NFT Collectibles Market Size, Statistics, Growth Trend Analysis and Forecast Report, 2021 - 2032

Digital NFT collectibles market or digital collectibles is segmented based on product (music collectibles and art collectibles), sales channel (Licensed Collectible Manufacturers, Specialized Collectibles Marketplace and E-commerce Portals) and Country (United States as major market and 20 countries analysed per category)

- Report ID : MD2847 |

- Pages : 220 |

- Tables : 75 |

- Formats :

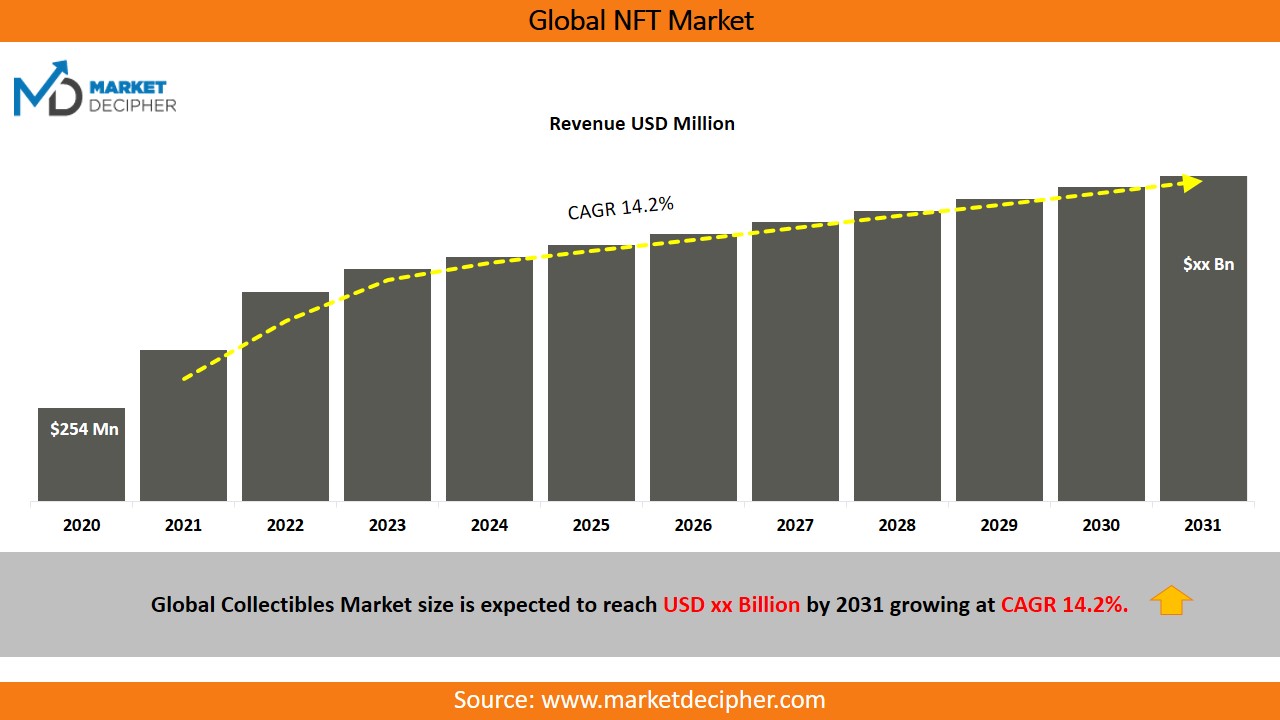

NFT Collectibles market size was estimated at $11.8 billion in 2020 and is expected to grow at a CAGR of 25.9% during the forecast period of 2021 to 2031.

Digital NFT collectibles are transacted through blockchain based NFTs and therefore are also known as NFT Collectibles Market. Non Fungible Tokens or NFTs collectibles marker make use of blockchain technology to commemorate the ownership of digital collectibles. This includes videos, images, and other forms of collectibles. NFTs have been considered as a worthwhile investment for collectors, where they get the ownership of digital assets with zero or minimal documentation. The high demand for digital assets has pushed up the prices of NFTs, with a sudden surge in the NFT collectibles market.

Boom in NFT collectibles market with capital growing by 1,785 % in 2021

Major NFT collectible Tokens witnessed a 1785% of business Cap growth in three months from Janurary to March in 2021. The digital collectible industry is on the boom. The first half of 2021 witnessed $2.5 billion dollars of sales. It is not only impressive but remarkable considering the economic slowdown in the post-pandemic era. The buyers who were interested in the digital collectibles ranged from Hollywood celebrities to institutional buyers. While a sizeable contribution was made by the small retail buyers. The participation from different sectors has gradually pushed the volume of the NFTs or Non Fungible Tokens. The NFT market has been quite active since last year. However, the biggest growth was witnessed in the first quarter of this year. There was an increase of 43% in the volume, in June 2021.

One of the key reasons behind the growth of NFT collectibles is easy accessibility to trade. One can easily buy and sell NFTs online, sitting anywhere in the world. NFTs are distinct and that is why they have become one most traded digital instruments. The Q3 of 2021 saw an overall sales of $10.7 Billion USDs which was itself a new high in the crypto frenzy market. It was a huge transition from Q1 and Q2. In Q1, the sales figure of NFTs stood at $1.2 Billion, and the same for Q2 was $1.3 Billion. OpenSea which is one of the biggest marketplaces for NFTs registered a sales volume of $3.4 Billion in August, and it exceeded that volume in September. Market analysts have maintained that strong growth in the crypto market in the pandemic era has driven the growth of the NFT market. The busiest blockchain platform used for trading has been Ethereum. In 2021, the volume of NFT trading on Ethereum stood at $7 billion. The most expensive sale of the year was a digital collage sold at a whopping price of $69.3 million, at Christies. Christies is one of the leading business houses that participates in the trading of digital collectibles. Apart from Christies, Art Blocks which is a US-based firm was also engaged in high-volume NFT trading. Art Blocks specializes in algorithmically generated digital artworks. Both Christies & Art Blocks did the maximum trading of NFTs on the Ethereum platform. The highest sales volume of NFTs was recorded by Bored Ape Yacht Club selling over 68,000 digital collectibles, worth over $1 billion. It was followed by CryptoPunks, Sandbox, and SuperRare. All these NFT traders traded on the Ethereum platform.

The growth in the NFT collectibles market have also resulted in the growth of the NFT wallets. NFT wallets are used for storing both, NFTs as well as for cryptocurrencies. The number of NFT wallets has surged over close to 1,85,000. Out of that 1,75,000 exist on the Ethereum platform. This is not a surprising fact as most of the trading platforms use Ether as a cryptocurrency for trading. One of the key reasons for the growth of NFT wallets is using NFTs as an investment for the future.

Risk and challenges in the Digital NFT Collectibles market

Even though wallets have increased, the number of active NFT wallets has decreased. The drop in active wallet was over 40 percent in the quarter beginning with June. Though there has been some recovery, it is not remarkable. One of the key reasons behind this is the drop in retail investors and small traders, while most of the trading is being done by the institutional investors and big traders, with the higher volume of transactions. Even though active wallets have decreased, the high sale volumes by the institutional investors have managed to keep overall sale volume high. However, a bigger challenge might come up in the future where the retail investors will gradually vanish from the NFT markets, and it will be completely regulated by the institutional investors. Something which we can relate to the modern-day money market.

Another key challenge is the lack of regulations in the NFT collectibles trading space, as there is no centralized marketplace. This is one of the key reasons, why trading is done on different blockchain platforms instead of one specific platform. For small investors, this is a problem because they need to maintain different wallets based on different blockchain platforms. For example, if someone has bought an NFT asset using Ether, then he cannot sell it in Flow if he doesn’t have a wallet in Flow. Thus, these wallets are not interoperable, and each of them operates only with their native blockchain platforms. This problem will become more complex as more competitors will enter the market, and introduce their wallets.

Since regulatory measures are not present in the NFT collectible marketplace, there are high chances of market frauds using blockchain. Blockchain itself is a secure technology for authentication, but definitely, this becomes its biggest flaw when it comes to trading between different platforms. If the passwords or the private identifiers are lost, the assets associated with them will be lost forever. This is the biggest risk on the blockchain platform as of today.

Current buying trends in the NFT Collectibles

One of the trending buys in NFT collectible industry space is membership of Bored Ape Yacht Club, where NFTs depicting apes are being sold to the members. These Apes are auctioned by Sotheby. It is closely followed by Cryptopunks, which has 10000 unique collectible characters for sale in form of NFTs. Buyers use these collectibles in a different format, such as brand logos, Twitter profiles, posters, etc. Another trending NFT is EtherRocks, which depicts the images of rocks in different art forms. These rock arts are expensive, and currently, it is being sold for over $100,000 per NFT.

In the current market, Visa and Budweiser have become the two largest investors, investing in buying NFTs for their business. In the market trends, Gaming NFTs are gradually trending with Axie Infinity leading the pack. It is a crypto game, where the players are rewarded with crypto tokens.

Digital NFT Collectibles Market Segment Revenue Breakdown

Analysis by Buying (Revenue, USD Million, 2021 to 2031)

- Primary Market

- Secondary Market

Analysis by Industry (Revenue, USD Million, 2021 to 2031)

- Music NFT Market

- Art NFT Market

- Movie Avatar NFT Market

- Sports NFT Market

- Adult NFT Market

- Gamifiction NFT Market

- Other NFTs

Analysis by Type (Revenue, USD Million, 2021 to 2031)

- Image/GIF NFT

- Video NFT

- Audio NFT

- Other NFT

Analysis by Sales Channel (Revenue, USD Million, 2021 to 2031)

- Licensed Collectible Manufacturers

- Specialized NFT Marketplace

Analysis by Country (Revenue, USD Million, 2021 to 2031)

- United States

- Canada

- Mexico

- Latin America

- United Kingdom

- France

- Germany

- Italy

- Spain

- China

- India

- Japan

- Philippines

- Malaysia

- Australia

- Austria

- South Korea

- UAE

- Qatar

- Saudi Arabia

- Africa

- Rest of World

Do you Need a Report for Specific Country? Focussed on NFT Market and Collectibles? Write your message in sample request form below.

NFT Company Profiles

- OpenSea

- Cloudflare, Inc.

- Dolphin Entertainment, Inc.

- Nifty Gateway

- MakersPlace

- SuperRare

- Decentraland

- PLBY Group, Inc.

- YellowHeart

- Rarible

- Other Companies (Total 15 Companies)

Related Reports:

Sports Memorabilia Collectibles Market

Movie Avatar Collectibles Market

Note: Customizations are available for clients who need modifications in the scope of the research report. You can fill-in any request forms on the page with your message in comment box.

Attention Journalists: Any data picked up from our website must be sourced/cited in your publication with a Hyperlink.

PURCHASE OPTIONS

20% Free Customization ON ALL PURCHASE

*Terms & Conditions Apply

Looking for report on this market in a particular region or country? Get In Touch

Request Free Sample

Please fill in the form below to Request for free Sample Report

-

Office Hours Mon - Sat 10:00 - 16:00

-

Call Us +91 6201075429

-

Send Us Mail sales@marketdecipher.com

Market Decipher is a market research and consultancy firm involved in provision of market reports to organisations of varied sizes; small, large and medium.

© 2018 Market Decipher. All Rights Reserved