Flex-fuel Engine Market Size, Statistics, Growth Trend Analysis and Forecast Report, 2022 - 2032

Flex Fuel Engine Market is segmented By Fuel (Diesel, Gasoline), By Vehicles (Passengers, Light Commercial Vehicles, Heavy Commercial Vehicles), By Engine System (Dedicated Fuel, Bi-Fuel, Dual Fuel), By Blend Type (E10 to E25, E25 to E85, Above E85, Others), By Sales Channel (OEM, Aftermarket), and By Region (U.S., Canada, Germany, France, U.K., Italy, Spain, Russia & CIS, Rest of Europe, China, Japan, India, ASEAN, Rest of Asia Pacific, Brazil, Mexico, Rest of Latin America, GCC, South Africa, Rest of Middle East & Africa)

- Report ID : MD2915 |

- Pages : 221 |

- Tables : 82 |

- Formats :

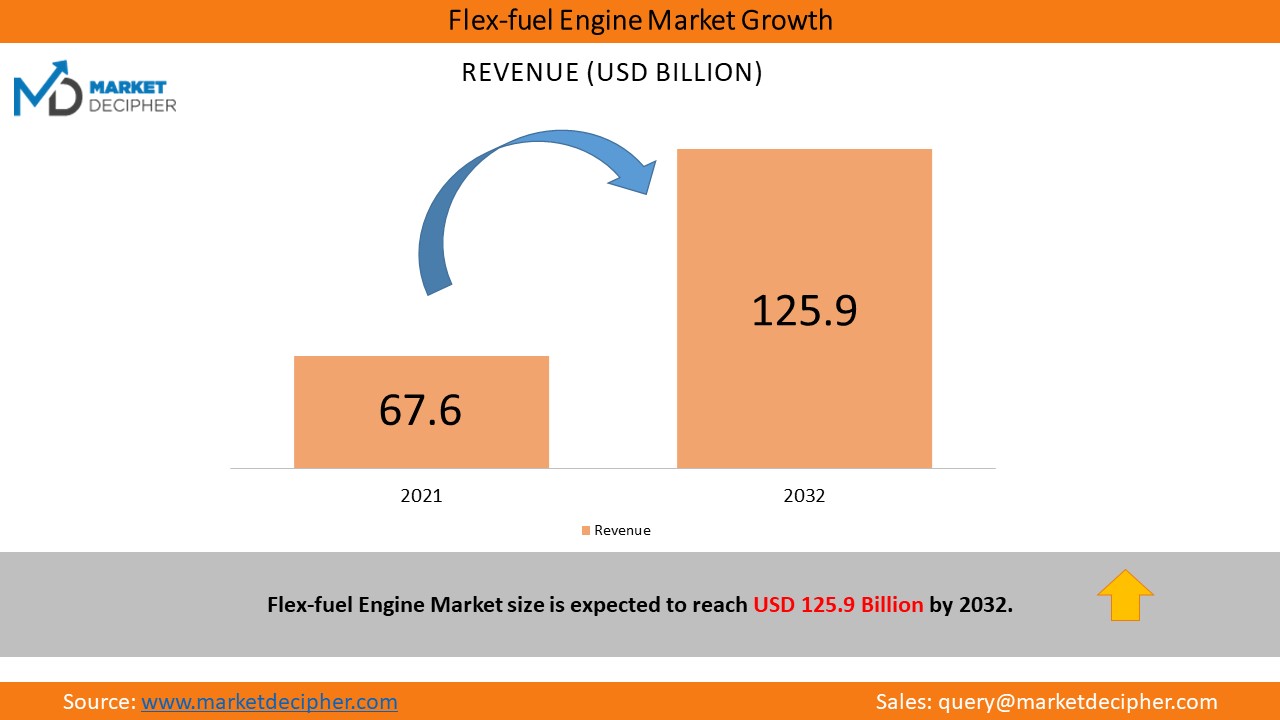

Flex Fuel Engine Market size is estimated at $67.71 Billion in 2021 and is expected to reach $125.9 Billion by 2032, growing at a CAGR of 5.8% over the forecast period 2022-2032.

The use of low carbon emitting vehicles is increasing as people become aware of CO2 emission, its impact on global warming, and the depletion of fossil fuels used in conventional engines. Governments worldwide are trying to promote zero-emission vehicles, and are shifting toward a low-carbon economy. Transportation produces 30% of the total CO2 emissions, making vehicle manufacturers focus on research and development of automotive flex-fuel engines which are highly sustainable for the long run and flexible with any blend of ethanol.

“Automotive flex-fuel engines are also known as dual-fuel engines. These engines have been structured in a manner to function on two dissimilar fuels within the same tank such as gasoline or diesel and there are no storage issues”. Flex fuel engines emit fewer carbon particles as compared to normal internal combustion engines owing to their high combustion of biofuels. Leading automotive companies such as Ford Motor Company, Toyota Motor Company, General Motors, and others have increased their efforts to develop and use flex-fuel engines for both commercial and passenger vehicles, offering a significant opportunity for growth for the flex-fuel engine market.

Driving Factors:

Exhausting natural deposits of petroleum, along with rising car emissions standards are driving the flex-fuel engine market. Call for minimizing reliance on natural sources of non-renewable energy and strict emission regulations set by governments are developing the market. Fossil fuels like coal and petroleum once depleted take millions of years to recover and this has been increasingly harming the environment and contributing to global warming.

Ethanol combustion is cleaner than regular gasoline as it emits less poisonous gas into the environment. Flex-fuel also produces lesser greenhouse gases making them more eco-friendly. Modern Flex-Fuel engines can run on any ratio of fuel mixture in the combustion chamber (that may contain 10% to 85% ethanol). Ethanol can be extricated from materials such as corn or sugar, modeling it as a more viable alternative to crude oil.

Restraining Factor:

The use of ethanol causes damage to the engine, as it has a higher affinity to water which corrodes and damages the engine. Ethanol has higher octane level but it holds less energy, as it takes 1.5 times more quantity than fuel to provide the same amount of energy making mileage the primary worry for Flex-fuel engines. Flex fuel can sustainably be produced using corn and sugar, but it has certain disadvantages. Yields intended to be used for flex-fuel manufacturing cannot be used for other applications which can perhaps increase the price of fodder for animals. Crops such as corn are also vulnerable and highly susceptible to infections due to weather conditions. This can be challenging for the production of ethanol, as it depends on the production of corn. The prices of ethanol may also be affected due to poor harvests.

The Covid-19 crisis slowed down the supply chain and created panic among the consumer which sequentially affected the flex-fuel engine market. The flex-fuel engine’s maintenance schedules convulsed, resulting in enormous losses for fleet owners and engine manufacturers.

Regional Analysis:

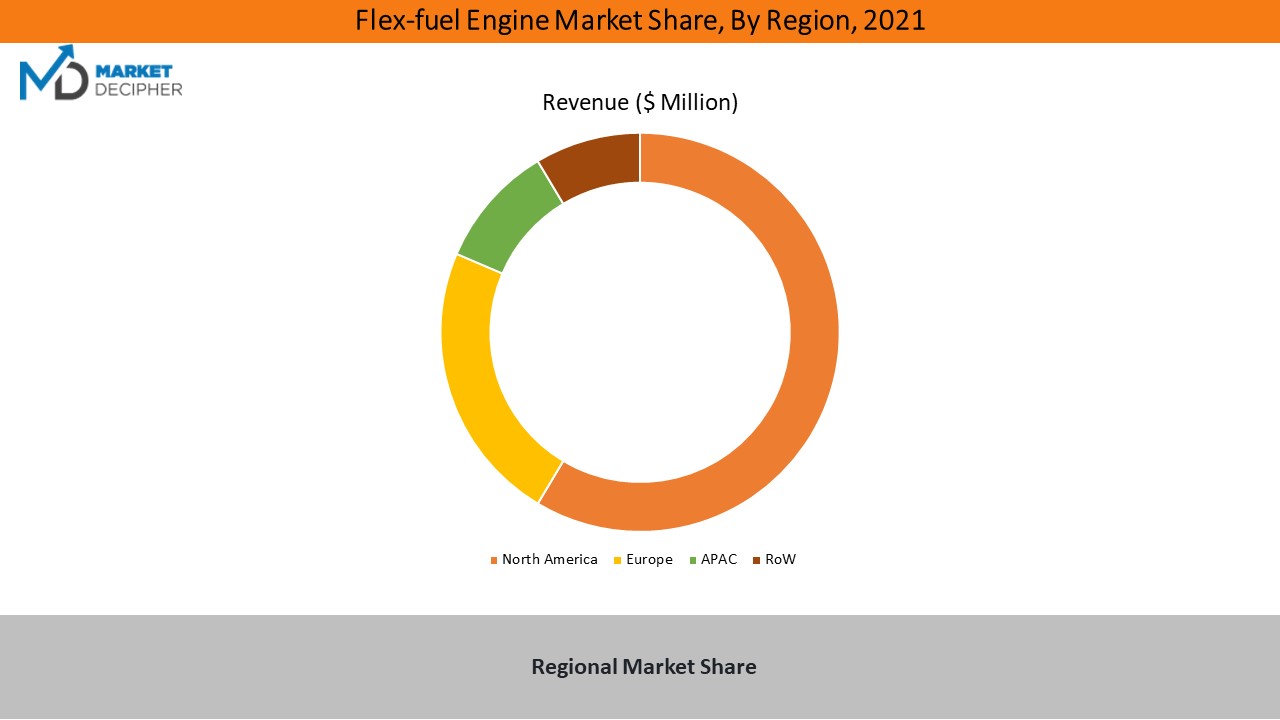

The North American region holds the largest market share, with the existence of nations like the United States, Canada, and Mexico. The rising demand for fuel-efficient vehicles, combined with high per capita income drives the market demand for flex-fuel engines in this region.

The Asia-Pacific region holds the second largest share and is the fastest growing region due to its increased demand for alternative fuel vehicles and the urgent need to improve air quality in countries like India and China. In India, the Ministry of Road Transport and Highways have set various deadlines for introducing ethanol-based fuel to reduce the amount of fossil fuel consumption in the country and reduce fuel cost. India produces 2% of the worldwide flex fuel and ethanol output is expected to increase from 70 to 150 million liters in the coming years resulting in increased demand and use of Flex-fuel engines.

Types Of Flex-Fuel Engines

The Flex Fuel Engines Market is segmented by gasoline and diesel flex-fuel engines. As consumers preference for eco-friendly vehicles is rising, there is large-scale development in technology, and a high rate of adoption of Flex-fuel vehicles in developing regions, causing the gasoline flex-fuel engine sector’s dominance in the market. With increased research and development by manufacturers to raise the blend quantity for diesel and continuous acceptance of this technology in heavy-duty pickup vehicles, the diesel flex-fuel segment is experiencing stable growth in the market.

Strategic Analysis

The players operating in Flex-Fuel Engines Market take up strategies such as enhancing their USP statements, diversifying product portfolios, and adding attractive features to compete with others. Key Developments in the flex-fuel engine markets are:

• In 2022, Europe is aiming to achieve a milestone of the E85 blend which would require cars equipped with flex-fuel engines and this would further boost the demand for automotive flex-fuel engines.

• In 2022, Toyota is set to Launch a Flex-Fuel Car in India

• In 2022, Maruti Suzuki plans to phase out the production of pure petrol vehicles in the next 10 years.

• In 2022, the Indian Government has issued an advisory to carmakers to introduce flex-fuel engines to vehicles.

• In 2023, Honda aims to launch Flex-fuel 2-wheelers

• In 2023, Maruti Suzuki is set to launch E20 and E85 compliant flex-fuel engines

Key Market Players

Some of the major manufacturers responsible for the growth of this market are Volvo Cars (Sweden), Mitsubishi Motors Corporation (Japan), Fiat Chrysler Automobiles (UK), Toyota Motor Corporation (Japan), AUDI (Germany), Nissan Motor Co. Ltd. (Japan), General Motors Company (US), Honda Motor Co. Ltd. (Japan), Volkswagen (Germany), Ford Motor Company (US).

Years considered for this report

• Historical Years: 2018-2021

• Base Year: 2021

• Forecast Period: 2022-2032

Flex-Fuel Engine Market Research Report Analysis Highlights

• Historical data available (as per request)

• Estimation/projections/forecast for revenue and unit sales (2022 – 2032)

• Data breakdown for application Industries (2022 – 2032)

• Integration and collaboration analysis of companies

• Capacity analysis with application sector breakdown

• Business trend and expansion analysis

• Import and export analysis

• Competition analysis/market share

• Supply chain analysis

• Client list and case studies

• Market entry strategies adopted by emerging companies

Industry Segmentation and Revenue Breakdown

Global Flex Fuel Engine Market, by Fuel Type Analysis (Revenue, USD Million, 2022 - 2032)

• Gasoline

• Diesel

Global Flex Fuel Engine Market, by Vehicle Type Analysis (Revenue, USD Million, 2022 - 2032)

• Passenger Vehicle

o Hatchbacks

o Sedans

o Utility Vehicles

• Light Commercial Vehicles

• Heavy Commercial Vehicle

Flex Fuel Engine Market, by Engine System Type Analysis (Revenue, USD Million, 2022 - 2032)

• Dedicated Fuel

• Bi-Fuel

• Dual Fuel

Global Flex Fuel Engine Market, by Blend Type Analysis (Revenue, USD Million, 2022 - 2032)

• E10 to E25

• E25 to E85

• Above E85

• Others

Flex Fuel Engine Market, by Sales Channel Analysis (Revenue, USD Million, 2022 - 2032)

• OEM

• Aftermarket

Flex Fuel Engine Market, by Region Analysis (Revenue, USD Million, 2022 - 2032)

• North America

o U.S.

o Canada

• Europe

o Germany

o France

o U.K.

o Italy

o Spain

o Russia & CIS

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o ASEAN

o Rest of Asia Pacific

• Latin America

o Brazil

o Mexico

o Rest of Latin America

• Middle East & Africa

o GCC

o South Africa

o Rest of Middle East & Africa

Key Players

• AB Volvo

• Cummins Inc.

• Fiat Chrysler Automobiles

• Ford Motor Company

• General Motors Company

• Honda Motor Co., Ltd.

• Mitsubishi Motors Corporation

• Nissan Motor Co., Ltd.

• Toyota Motor Corporation

• Volkswagen AG

Flex Fuel Motor Market Available Versions: -

United States Flex Fuel Motor Market Research Report

Europe Flex Fuel Motor Market Research Report

Asia Specific Flex Fuel Motor Market Research Report

India Flex Fuel Motor Market Research Report

• Customization can be done in the existing research scope to cater to your specific requirements without any extra charges* (terms and conditions apply)

• Send us a query to get the Table of Contents and Research Scope along with the research scope and proposal.

Fill the sample request form OR reach out directly to David Correa at his email: - david@marketdecipher.com

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved