysis

10.5.3. Estimated revenue from gas sensor business and market share

10.5.4. Regional & business segment Revenue Analysis

10.6. Dynament Limited

10.6.1. Company overview

10.6.2. Portfolio Analysis

10.6.3. Estimated revenue from gas sensor business and market share

10.6.4. Regional & business segment Revenue Analysis

10.7. Siemens AG

10.7.1. Company overview

10.7.2. Portfolio Analysis

10.7.3. Estimated revenue from gas sensor business and market share

10.7.4. Regional & business segment Revenue Analysis

10.8. Robert Bosch LLC

10.8.1. Company overview

10.8.2. Portfolio Analysis

10.8.3. Estimated revenue from gas sensor business and market share

10.8.4. Regional & business segment Revenue Analysis

10.9. ABB Limited

10.9.1. Company overview

10.9.2. Portfolio Analysis

10.9.3. Estimated revenue from gas sensor business and market share

10.9.4. Regional & business segment Revenue Analysis

10.10. GfG Europe Limited

10.10.1. Company overview

10.10.2. Portfolio Analysis

10.10.3. Estimated revenue from gas sensor business and market share

10.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved