- Report ID : MD1143 |

- Pages : 195 |

- Tables : 87 |

- Formats :

Food Certification Market By Type (Halal, BRC, IFS, SQF, ISO 22000, free form certification and Kosher), By Application (Infant food, meat poultry, dairy, seafood, bakery, and confectionery, and beverages), By Region (North America, Europe, APAC and Rest of the World)

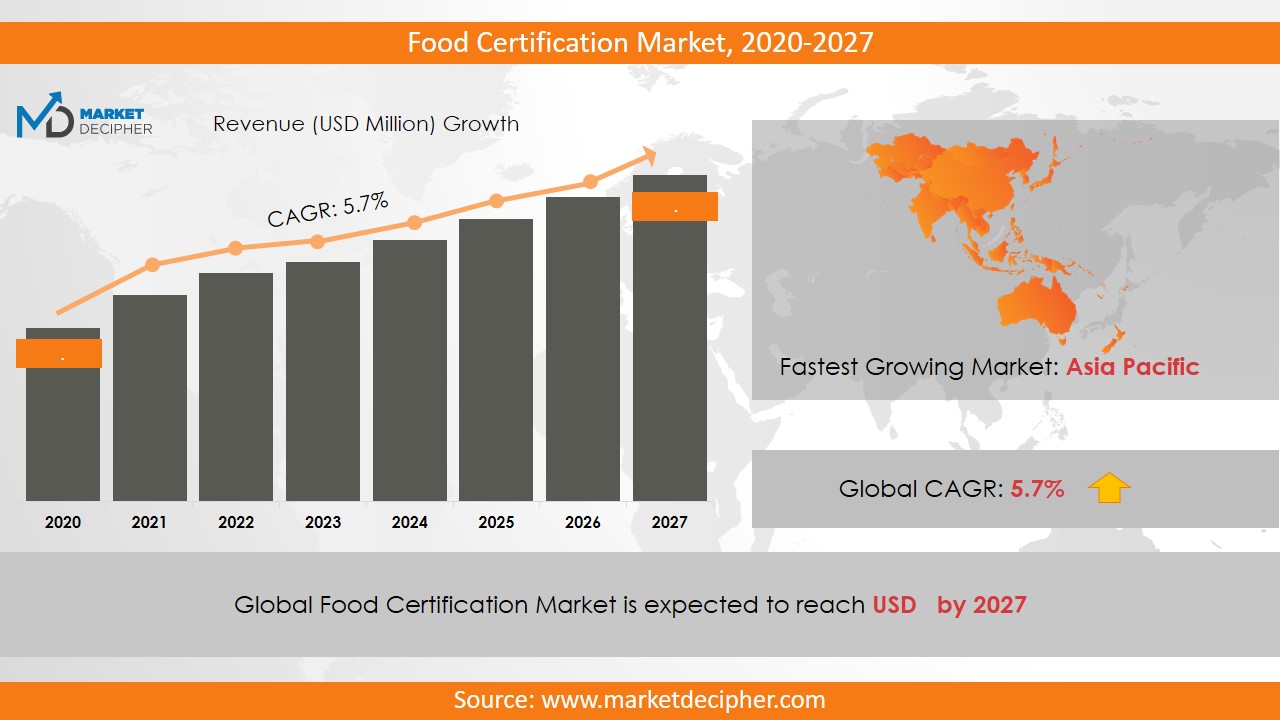

The market revenue of Food certification shall reach a value of $17.8 Billion in 2026, growing with a CAGR of 7.2% during the forecast period of 2019 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

One of the major factors augmenting the food certification market growth is the rising concerns of the consumers regarding food quality and safety. Further, the increasing awareness among the consumers regarding the health and healthy lifestyle is anticipated to grow the food certification market share during the forecast period. Nowadays, the wide use of synthetic fertilizers and chemicals in the agriculture sector has given birth to many health issues and allergies. Thus, keeping in mind the health concerns, food certification has become extremely important. The rising diseases and health problems due to contaminated food or increasing food-borne illness are also anticipated to fuel up the food certification market size significantly over the forecast period. The rising disposable income of the consumers is responsible for the high consumption of better quality food products among the consumers.

However, the high consumption of minimally processed food is likely to hamper the food certification market growth. Moreover, the increasing development of the healthcare infrastructure across the world is expected to increase. Various stringent rules and regulations have been imposed by government agencies in order to ensure the adoption of healthy eating habits among consumers. Further, these rules are working significantly in raising the awareness among consumers regarding the healthcare services which is also anticipated to fuel up the market revenue significantly over the forecast period.

REGIONAL ANALYSIS

The North American region is the dominant region in contributing to market growth in 2018. The rising strict rules and regulations of the government regarding food safety in the region is driving the revenue of the market in North America. Further, the European region is anticipated to fuel the market revenue significantly over the forecast period. Moreover, the Asia Pacific region is also anticipated to grow significantly over the forecast period owing to the rising concerns about health in the region and increasing development of the infrastructure of the healthcare industries. The rapid development of healthcare and medical industries is expected to increase the market revenue tremendously in this region.

SEGMENT ANALYSIS

On the basis of type, the segmentation has been done as Halal, BRC, IFS, SQF, ISO 22000, free form certification and Kosher. It is estimated that the free-form segment is expected to grow with a notable CAGR during the period. This form of food certification includes foods that are processed with different types of foods or "free" certificates. Demand for gluten-free and allergen-free certified products is growing due to increasing diseases and allergic reactions.

In addition, the demand for organic food free of chemical fertilizers, pesticides, GMOs and development regulators is to increase the growth of this region in the next five years. Further, the ISO 22000 segment is anticipated to grow significantly over the forecast period. By application, the segmentation has been done as Infant food, meat poultry, dairy, seafood, bakery and confectionery, and beverages. Other foods contributed significantly to the market growth. They generated about 23.6% of the overall market revenue in 2018.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include DEKRA SE, DNV GL, TÜV SÜD, Lloyd’s Register, Intertek Group Plc, SGS SA, Eurofins Scientific, ALS Limited, UL LLC and Kiwa Sverige. Many industry players are likely to adopt different strategies to acquire acquisition across the world.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS:

By Type Outlook ($Revenue, 2018-2026)

· Halal

· BRC

· IFS

· SQF

· ISO 22000

· Free- form Certification

· Kosher

By Application Outlook ($Revenue, 2018-2026)

• Infant food

• Meat poultry

• Dairy

• Seafood

• Bakery and confectionery

• Beverages

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

INDUSTRY PLAYERS ANALYSIS:

· DEKRA SE

· DNV GL

· TÜV SÜD (Germany)

· Lloyd’s Register

· Intertek Group Plc

· SGS SA

· Eurofins Scientific

· ALS Limited

· UL LLC

· Kiwa Sverige

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. FOOD CERTIFICATION MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL FOOD CERTIFICATION MARKET DEMAND SIDE ANALYSIS

2.1. FOOD CERTIFICATION MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. FOOD CERTIFICATION MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL FOOD CERTIFICATION MARKET SUPPLY SIDE ANALYSIS

3.1. FOOD CERTIFICATION MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL FOOD CERTIFICATION MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL FOOD CERTIFICATION MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL FOOD CERTIFICATION MARKET BY TYPE

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY TYPE, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY TYPE, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY TYPE, BILLION UNITS, 2018 – 2025

6.4. HALAL

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. BRC

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

6.6. IFS

6.6.1. Market determinants and trend analysis

6.6.2. Market revenue, sales and production volume, 2018 – 2025

6.7. SQF

6.7.1. Market determinants and trend analysis

6.7.2. Market revenue, sales and production volume, 2018 – 2025

6.8. ISO 22000

6.8.1. Market determinants and trend analysis

6.8.2. Market revenue, sales and production volume, 2018 – 2025

6.9. FREE FORM CERTIFICATION

6.9.1. Market determinants and trend analysis

6.9.2. Market revenue, sales and production volume, 2018 – 2025

6.10. KOSHER

6.9.1. Market determinants and trend analysis

6.9.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL FOOD CERTIFICATION MARKET BY APPLICATION

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY APPLICATION, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY APPLICATION, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY APPLICATION, BILLION UNITS, 2018 – 2025

7.4. INFANT FOOD

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.5. MEAT POULTRY

7.5.1. Market determinants and trend analysis

7.5.2. Market revenue, sales and production volume, 2018 – 2025

7.6. DAIRY

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

7.7. SEAFOOD

7.7.1. Market determinants and trend analysis

7.7.2. Market revenue, sales and production volume, 2018 – 2025

7.8. BAKERY AND CONFECTIONERY

7.8.1. Market determinants and trend analysis

7.8.2. Market revenue, sales and production volume, 2018 – 2025

7.9. BEVERAGES

7.9.1. Market determinants and trend analysis

7.9.2. Market revenue, sales and production volume, 2018 – 2025

7.12. XYZPLATFORMS

7.12.1. Market determinants and trend analysis

7.12.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL FOOD CERTIFICATION MARKET BY REGIONS

8.1. REGIONAL OUTLOOK

8.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

8.3. NORTH AMERICA

8.3.1. Current Trends and Future Prospects

8.3.2. North America market revenue, sales and production volume, 2018 – 2025

8.3.3. U.S.

8.3.3.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.3.3.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.3.3.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.3.4. Canada

8.3.4.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.3.4.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.3.4.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.3.5. Mexico

8.3.5.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.3.5.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.3.5.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.4. EUROPE

8.4.1. Current Trends and Future Prospects

8.4.2. Europe market revenue, sales and production volume, 2018 – 2025

8.4.3. U.K

8.4.3.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.4.3.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.4.3.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.4.4. Germany

8.4.4.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.4.4.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.4.4.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.4.5. France

8.4.5.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.4.5.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.4.5.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.4.6. Italy

8.4.6.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.4.6.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.4.6.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.4.7. Rest of Europe

8.4.7.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.4.7.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.4.7.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.5. ASIA PACIFIC

8.5.1. Current Trends and Future Prospects

8.5.2. Europe market revenue, sales and production volume, 2018 – 2025

8.5.3. India

8.5.3.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.5.3.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.5.3.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.5.4. Japan

8.5.4.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.5.4.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.5.4.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.5.5. China

8.5.5.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.5.5.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.5.5.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.5.6. South Korea

8.5.6.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.5.6.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.5.6.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.5.7. Rest of APAC

8.5.7.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.5.7.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.5.7.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.6. REST OF THE WORLD

8.6.1. Current Trends and Future Prospects

8.6.2. Europe market revenue, sales and production volume, 2018 – 2025

8.6.3. Latin America

8.6.3.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.6.3.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.6.3.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.6.4. Middle East

8.6.4.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.6.4.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.6.4.3. Food Certification Market Production BILLION Units (2018 – 2025)

8.6.5. Africa

8.6.5.1. Food Certification Market Revenue $BILLION (2018 – 2025)

8.6.5.2. Food Certification Market Consumption BILLION Units (2018 – 2025)

8.6.5.3. Food Certification Market Production BILLION Units (2018 – 2025)

CHAPTER 9. KEY VENDOR PROFILES

9.1. DEKRA SE

9.1.1. Company overview

9.1.2. Portfolio Analysis

9.1.3. Estimated revenue from food certification business and market share

9.1.4. Regional & business segment Revenue Analysis

9.2. DNV GL

9.2.1. Company overview

9.2.2. Portfolio Analysis

9.2.3. Estimated revenue from food certification business and market share

9.2.4. Regional & business segment Revenue Analysis

9.3. TÜV SÜD

9.3.1. Company overview

9.3.2. Portfolio Analysis

9.3.3. Estimated revenue from food certification business and market share

9.3.4. Regional & business segment Revenue Analysis

9.4. LLOYD’S REGISTER

9.4.1. Company overview

9.4.2. Portfolio Analysis

9.4.3. Estimated revenue from food certification business and market share

9.4.4. Regional & business segment Revenue Analysis

9.5. INTERTEK GROUP PLC

9.5.1. Company overview

9.5.2. Portfolio Analysis

9.5.3. Estimated revenue from food certification business and market share

9.5.4. Regional & business segment Revenue Analysis

9.6. SGS SA

9.6.1. Company overview

9.6.2. Portfolio Analysis

9.6.3. Estimated revenue from food certification business and market share

9.6.4. Regional & business segment Revenue Analysis

9.7. EUROFINS SCIENTIFIC

9.7.1. Company overview

9.7.2. Portfolio Analysis

9.7.3. Estimated revenue from food certification business and market share

9.7.4. Regional & business segment Revenue Analysis

9.8. ALS LIMITED

9.8.1. Company overview

9.8.2. Portfolio Analysis

9.8.3. Estimated revenue from food certification business and market share

9.8.4. Regional & business segment Revenue Analysis

9.9. UL LLC

9.9.1. Company overview

9.9.2. Portfolio Analysis

9.9.3. Estimated revenue from food certification business and market share

9.9.4. Regional & business segment Revenue Analysis

9.10. Kiwa Sverige

9.10.1. Company overview

9.10.2. Portfolio Analysis

9.10.3. Estimated revenue from food certification business and market share

9.10.4. Regional & business segment Revenue Analysis

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Please fill in the form below to Request for free Sample Report

Office Hours Mon - Sat 10:00 - 16:00

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved