Enterprise Application Market Size, Statistics, Trend Analysis and Forecast Report, 2020 - 2027

Enterprise Application Market By Product (CRM, ERP, SCM, Web Conferencing, Business Intelligence [BI], BPM, CMS, EAM), By End-Use (Manufacturing, BFSI, Healthcare, Retail, Government, Aerospace & Defense, Telecom & IT), By Deployment (On-Premise, Cloud), Industry Analysis Report, Regional Outlook (U.S., Canada, UK, Germany, China, Japan, India, Brazil, Mexico, MEA)

- Report ID : MD1416 |

- Pages : 220 |

- Tables : 80 |

- Formats :

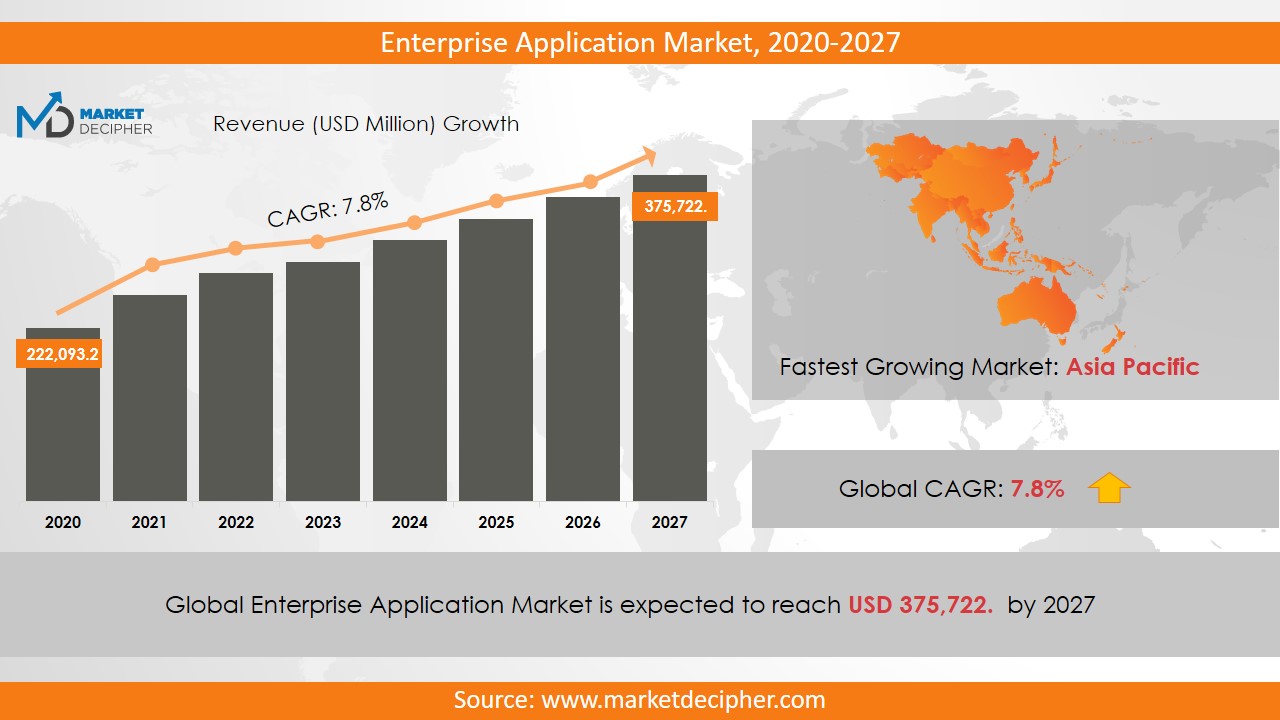

Enterprise Application Market size was estimated at $213,430 Million in 2019 and is expected to reach $351,791.6 Million by 2027, growing at a CAGR of 7.4% during the forecast period of 2020 to 2027.

Enterprise applications comprise of a large pool of very useful Business suites that aid in the functioning of a wide variety of industries. They enable control, reporting, and management decision-making in large, complex business environments.

Analysis by Product

According to Product, the segments are Customer Relationship Management, Enterprise Resource Planning, Supply Chain Management, Web Conferencing, Business Intelligence [BI], BPM, CMS, and EAM.

The most promising product is Business Intelligence. It is well on its way to reach double-digit market share by the middle of the projected period. They are so well sought after due to the functionality that they bring for businesses. This includes analysis of a mammoth quantum of data to derive actionable results.

Another large jump is anticipated by CRM. They aid in team alliance, improved client relationships, and enhanced productivity. CRM enables managers to draw insights on their customers and suitably customize marketing actions and positions.

Analysis by End-use

According to end-use, the considerations are Manufacturing, BFSI, Healthcare, Retail, Government, Aerospace & Defense, and Telecom & IT.

The BFSI sector will gain the largest in this period. Banks and Financial institutions are feeling a strong need to transform their services to cater to the rising expectations of the modern retail and business users. Gone are the days when banking was a black and white service. Customers are expecting an enhanced service experience and Enterprise Applications are a boon for banks that intend to keep up with the evolving trends. This will also drive profitability for the companies as well as garner loyal customers.

Analysis by Deployment

From deployment, the two groupings are On-Premise and Cloud.

The On-premise deployment model continues to hold the lion’s share of the market in this segregation. Despite the larger costs associated with setting up of on-premise solutions and the continued variable costs in terms of IT specialists, it is observed that large organizations value the integrity and control over their business’s data over everything else. For large companies with billions of data points, a lot of insights can be drawn. They are preferring to keep a watertight security over it to maintain their competitive advantage in the market.

Analysis by Region

The North American region will grow steadily owing to the adoption of cloud services and enterprise mobility. Organizations are finding a great buy in Cloud-based Enterprise applications as it eases the cost of running the system and eliminates a large chunk of the upfront capital costs as well. Moreover, the presence of system integrators will also bode well for the industry.

Moreover, there are a few hundred On-premise system transitions to the cloud that have already been approved. This will keep the suppliers in very good stead as a large amount of revenue will be realized in the projected timeframe.

Analysis by Market

Some of the notable names in this industry are Hewlett-Packard Company, SAP AG, IBM, QAD Inc., Oracle, Microsoft, IFS AB, and Epicor Software Corporation, and Epicor Software Corporation.

Most of them are investing their resources and efforts in putting together customized Enterprise applications to make their clients’ product acceptance more useful. Such customizations aren’t available out of the box in the default programs by the OEM. Considerable effort and understanding of the tool is needed to get to industry-specific capabilities.

This augurs very well for the future growth of the Enterprise Application Market globally.

COVERAGE HIGHLIGHTS

● Market Revenue Estimation and Forecast (2019 – 2026)

● Market Production Estimation and Forecast (2019 – 2026)

● Market Sales/Consumption Volume Estimation and Forecast (2019 – 2026)

● Breakdown of Revenue by Segments (2019 – 2026)

● Breakdown of Production by Segments (2019 – 2026)

● Breakdown of Sales Volume by Segments (2019 – 2026)

● Gross Margin and Profitability Analysis of Companies

● Business Trend and Expansion Analysis

● Import and Export Analysis

● Regional Analysis and Market Data Breakdown

MARKET SEGMENTATION

By Product Outlook ($Revenue and Unit Sales, 2019-2026)

• CRM

• ERP

• SCM

• Web Conferencing

• Business Intelligence [BI]

• BPM

• CMS

• EAM

By End-use Outlook ($Revenue and Unit Sales, 2019-2026)

• Manufacturing

• BFSI

• Healthcare

• Retail

• Government

• Aerospace & Defense

• Telecom & IT

By Deployment Outlook ($Revenue and Unit Sales, 2019-2026)

• On-Premise

• Cloud

By Regional Outlook ($Revenue and Unit Sales, 2019-2026)

• U.S.

• Canada

• UK

• Germany

• China

• Japan

• India

• Brazil

• Mexico

• MEA

Market Players

• Epicor Software Corporation

• Hewlett-Packard Company (HP)

• IBM Corporation

• IFS AB

• Infor Inc.

• Microsoft Corporation

• Oracle Corporation

• SAP AG

• QAD Inc.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved