File Integrity Monitoring Market Revenue and Trend Forecasts Report, 2019-2026

By Deployment (On-Premise and Cloud), By Installation (Agentless and Agent-based), By End-Use (Healthcare, BFSI, IT and Telecom, Education, Government and Others), By Organization (Large Enterprises, Small Enterprises and fuelled Medium Enterprises), By Region (North America, Europe, APAC and Rest of the World)

- Report ID : MD1069 |

- Pages : 196 |

- Tables : 89 |

- Formats :

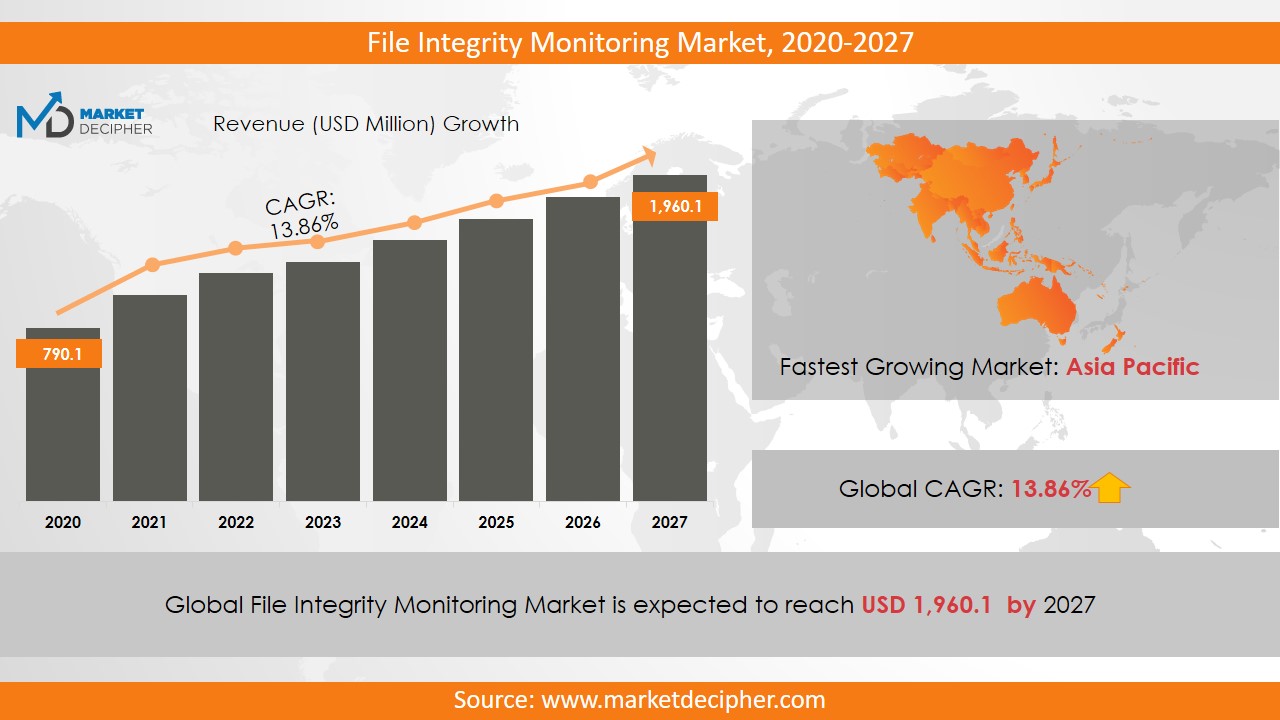

File Integrity Monitoring market revenue shall reach a value of $1.7 Billion in 2026, growing with a CAGR of 13.42% during the forecast period of 2018 to 2026. In terms of volume sales, the market is anticipated to reach XX Units.

Increasing demand for maintaining customers’ sensitive information in various industries and the necessity to maintain exact regulatory compliances are the major factors driving the file integrity monitoring market growth substantially. In the business sector such as healthcare, e-commerce, manufacturing, and service there is an elevated need of 24/7 assistance for customers and to fulfill the customer’s needs, the business industries often use advanced technologies and sometimes become a target for the cybersecurity threats. Thus, there is a high demand for File Integrity Monitoring in the business sector which further increases file integrity monitoring market size at a substantial rate.

The agentless installation of the File Integrity monitoring has fueled up the file integrity monitoring market shares tremendously as it has eliminated the need of agents at the endpoints which is further making its operation easy. However, the high cost for the development of the cutting edge of the market may hamper market growth. Additionally, the rising demand for cloud computing is anticipated to influence the file integrity monitoring market trends positively. But the increasing complication in its infrastructure may let the market to foresee a decline in its revenue in the coming few years.

REGIONAL ANALYSIS

The North America region is estimated to account for the majority of the overall revenue generated in 2018 and is further expected to grow at the fastest rate over the forecast period. The growing use of the internet and the rising incidents of cyber-attack are the major drivers of the industry in the region. Further, the Asia Pacific region is anticipated to increase the revenue at the fastest rate during the forecast period. Middle-East Asia and Latin America also contributed to market growth.

SEGMENT ANALYSIS

In terms of Deployment, the segmentation has been done as on-premise and cloud. By installation, the file integrity monitoring technology has been segmented as agentless and agent-based. Based on end-use the market has been segmented as Healthcare, BFSI, IT and Telecom, Education, Government, and Others. The BFSI segment accounted highest for the growth of the market. Based on Organization, the bifurcation has been done as large enterprises and SMEs. The large enterprises are estimated to account for more than 60% of the total revenue. During the forecast period, the revenue of the government segment is expected to generate $523.4 million in revenue. Due to the growing threats to confidential information and hacking incidents, the government is adopting various safeguards at a critical level. It is important to check the risks and threats to documents to prevent cyber attacks, which is encouraging government enterprises to adopt the FIM solution.

In 2018, the agent-less installation segment generated a market revenue of $308.7 million. Apart from this, the growth of the FIM market is expected to accelerate with the low switching and installation cost of this service. Agent-less monitoring is done with the help of a proxy agent in the management server or device. During the forecast period, the CAGR of 15.9% is an important increase for small and medium enterprises. The affordable cost of FIM solutions is responsible for its high adoption in small and medium enterprises. The cloud-based FIM solution has a bit high installation cost and can be customized according to the customers requirement.

INDUSTRY PLAYER ANALYSIS

Major industry players have been analyzed with coverage on their operating areas, revenues, and other strategic aspects. These industry players include Alien Vault Incorporated, McAfee, Qualys, Solar winds worldwide, Trustwave Holdings Incorporated, Paessler AG, LLC, LogRhythm, Tripwire, and Trend Micro Incorporated.

Trustwave Endpoint Protection, a cloud-based solutions provider, has announced an alliance with Cybereason to further strengthen their MDR for endpoints, on 20 February 2019. Trustwave has also announced its new platform Trustwave Security Testing Services to manage the security protocols of various clients. Belden, a network solutions provider, and its other brands Tripwire and Hirschmann, announced on 17 June 2020, that they have agreed to an extended partnership with Forescout, another network security solutions provider.

SolarWinds, a leading giant of powerful IT management and FIM provider, announced its launch in May 2019, a new platform for secure networking named SolarWinds Security Event Management (SEM). Keeper Security, a cybersecurity company providing security solutions, has announced that it has now officially partnered with LogRhythm and has become a LogRhythm Technology Alliance Partner. “Passwords are powerful. Jeopardized passwords are dangerous. If a cybercriminal gets access to even one set of credentials, that can set them up to have unfettered access to an organizations environment.”, said Vice President at LogRhythm, Mike Jones. Other industries in this domain that are growing at a high CAGR include Managed File Transfer Market and Industrial Environment Monitoring System Market.

COVERAGE HIGHLIGHTS

• Revenue Estimation and Forecast (2018 – 2026)

• Production Estimation and Forecast (2018 – 2026)

• Sales/Consumption Volume Estimation and Forecast (2018 – 2026)

• Breakdown of Revenue by Segments (2018 – 2026)

• Breakdown of Production by Segments (2018 – 2026)

• Breakdown of Sales Volume by Segments (2018 – 2026)

• Gross Margin and Profitability Analysis of Companies

• Business Trend and Expansion Analysis

• Import and Export Analysis

• Regional Analysis and Data Breakdown

SEGMENTAL ANALYSIS:

By Deployment Outlook ($Revenue, 2018-2026)

• On-premise

• Cloud

By Installation Outlook ($Revenue, 2018-2026)

• Agent less

• Agent-based

By End-Use Outlook ($Revenue, 2018-2026)

· Healthcare

· BFSI

· IT and Telecom

· Education

· Government

· Others

By Organisation Outlook ($Revenue, 2018-2026)

· Large Enterprises

· SMEs

By Regional Outlook ($Revenue and Unit Sales, 2018-2026)

• North America

• Canada

• U.S

• Mexico

• Europe

• Germany

• U.K

• France

• Netherlands

• Austria

• Rest of Europe

• Asia-Pacific

• China

• India

• Japan

• South Korea

• Australia

• Rest of Asia Pacific

• The Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East

• Africa

• South America

• Brazil

• Argentina

• Rest of South America

File Integrity Monitoring Market Companies

• SolarWinds (US)

• AlienVault (US)

• LogRhythm (US)

• Trustwave(US)

• ManageEngine (US)

• Trend Micro (Japan)

• New Net Technologies (US)

• Netwrix (US)

• McAfee (US)

• Tripwire (US)

• Cimcor (US)

• Qualys (US)

Available Versions:-

United States File Integrity Monitoring Market Industry Research Report

Europe File Integrity Monitoring Market Industry Research Report

Asia Pacific File Integrity Monitoring Market Industry Research Report

CHAPTER 1. INTRODUCTION

1.1. RESEARCH METHODOLOGY

1.1.1. Data Collection

1.1.2. Data Modeling

1.1.3. Historical Revenue and Sales Estimation

1.1.4. Data Triangulation

1.2. RESEARCH PROCESS

1.2.1. Primary Research

1.2.2. Secondary Research

1.2.3. Survey Data

1.2.4. Validation by In-House Expert

1.3. FILE INTEGRITY MONITORING MARKET OVERVIEW

1.3.1. Research Scope and Market Definition

1.3.2. Executive Summary

CHAPTER 2. GLOBAL FILE INTEGRITY MONITORING MARKET DEMAND SIDE ANALYSIS

2.1. FILE INTEGRITY MONITORING MARKET CONSUMPTION VOLUME (BILLION UNITS), 2018 – 2025

2.2. MARKET CONSUMPTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.3. MARKET CONSUMPTION VOLUME SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

2.4. MARKET REVENUE (BILLION USD), 2018-2025

2.5. MARKET REVENUE SPLIT BY REGION (BILLION UNITS), 2018 – 2025

2.6. FILE INTEGRITY MONITORING MARKET REVENUE SPLIT BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 3. GLOBAL FILE INTEGRITY MONITORING MARKET SUPPLY SIDE ANALYSIS

3.1. FILE INTEGRITY MONITORING MARKET PRODUCTION VOLUME (BILLION UNITS), 2018 – 2025

3.2. MARKET PRODUCTION VOLUME SPLIT BY REGION (BILLION UNITS), 2018-2025

3.3. MARKET PRODUCTION VOLUME SPLIT/RANKING BY COUNTRIES (BILLION UNITS), 2018 – 2025

CHAPTER 4. GLOBAL FILE INTEGRITY MONITORING MARKET COMPETITIVE SCENARIO & BUSINESS OPPORTUNITY ANALYSIS

4.1. COMPETITIVE STRENGTH RANKING BY MAJOR COUNTRIES, 2018

4.2. MARKET ATTRACTIVENESS RANKING BY MAJOR COUNTRIES, 2018 - 2025

4.3. EMERGING BUSINESS OPPORTUNITIES AND GROWTH PROSPECTS

4.3.1. Growth Drivers

4.3.2. Market Restraints

4.3.2. Opportunities

CHAPTER 5. GLOBAL FILE INTEGRITY MONITORING MARKET ENTRY STRATEGIES

5.1. ENTRY STRATEGIES IN DEVELOPING MARKETS

5.2. ENTRY STRATEGIES IN DEVELOPED MARKETS

CHAPTER 6. GLOBAL FILE INTEGRITY MONITORING MARKET BY DEPLOYMENT

6.1. SEGMENT OUTLINE

6.2. REVENUE SHARE BY DEPLOYMENT, $BILLION, 2018 – 2025

6.2. CONSUMPTION SHARE BY DEPLOYMENT, BILLION UNITS, 2018 - 2025

6.3. PRODUCTION SHARE BY DEPLOYMENT, BILLION UNITS, 2018 – 2025

6.4. ON PREMISE

6.4.1. Market determinants and trend analysis

6.4.2. Market revenue, sales and production volume, 2018 – 2025

6.5. CLOUD

6.5.1. Market determinants and trend analysis

6.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 7. GLOBAL FILE INTEGRITY MONITORING MARKET BY INSTALLATION

7.1. SEGMENT OUTLINE

7.2. REVENUE SHARE BY INSTALLATION, $BILLION, 2018 – 2025

7.2. CONSUMPTION SHARE BY INSTALLATION, BILLION UNITS, 2018 - 2025

7.3. PRODUCTION SHARE BY INSTALLATION, BILLION UNITS, 2018 – 2025

7.4. AGENT LESS

7.4.1. Market determinants and trend analysis

7.4.2. Market revenue, sales and production volume, 2018 – 2025

7.6. AGENT BASED

7.6.1. Market determinants and trend analysis

7.6.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 8. GLOBAL FILE INTEGRITY MONITORING MARKET BY END-USE

8.1. SEGMENT OUTLINE

8.2. REVENUE SHARE BY END-USE, $BILLION, 2018 – 2025

8.2. CONSUMPTION SHARE BY END-USE, BILLION UNITS, 2018 - 2025

8.3. PRODUCTION SHARE BY END-USE, BILLION UNITS, 2018 – 2025

8.4. HEALTHCARE

8.4.1. Market determinants and trend analysis

8.4.2. Market revenue, sales and production volume, 2018 – 2025

8.5. BFSI

8.5.1. Market determinants and trend analysis

8.5.2. Market revenue, sales and production volume, 2018 – 2025

8.6. IT AND TELECOM

8.6.1. Market determinants and trend analysis

8.6.2. Market revenue, sales and production volume, 2018 – 2025

8.7. EDUCATION

8.7.1. Market determinants and trend analysis

8.7.2. Market revenue, sales and production volume, 2018 – 2025

8.8. GOVERNMENT

8.8.1. Market determinants and trend analysis

8.8.2. Market revenue, sales and production volume, 2018 – 2025

8.9. OTHERS

8.9.1. Market determinants and trend analysis

8.9.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 9. GLOBAL FILE INTEGRITY MONITORING MARKET BY ORGANIZATION

9.1. SEGMENT OUTLINE

9.2. REVENUE SHARE BY ORGANIZATION, $BILLION, 2018 – 2025

9.2. CONSUMPTION SHARE BY ORGANIZATION, BILLION UNITS, 2018 - 2025

9.3. PRODUCTION SHARE BY ORGANIZATION, BILLION UNITS, 2018 – 2025

9.4. LARGE ENTERPRISES

9.4.1. Market determinants and trend analysis

9.4.2. Market revenue, sales and production volume, 2018 – 2025

9.5. SMES

9.5.1. Market determinants and trend analysis

9.5.2. Market revenue, sales and production volume, 2018 – 2025

CHAPTER 10. GLOBAL FILE INTEGRITY MONITORING MARKET BY REGIONS

10.1. REGIONAL OUTLOOK

10.2. MARKET PRODUCTION, CONSUMPTION & REVENUE BY REGION, 2018-2025

10.3. NORTH AMERICA

10.3.1. Current Trends and Future Prospects

10.3.2. North America market revenue, sales and production volume, 2018 – 2025

10.3.3. U.S.

10.3.3.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.3.3.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.3.3.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.3.4. Canada

10.3.4.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.3.4.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.3.4.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.3.5. Mexico

10.3.5.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.3.5.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.3.5.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.4. EUROPE

10.4.1. Current Trends and Future Prospects

10.4.2. Europe market revenue, sales and production volume, 2018 – 2025

10.4.3. U.K

10.4.3.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.4.3.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.4.3.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.4.4. Germany

10.4.4.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.4.4.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.4.4.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.4.5. France

10.4.5.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.4.5.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.4.5.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.4.6. Italy

10.4.6.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.4.6.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.4.6.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.4.7. Rest of Europe

10.4.7.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.4.7.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.4.7.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.5. ASIA PACIFIC

10.5.1. Current Trends and Future Prospects

10.5.2. Europe market revenue, sales and production volume, 2018 – 2025

10.5.3. India

10.5.3.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.5.3.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.5.3.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.5.4. Japan

10.5.4.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.5.4.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.5.4.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.5.5. China

10.5.5.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.5.5.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.5.5.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.5.6. South Korea

10.5.6.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.5.6.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.5.6.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.5.7. Rest of APAC

10.5.7.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.5.7.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.5.7.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.6. REST OF THE WORLD

10.6.1. Current Trends and Future Prospects

10.6.2. Europe market revenue, sales and production volume, 2018 – 2025

10.6.3. Latin America

10.6.3.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.6.3.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.6.3.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.6.4. Middle East

10.6.4.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.6.4.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.6.4.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

10.6.5. Africa

10.6.5.1. File Integrity Monitoring Market Revenue $BILLION (2018 – 2025)

10.6.5.2. File Integrity Monitoring Market Consumption BILLION Units (2018 – 2025)

10.6.5.3. File Integrity Monitoring Market Production BILLION Units (2018 – 2025)

CHAPTER 11. KEY VENDOR PROFILES

11.1. Alien Vault Incorporated

11.1.1. Company overview

11.1.2. Portfolio Analysis

11.1.3. Estimated revenue from file integrity monitoring business and market share

11.1.4. Regional & business segment Revenue Analysis

11.2. McAfee

11.2.1. Company overview

11.2.2. Portfolio Analysis

11.2.3. Estimated revenue from file integrity monitoring business and market share

11.2.4. Regional & business segment Revenue Analysis

11.3. Qualys

11.3.1. Company overview

11.3.2. Portfolio Analysis

11.3.3. Estimated revenue from file integrity monitoring business and market share

11.3.4. Regional & business segment Revenue Analysis

11.4. Solar winds worldwide,

11.4.1. Company overview

11.4.2. Portfolio Analysis

11.4.3. Estimated revenue from file integrity monitoring business and market share

11.4.4. Regional & business segment Revenue Analysis

11.5. Trustwave Holdings Incorporated

11.5.1. Company overview

11.5.2. Portfolio Analysis

11.5.3. Estimated revenue from file integrity monitoring business and market share

11.5.4. Regional & business segment Revenue Analysis

11.6. Paessler AG

11.6.1. Company overview

11.6.2. Portfolio Analysis

11.6.3. Estimated revenue from file integrity monitoring business and market share

11.6.4. Regional & business segment Revenue Analysis

11.7. Paessler AG, LLC

11.7.1. Company overview

11.7.2. Portfolio Analysis

11.7.3. Estimated revenue from file integrity monitoring business and market share

11.7.4. Regional & business segment Revenue Analysis

11.8. LogRhythm

11.8.1. Company overview

11.8.2. Portfolio Analysis

11.8.3. Estimated revenue from file integrity monitoring business and market share

11.8.4. Regional & business segment Revenue Analysis

11.9. Tripwire

11.9.1. Company overview

11.9.2. Portfolio Analysis

11.9.3. Estimated revenue from file integrity monitoring business and market share

11.9.4. Regional & business segment Revenue Analysis

11.10. Trend Micro Incorporated

11.10.1. Company overview

11.10.2. Portfolio Analysis

11.10.3. Estimated revenue from file integrity monitoring business and market share

11.10.4. Regional & business segment Revenue Analysis

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved